In recent days, trading activity for Bitcoin (BTC) futures has experienced a significant spike, highlighting a highly reactive, leveraged, and structurally cautious market environment.

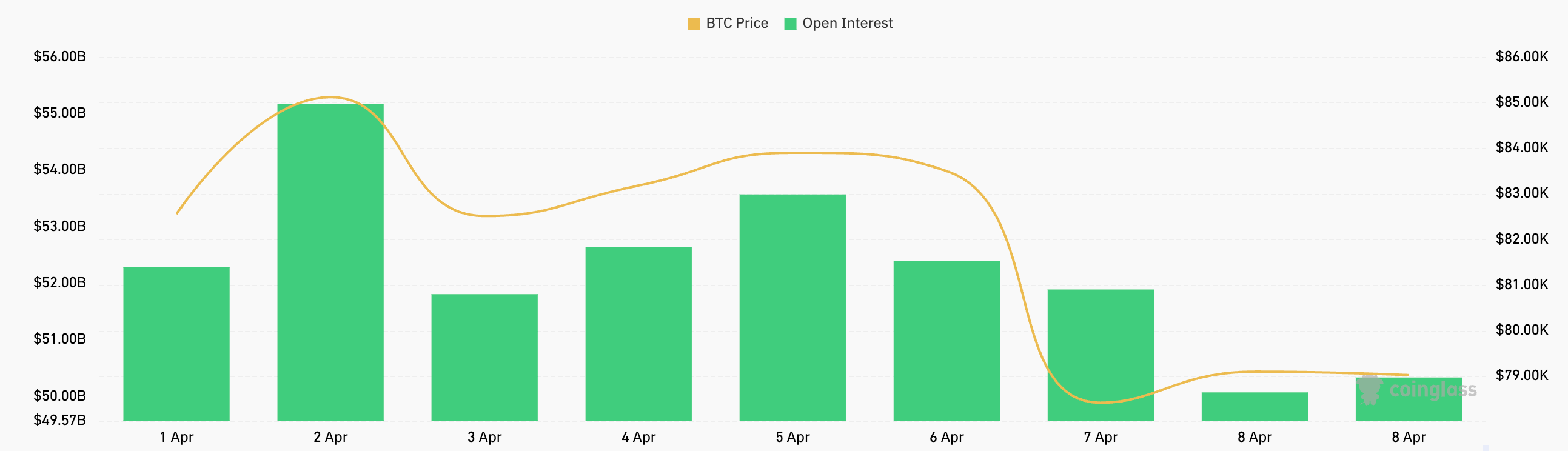

Daily futures volume across major derivatives exchanges skyrocketed from $109.39 billion on April 4 to $227.53 billion by April 8, representing a remarkable 108% increase in just a span of four days. In contrast, open interest (OI) declined during the same timeframe, dropping from $52.64 billion to $50.34 billion.

The disconnect between volume and OI becomes particularly clear when observing the period from April 6 to April 8. On April 6, the futures volume was at $58.02 billion, and just two days later, by April 8, it surged to an unprecedented $227.53 billion, marking a stunning 292% increase. Despite this vigorous trading, OI fell from $53.39 billion on April 6 to $50.34 billion on April 8.

This combination of rising volume alongside decreasing OI strongly suggests that trading was predominantly driven by short-term speculative activity and liquidations rather than the creation of long-term holdings.

The sheer scale of this volume increase demonstrates how traders reacted to rapidly changing macroeconomic and geopolitical developments, particularly the intensification of the US-China trade conflict. It also highlights the derivatives market’s sensitivity to volatility and uncertainty, which typically provides fertile ground for leveraged trading but is also susceptible to swift reversals and liquidation cascades.

Volume Lacks Commitment

Futures volume captures the total monetary value of contracts traded within a day, but it does not differentiate whether traders are establishing new positions or closing existing ones. Open interest, on the other hand, indicates the total count of active contracts held by participants, yielding a clearer picture of traders’ commitment to their positions.

The timeline from April 6 to April 8 is particularly enlightening. On April 6, the futures market saw a typical weekend slowdown, with daily volume dropping to $58.02 billion. This dip is common during weekends as institutional players reduce exposure and order books become thinner. Yet, the following two days witnessed a robust return of liquidity. Volume soared to $123.96 billion on April 7 and nearly doubled to $227.53 billion on April 8, marking the highest daily volume in over a month.

However, OI did not mirror this explosive uptick. After remaining relatively stable at $53.39 billion on April 6, it decreased to $51.89 billion on April 7 and fell further to $50.34 billion by April 8. This dramatic rise in volume paired with stagnant or declining OI suggests a surge in intraday trading, resulting in liquidations and quick position shifts. Traders were actively entering and exiting the market en masse but were hesitant to hold onto their positions long-term.

This information yields several crucial insights. First, a significant portion of the trading volume likely stemmed from leveraged traders responding to volatility and risk. Second, the stagnation in open interest indicates that traders prioritized risk management and opportunistic scalping rather than committing to directional positions. Lastly, it implies that forced liquidations were a significant factor inflating volume.

Such circumstances exemplify market stress, characterized by high transaction rates without strong conviction, where capital is deployed aggressively yet not maintained long-term. This environment favors market-neutral strategies and high-frequency trading while disadvantaging overleveraged directional players. The decrease in OI reinforces the notion that few were willing to retain exposure amid the uncertainty, even with surging trading activity.

The main trigger for this surge in futures trading was a sudden decline in global trade relations. On April 6, China enacted retaliatory tariffs on essential U.S. exports, such as semiconductors and electric vehicles, in response to prior actions taken by Washington.

