The shifting dynamics between Bitcoin and conventional financial markets are experiencing renewed strain as global investors withdraw from risk assets amid escalating US trade tensions.

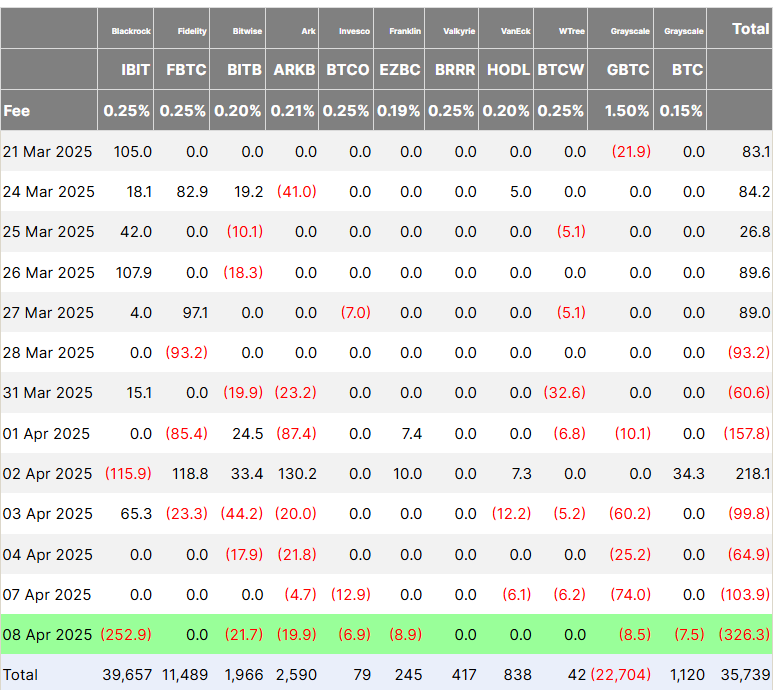

Bitcoin ETF flows, in millions of US dollars.

This selling pressure came in the wake of the US President’s April 2 announcement regarding extensive reciprocal import tariffs, which led to a historic $5 trillion loss in the S&P 500 over just two days.

Related: Bitcoin may compete with gold as an inflation hedge over the next decade.

“Despite a 26% decline since January’s inauguration, Bitcoin’s relative strength in the two days following the tariff announcement — a 6% drop compared to an 11% dip in the Nasdaq — indicates a complex relationship developing between cryptocurrency and traditional assets.”

Initially, Bitcoin held steady above the $82,000 support level but later dropped below $75,000 on Sunday, April 6.

BTC/USD, 1-year chart.

Related: Bitcoin price could reach $250K by 2025 if the Fed returns to quantitative easing.

Bitcoin’s Connection to Global Liquidity

“While I’m detecting early indications of divergence, I believe Bitcoin is still fundamentally aligned with global liquidity dynamics, necessitating caution amid possible market upheavals — while gold continues to serve as a hedge against geopolitical unrest.”

“Bitcoin is primarily influenced by market expectations regarding future fiat supply,” noted a prominent co-founder of a cryptocurrency exchange.

Magazine: Could Bitcoin reach an all-time high sooner than anticipated? Is XRP set to drop 40%? And more in the Hodler’s Digest.