- XRP rebounds following significant volatility in recent days, spurred by reciprocal tariffs imposed by US President Donald Trump.

- A negative MVRV ratio indicates that XRP is largely undervalued, encouraging traders to consider purchasing the token.

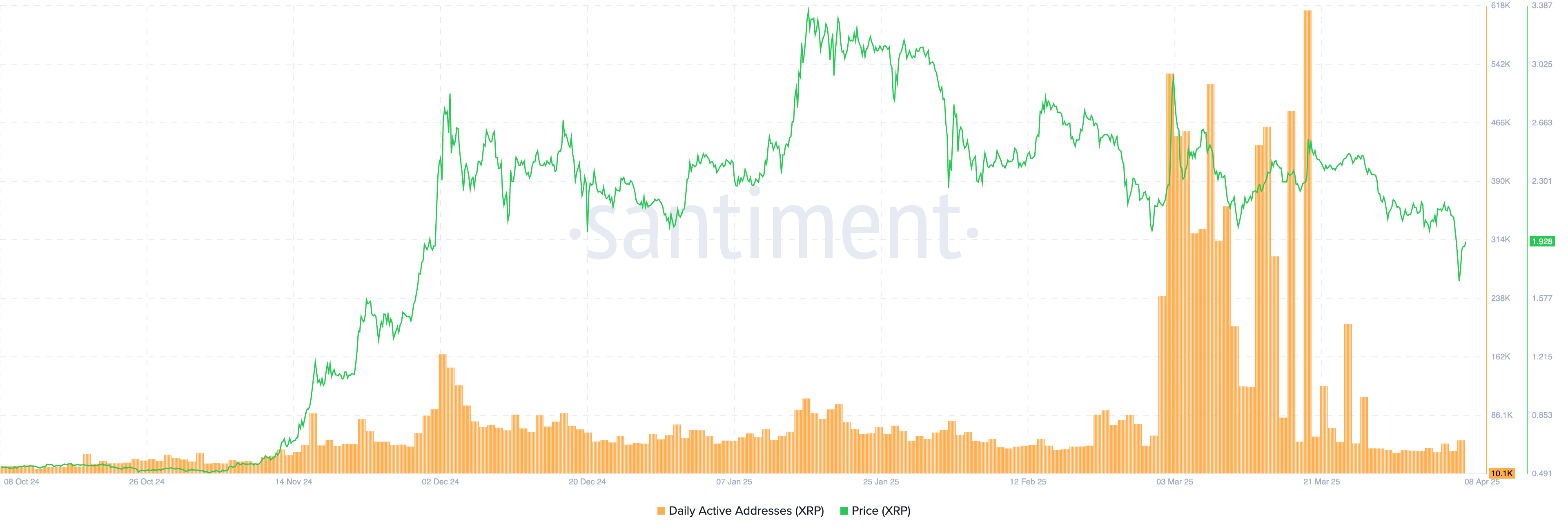

- A noticeable decrease in on-chain activity may hinder recovery efforts.

Ripple (XRP) aims to find stability in a fluctuating cryptocurrency market influenced by macroeconomic elements, including tariff policies. The international money transfer token dropped to a low of $1.64 on Monday after starting the week at $1.92, marking a 14.5% decline in a single day. As of late Tuesday during the Asian session, XRP managed to recover its losses and was trading at $1.92, as global markets continue to adapt to US President Donald Trump’s unpredictable tariff strategy.

XRP’s rebound aims for $2 as President Trump maintains tariff stance

After a brutal sell-off on Monday, major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are experiencing a rebound. Trump’s blanket 10% reciprocal tariffs announced on April 2 will take effect on Wednesday.

Despite turbulence in global markets, including US stock performance, Trump stated during a press conference with Israeli Prime Minister Benjamin Netanyahu on Monday that the tariff plans would proceed as scheduled. He even hinted at an additional 50% tariff on China, further escalating the situation.

It remains uncertain whether XRP’s price recovery to $1.92 can be sustained, especially with tariffs set to come into play imminently. Nonetheless, some on-chain metrics indicate the possibility of a more significant rebound, suggesting that investors may want to consider acquiring XRP at the current price point.

The Market Value Realized Value (MVRV) metric from Santiment indicates it sits at 9.47% below the means calculated, signaling that XRP is significantly undervalued. Traders currently holding XRP are less likely to sell at these levels, as doing so would mean incurring considerable losses. This scenario might lead to diminished selling pressure, indicating a potential recovery as sellers grow increasingly exhausted. Historically, a negative MVRV ratio has been perceived as a buy signal.

XRP MVRV | Source: Santiment

Can XRP maintain a recovery above $2?

XRP could regain its bullish stance if it re-establishes support at the $2 level. However, bulls must first navigate a tumultuous market environment to sustain any price increases, including achieving a daily close above the 200-day Exponential Moving Average (EMA). Additionally, the Relative Strength Index (RSI) continues to trend toward oversold territory, which might dissuade sellers from exiting the market. Simultaneously, the Moving Average Convergence Divergence (MACD) indicator has retained a sell signal since March 28, indicating a continued downtrend may be underway.

XRP/USDT daily chart

Attention is focused on the bulls’ ability to restore the $2.00 level as a support line, a movement that could reinforce XRP’s bullish framework and lay the groundwork for a recovery to $3.00.

Nonetheless, the downward trend in network activity highlighted by Santiment’s Daily Active Addresses metric may impede recovery. The data reveals that only 10,100 addresses were active on the network this past Monday, a stark contrast to 581,000 addresses observed on March 19.

XRP Daily Active Addresses | Source: Santiment

A persistent decline in network activity negatively affects the underlying asset’s performance, depriving it of sufficient momentum to sustain recovery due to weak demand. Therefore, it may be wise to wait for confirmation of a trend before fully committing to buying in at these lower levels.