A governance proposal to initiate the buyback of AAVE, the governance token of the decentralized finance (DeFi) platform, was approved by its tokenholders, marking the beginning of a substantial revamp in tokenomics, as reported on April 9.

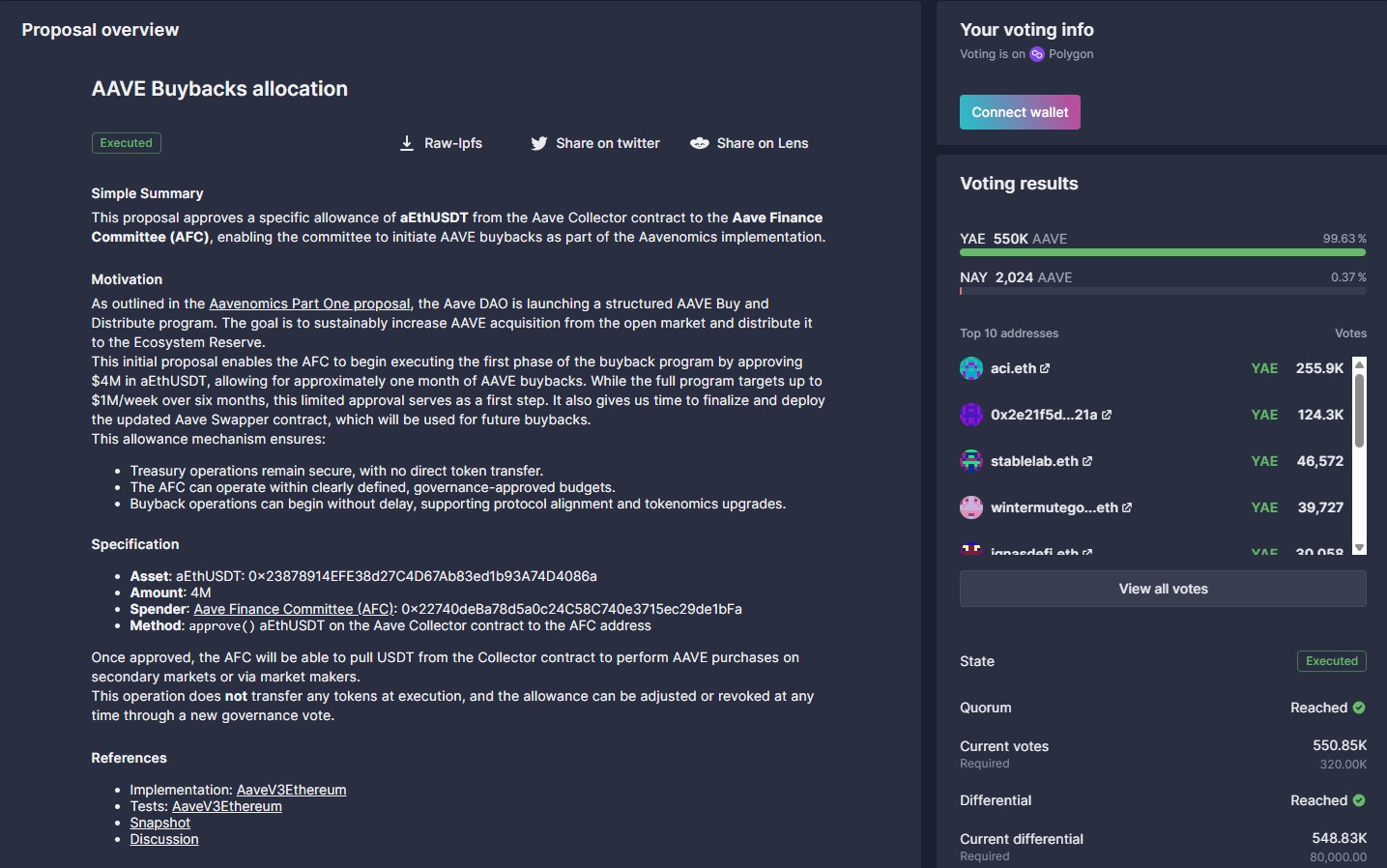

More than 99% of AAVE tokenholders supported the approved proposal, which allows the protocol to acquire $4 million worth of AAVE tokens, sufficient for one month of buybacks.

This initiative serves as a “first step” towards a more extensive strategy aimed at repurchasing $1 million in AAVE tokens each week over a six-month period. It also reflects a growing trend among DeFi protocols to implement buyback strategies in response to requests from tokenholders.

