In response to the 104% tariffs placed on imports from China by the US President, Beijing has opted to allow the yuan to devalue against the dollar. Analysts suggest this could trigger a new phase in the Bitcoin bull market.

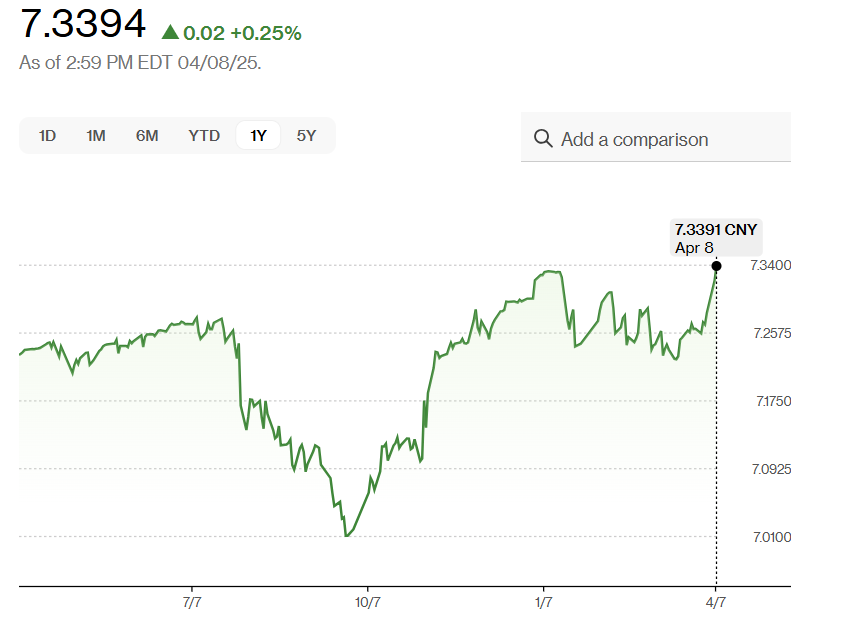

On April 8, the yuan’s exchange rate against the US dollar reached its lowest point since 2023, indicating the Chinese central bank’s openness to more flexible currency fluctuations.

The exchange rate between the US dollar and yuan on April 8.

As the trade conflict intensifies, expectations for a possible yuan devaluation have surged, and analysts note the pressure is unlikely to dissipate soon. “The anticipation for China to eventually weaken its currency has considerably increased,” said a financial expert in the field.

A decline in the yuan could promote the idea of capital fleeing China in favor of hard assets such as Bitcoin (BTC), according to the founder of BitMEX.

The co-founder and CEO of Bybit concurred, stating that China is likely to allow the yuan to weaken in order to mitigate the effects of the trade war. This could result in “significant Chinese capital flowing into BTC, which is bullish for BTC,” he remarked.

Comment from Bybit’s co-founder.

Bybit is the second-largest cryptocurrency exchange globally in terms of trading volume and is well-known among derivatives traders. Recently, the platform announced that users in mainland China can trade without the need for a VPN, although trades in yuan are not allowed.

Related: $2T fake tariff news pump reveals market readiness to speculate

Currency fluctuations expected to persist amid escalating US-China trade tensions

Currency volatility is becoming a hallmark of the escalating trade conflict between the two largest economies globally.

Apart from the yuan-dollar dynamics, investors are preparing for significant foreign exchange volatility associated with this trade war, as noted by a market professional.

Since the inauguration of the current US President, the US dollar has steadily declined, with the DXY Dollar Index dropping from nearly 110 to below 103.

A notable decline occurred between late February and early March, marking one of the steepest shifts in the last ten years, as reported by a macro researcher.

The DXY reflects the performance of the US dollar against a selection of six currencies, with predominant influences coming from the euro and the Japanese yen.

Recent significant weakening of the US dollar as seen in the DXY index.

Historically, Bitcoin’s price has shown a pronounced inverse correlation with the US dollar; when the dollar weakens, Bitcoin prices tend to rise, and vice versa.

Related: As policy affects Bitcoin, PMI provides insights into future trends