A blockchain oracle provider has launched a push-based oracle on MegaETH to address latency problems that hinder the effectiveness of on-chain trading.

A representative from the company stated that this new oracle can push real-time prices on-chain every 2.4 milliseconds. Initially rolled out on MegaETH, an Ethereum layer-2 network, the offering may expand to other chains in the future.

The oracle sources its prices from centralized exchanges and transmits them directly to applications or smart contracts through nodes that operate natively on the MegaETH chain.

This “co-location” approach reduces latency by removing delays typically caused by the physical distance between servers. Looking ahead, the company also aims to incorporate price feeds from decentralized exchanges.

Oracles that are compatible with the Ethereum Virtual Machine (EVM) are gaining traction. Currently, there are 12 decentralized oracle networks functioning on Ethereum, according to recent statistics.

Oracles generate revenue through data usage fees, licensing, staking rewards, and incentives for node operators. At present, the market cap for oracle tokens stands at $10.2 billion.

Related: Trump’s World Liberty Financial chooses Chainlink as its oracle provider

Expansion of DeFi Fuels Demand for Oracles

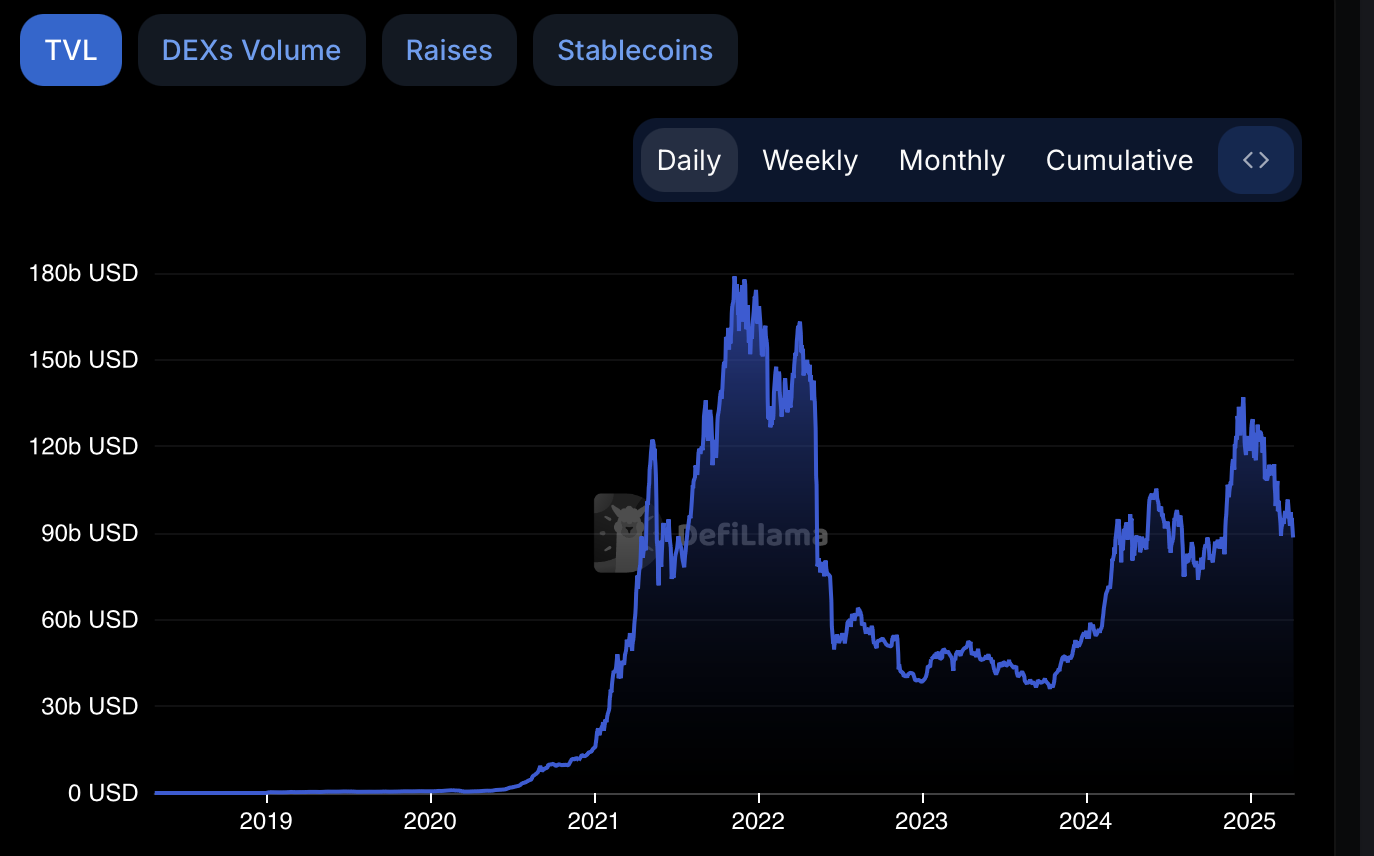

The total value locked in decentralized finance has approached $88 billion as of April 8, soaring by 116% in 2024, according to DefiLlama. Ethereum remains the leading blockchain for DeFi applications, with $47.8 billion locked in the network, followed by Solana at $6.1 billion in DeFi total value locked.

DeFi Total Value Locked over time. Source: DefiLlama

The growth of DeFi has heightened competition in the oracle market, which is crucial for the operation of decentralized applications. Price oracles supply smart contracts with up-to-the-minute market data, acting as a link between blockchains and the real world.

Magazine: The age of financial nihilism in crypto has ended — It’s time to dream big again