The intent behind this action is to sustainably enhance AAVE acquisition from the open market and allocate it to the Ecosystem Reserve, according to the proposal.

On April 9, the AAVE token’s price surged by over 13%, resulting in a market capitalization exceeding $2.1 billion, according to metrics from CoinGecko.

The buyback proposal received overwhelming support. Source: Aave

Related: A suggestion to link Ethena’s USDe to USDT meets community backlash

Rising Trend of Buybacks

In March, the Aave Chan Initiative (ACI), which acts as a governance advisory group, put forth a proposal for a tokenomics update that would introduce new revenue distributions for AAVE tokenholders, improve user safety features, and establish an “Aave Finance Committee.”

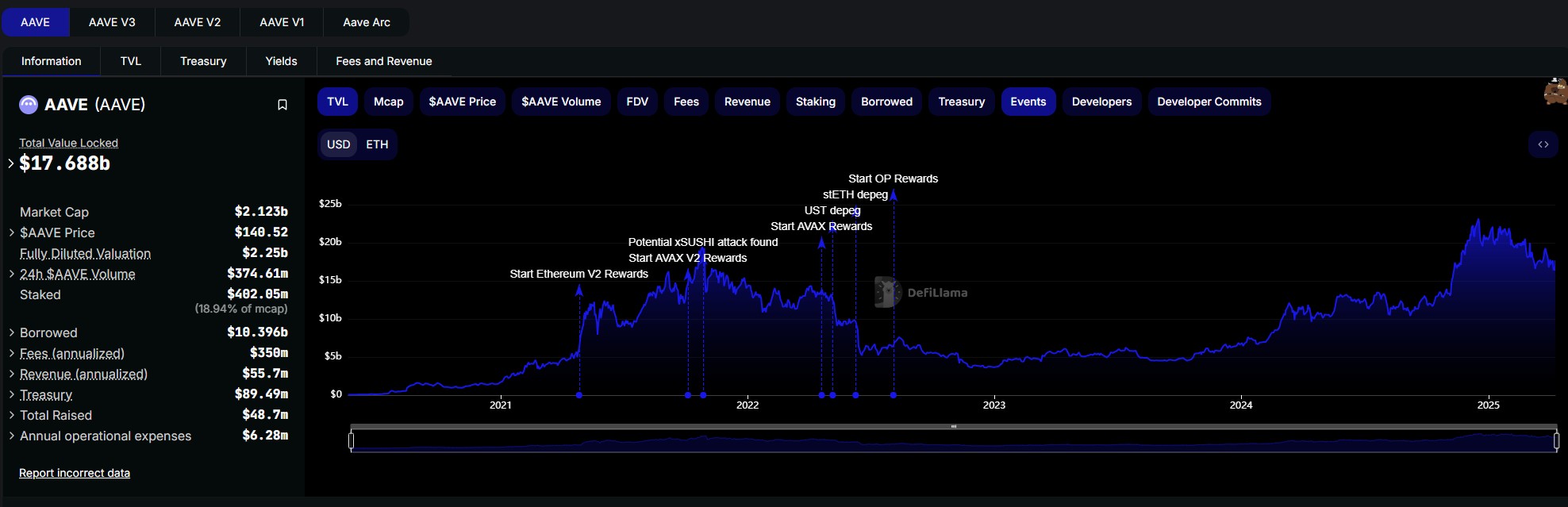

As of April 9, Aave stands as the leading DeFi protocol within Web3, boasting a total value locked of over $17.5 billion, as outlined by DefiLlama.

Additionally, it ranks among the top fee-generating DeFi protocols, with an estimated annual revenue of $350 million, according to available data.

Aave is the leading DeFi protocol by total value locked. Source: DeFiLlama

With increasing pressure on DeFi protocols to share a portion of protocol revenues with tokenholders—partly influenced by a more favorable regulatory climate for DeFi initiatives—many are exploring ways to create value for their native tokens.

Earlier this year, the community of Maple Finance proposed a buyback strategy for their native SYRUP tokens to reward stakers.

Lately, Ether.fi, a liquid restaking token provider, announced plans to allocate 5% of protocol revenues towards purchasing native ETHFI tokens.

Likewise, Ethena reached an agreement to distribute some of its approximately $200 million in protocol revenues to its tokenholders in November.

Magazine: DeFi will see resurgence as interest in memecoins wanes: Insights from Sasha Ivanov, X Hall of Flame