Asset management company Teucrium Investment Advisors is preparing to introduce the first XRP-based exchange-traded fund in the United States, specifically a leveraged XRP ETF on the NYSE Arca.

The Teucrium 2x Long Daily XRP ETF aims to provide investors with double the daily returns of the XRP token, accompanied by a 1.85% management fee and an annual expense ratio, as detailed on the firm’s website. This ETF will be listed under the ticker XXRP, starting April 8.

“For those holding a short-term, confident view on XRP prices, the Teucrium 2x Long Daily XRP ETF may be worth considering,” stated the alternative asset manager.

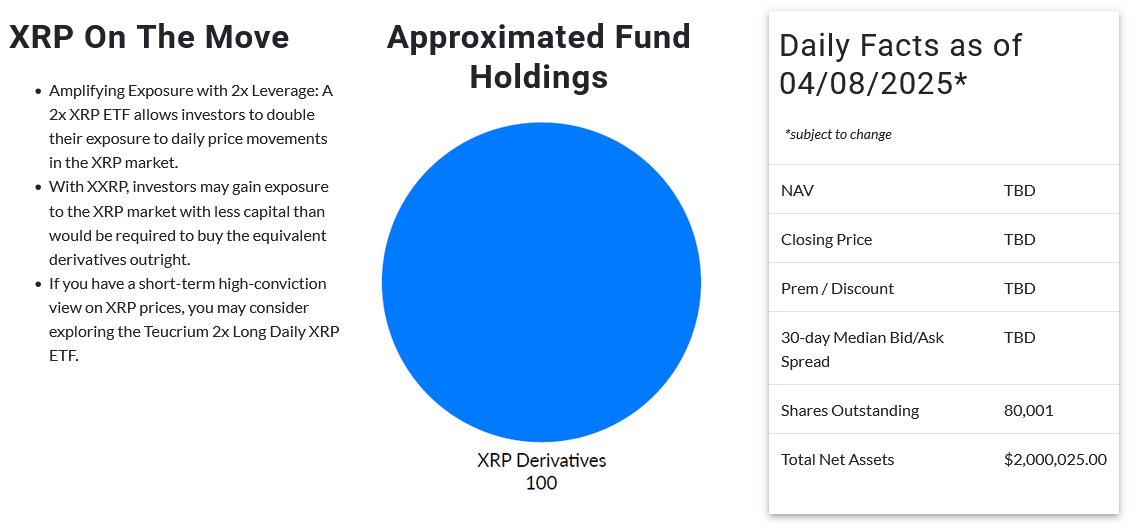

Currently, XXRP has net assets valued at $2 million.

Details regarding the upcoming launch of the XXRP ETF.

The founder and CEO of Teucrium, Sal Gilbertie, shared on April 7 that there has been considerable interest from investors in an XRP ETF and hinted at the possibility of submitting applications for additional crypto ETFs in the future.

Gilbertie expressed his satisfaction that XXRP is set to debut amidst a market downturn largely influenced by tariffs from US President Donald Trump.

“What could be a better time to launch a product than when prices are low?” remarked Gilbertie.

High Likelihood of Approval for Spot XRP ETF: Analyst

Bloomberg ETF analyst Eric Balchunas noted it is “very unusual” for a new asset’s first ETF to be leveraged; however, he emphasized that the likelihood of a spot XRP ETF receiving approval remains “pretty high.”

Source:

Numerous applications for spot XRP ETFs, submitted by firms including Grayscale, Bitwise, Franklin Templeton, Canary Capital, and 21Shares, are currently being evaluated by the Securities and Exchange Commission.

In February, Balchunas and fellow Bloomberg ETF analyst James Seyffart assigned a 65% probability of approval to a spot XRP ETF in 2025.

Prediction market Polymarket currently indicates a 75% chance that the SEC will approve a spot XRP ETF within the year 2025.

Related: XRP price sell-off projected to increase in April as inverse cup and handle suggests a 25% drop

Until recently, the environment for ETF issuers filing for XRP ETFs would have looked quite different due to a prolonged four-year court battle between Ripple Labs—the creators of the XRP token—and the SEC over XRP’s classification as a security.

This legal dispute concluded last month.

Since its inception in 2010, Teucrium has managed to accumulate over $310 million in assets under management.

The firm primarily focuses on agricultural commodities, offering ETFs that track assets like corn, soybeans, sugar, and wheat.

Magazine: XRP win leaves Ripple and industry with no crypto legal precedent established