Heightened global trade tensions instigated by the extensive tariff policies implemented by the former US President have led to speculation about a possible agreement with China, despite concerns from investors regarding further escalations from both nations.

The proclamation made on April 2 regarding reciprocal import tariffs generated significant upheaval in both global stock and cryptocurrency markets. The announced policies include a standard 10% tariff on all imported items starting from April 5, with increased rates—such as a 34% tariff on imports from China—scheduled to take effect on April 9.

However, some experts suggest that these tariff discussions may merely be strategic maneuvers aiming to facilitate a deal with China. According to a prominent financial strategist, many of the public negotiations and aggressive rhetoric appear centered around pressuring China to come to an agreement.

“Ultimately, the majority of the tariff discussions are largely aimed at achieving an agreement with China,” the strategist noted, emphasizing that both nations are aware of the significance of this deal. He added that all other discussions are merely part of the negotiation tactics, highlighting that China could benefit from a weaker dollar, while the US seems to require the imposed tariffs.

Image description

Additionally, he mentioned that the US might be attempting to curb tariff arbitrage from China through alternative channels like Mexico and Vietnam.

China Implements New Tariffs

In light of China’s recent counter-tariff actions, prospects for a speedy resolution appear dim.

Following the US tariffs, China announced a 34% tariff on all US imports, effective April 10. The Chinese foreign ministry also declared its intention to “fight till the end” against the tariffs imposed by the US, labeling them as “bullying” from the leading global economy.

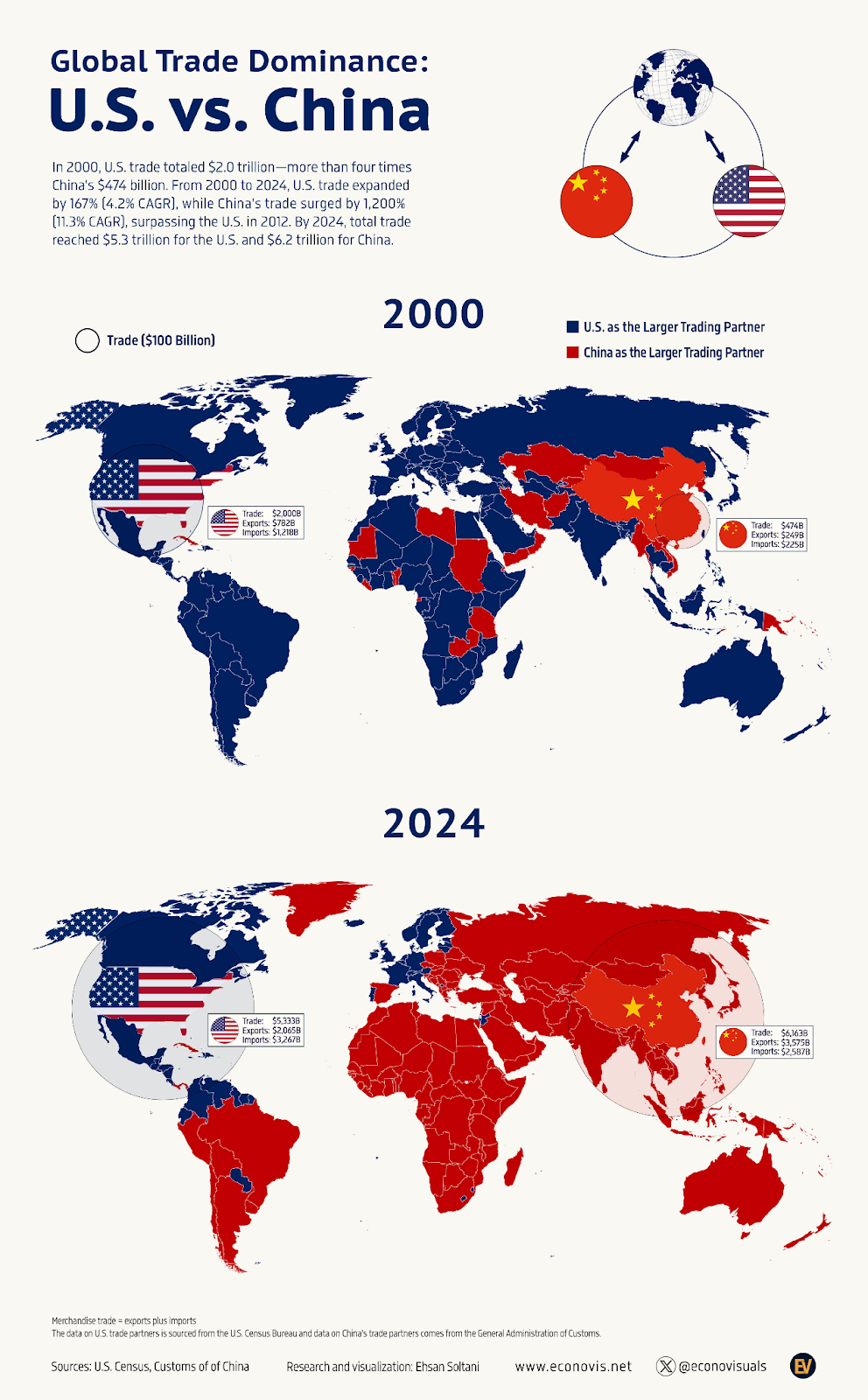

Image description

China surpassed the US in 2012 to become the largest trading nation worldwide, with its total trade in goods exceeding $4 trillion that year.

Digital Asset Markets Monitor Trade Developments

The ongoing trade dispute is drawing close scrutiny from analysts, who believe that a potential resolution between the two dominant economic powers could act as a significant driver for a rebound in digital asset markets.

According to analysts, there is a 70% probability that the cryptocurrency market will reach its lowest point by June 2025 before experiencing a recovery.

Investor willingness to engage with higher-risk assets like Bitcoin hinges on the reactions of other nations to the tariffs imposed, as noted by a research analyst.

“We have likely hit a temporary low regarding tariffs and their impact on market prices,” he remarked during a live broadcast, adding:

“The situation escalated rapidly on the US side, and we may have seen the worst of it, so it’s possible other countries might consider reducing some tariffs, which would likely prompt similar actions from the US.”

Magazine Summary: Could Bitcoin hit an all-time high sooner than anticipated? Predictions regarding XRP and more: March 23 – 29 Summary