The $1.25 billion acquisition of prime broker Hidden Road by Ripple marks a “turning point” for the blockchain payments firm, opening up new possibilities for the XRP Ledger’s application within institutional environments, according to David Schwartz, Ripple’s chief technology officer.

On social media, Schwartz emphasized on April 8, “This acquisition is a pivotal moment for both the XRP Ledger and XRP.”

Hidden Road is a prime brokerage and credit network serving over 300 institutional clients. Typically, it handles more than $10 billion in clearances and processes upwards of 50 million transactions daily through traditional systems.

“Now, envision even a fraction of that activity occurring on the XRP Ledger — that’s precisely what Hidden Road intends to pursue — along with future uses of tokenized collateral and real-world assets on the XRPL,” Schwartz added.

Image Source:

Ripple has consistently promoted the XRP Ledger as an adaptable platform for real-world assets (RWAs). In November, the firm collaborated with a crypto exchange to launch a tokenized money market fund.

Yet, up until now, tokenization activity on the XRP Ledger has been limited. Current industry data reveals only two RWAs on the XRP Ledger, collectively valued at approximately $50 million.

The XRP Ledger’s potential as a tokenization platform remains largely untapped.

Related: Funding Roundup: Eight-figure investments indicate the crypto bull market is far from finished

Growth in the RWA Market

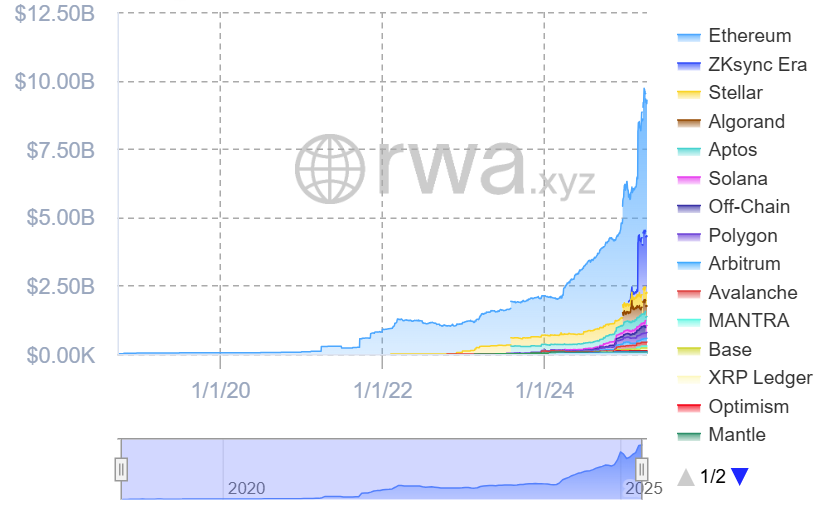

The total value of on-chain RWAs has risen by 9.2% over the past month, contrasting with a general downturn in the cryptocurrency market linked to global growth concerns and tighter financial conditions. During this time, the count of asset holders has grown by 6.2%, as reported by RWA.xyz.

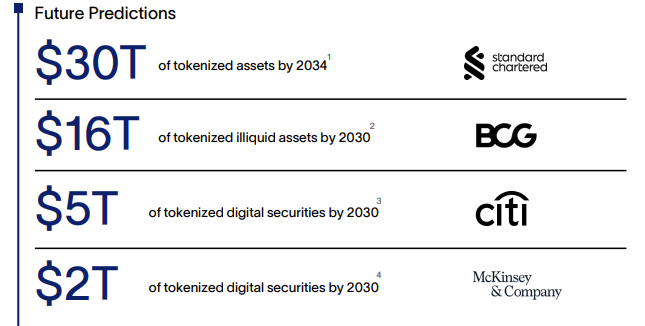

Analysts in traditional finance predict that tokenized RWAs could evolve into a multi-trillion-dollar market by 2030, driven by extensive opportunities in bonds, commodities, equities, real estate, and the M2 money supply.

Some estimates suggest the value of tokenized securities could hit at least $2 trillion by 2030.

Major corporations, including CME Group and Google, are exploring asset tokenization, with a recent collaboration aimed at enhancing capital market efficiency through the Google Cloud Universal Ledger.

Prometheum’s CEO noted that the regulatory environment in the United States is favorable for the adoption of tokenization. However, a significant barrier remains the lack of secondary markets for trading tokenized assets. This situation may soon change as crypto-native firms and traditional brokerages vie for market presence.

Magazine: Bit by Bit: How blockchain technology is reshaping the real estate sector