Core, a proof-of-stake blockchain leveraging Bitcoin, has reached over $260 million in dual-staked assets as institutional interest in Bitcoin-focused decentralized finance (DeFi) rises.

According to initial contributor Rich Rines, as of April 7, more than 44 million Core tokens have been dual-staked alongside 3,140 Bitcoin (BTC). At the time of this report, these assets are valued at approximately $260 million.

Core’s dual-staking mechanism allows Bitcoin holders to earn increased yields by utilizing CORE tokens. Although users can stake BTC at a standard rate, those who opt to dual stake with Core tokens benefit from enhanced returns.

“By using dual staking, base staking rewards can more than double, with the potential to increase over 15 times based on the quantity of CORE tokens staked,” the Core team stated.

Core’s achievement underscores rising demand for Bitcoin staking

This recent achievement has been partly fueled by institutional players adopting Core’s staking model within their platforms.

The Core Foundation noted that prominent custodians like BitGo, Copper, and Hex Trust have given their clients access to the protocol through the integration of dual staking. Additionally, Core has teamed up with Maple Finance to develop a structured asset that leverages dual staking to create yield.

Rines mentioned that institutions have played a pivotal role in the early success of the dual staking model. He highlighted that this approach opens up new possibilities for institutions.

“This change could significantly affect the Bitcoin ecosystem. Traditionally, institutional BTC holdings involved custody fees without generating any yields,” Rines explained.

He further stated that by adopting Core’s staking model, institutions can transform Bitcoin into a yield-generating asset, helping to offset costs and unlock new financial efficiencies.

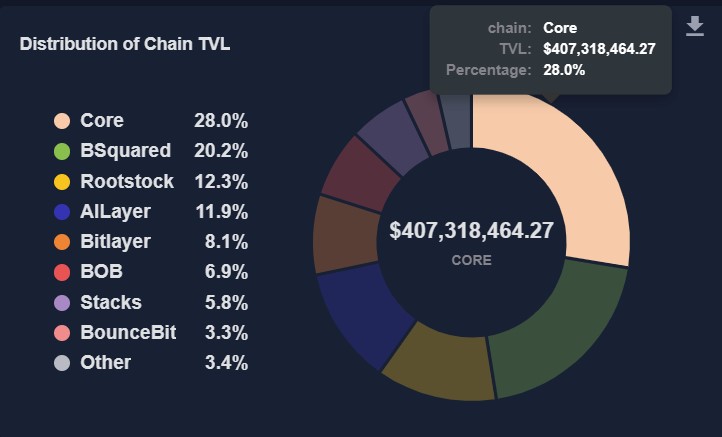

As of now, Core boasts the largest total value locked (TVL) among Bitcoin sidechains. Reports suggest Core’s TVL exceeds $400 million, accounting for a 28% market share.

Distribution of chain TVLs among Bitcoin sidechains.

Related: Bitcoin ETFs face $326M decline amid changing relationship with traditional finance markets

Bitcoin evolving into a “productive” asset

The Core team noted that the growth in dual-staked CORE tokens illustrates the product’s effectiveness. Rines remarked:

“The fact that over 44 million CORE tokens have been dual-staked to date demonstrates tangible adoption of the model. It indicates that both retail and institutional users are eager to put their Bitcoin to work in a secure and sustainable manner.”

Rines stressed that Core’s dual-staking model provides sustainable utility for long-term Bitcoin holders while allowing them to maintain custody of their assets.

“This represents a shift towards Bitcoin becoming productive—not through third-party trust, but by engaging in a system designed to foster real alignment and long-term commitment,” Rines stated.

Magazine: New ‘MemeStrategy’ Bitcoin venture by 9GAG, imprisoned CEO’s $3.5M bonus: Asia Express