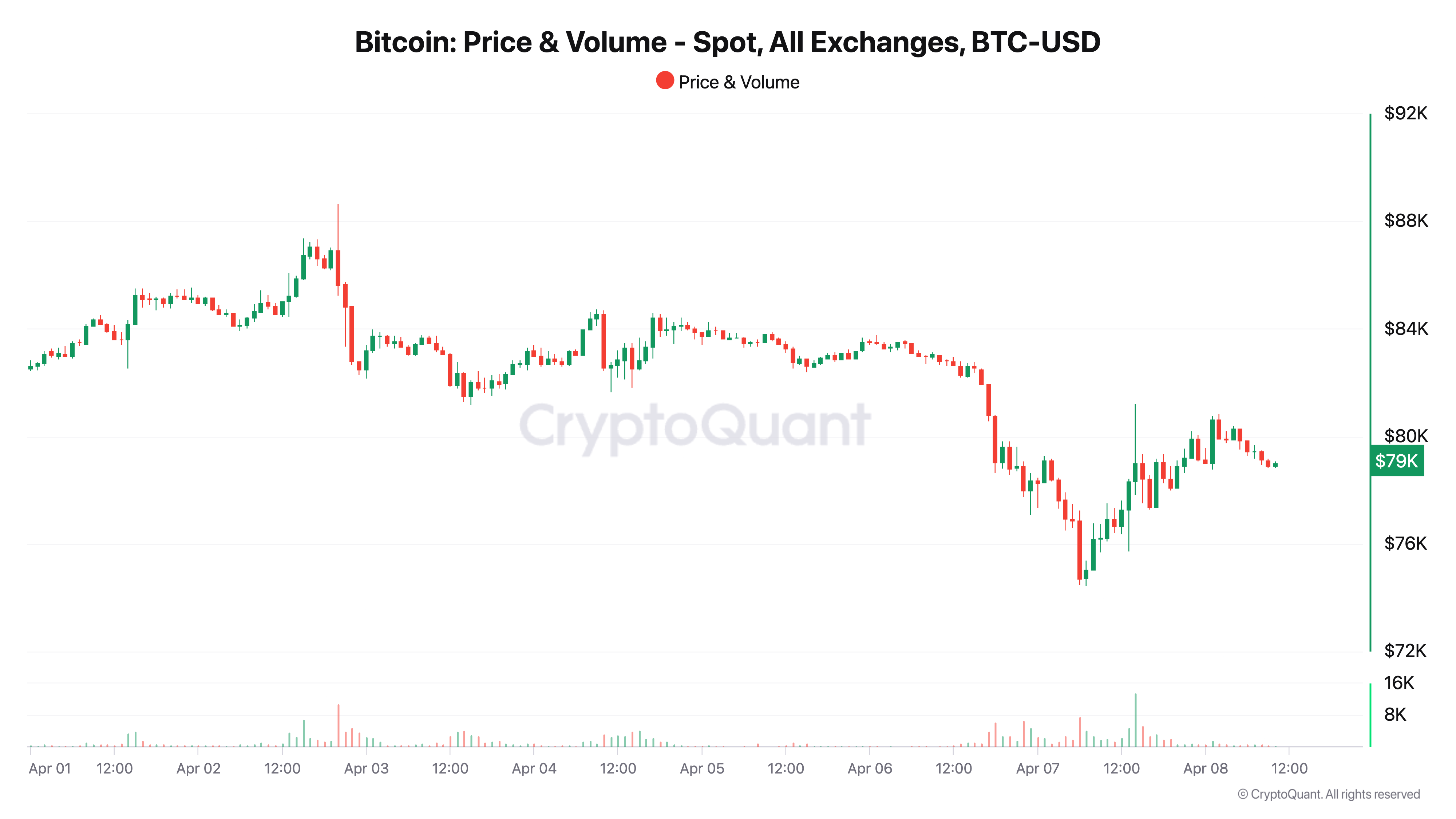

Initially, Bitcoin reacted negatively, dropping to $78,367 by April 6, reflecting a 6.2% decline from the close on April 5. The markets were unsettled by headlines indicating that the Trump administration might impose a 50% tariff increase on China if no agreement was reached within 24 hours. This news sent shockwaves through both global equities and cryptocurrencies.

Compounding the confusion, a misleading report briefly circulated on April 7 about a temporary hold on tariffs, triggering a swift rebound in BTC to $79,144, which was accompanied by a sharp rise in U.S. stock prices. However, this uptick proved temporary, as Bitcoin retraced back below $79,100 by April 8. The S&P 500 (SPX) mirrored this volatility, experiencing significant swings and losing nearly $2 billion in value over the same period.

This heightened environment of uncertainty is perfect for derivatives traders who thrive in volatile conditions. Consequently, there was a marked increase in short-term positions as traders rushed to hedge, speculate, or adjust their exposure. While OI declined, the massive rise in volume strongly suggests numerous forced liquidations, exceeding $1 billion throughout the weekend.

This indicates that traders were heavily leveraged and likely found themselves on the wrong side of volatility. Given that funding rates across major perpetual swaps remained either neutral or slightly positive, it suggests that longs initially had the upper hand, faced a squeeze, and were then swiftly unwound.

The turbulence reaffirmed Bitcoin’s dual role as both a speculative asset and a macro hedge. During the tariff escalation, Bitcoin did not function as a safe haven, declining alongside equities and commodities. However, the subsequent stabilization combined with high-volume activity indicates that traders still consider Bitcoin a vehicle for expressing views on macroeconomic policies, monetary instability, and geopolitical risks.

This split—marked by high transactional interest without increasing commitment—might continue to shape the market structure in the short term. Without a definitive resolution to macroeconomic uncertainties or a clear technical breakout, both bullish and bearish traders seem hesitant to maintain long-term exposure.