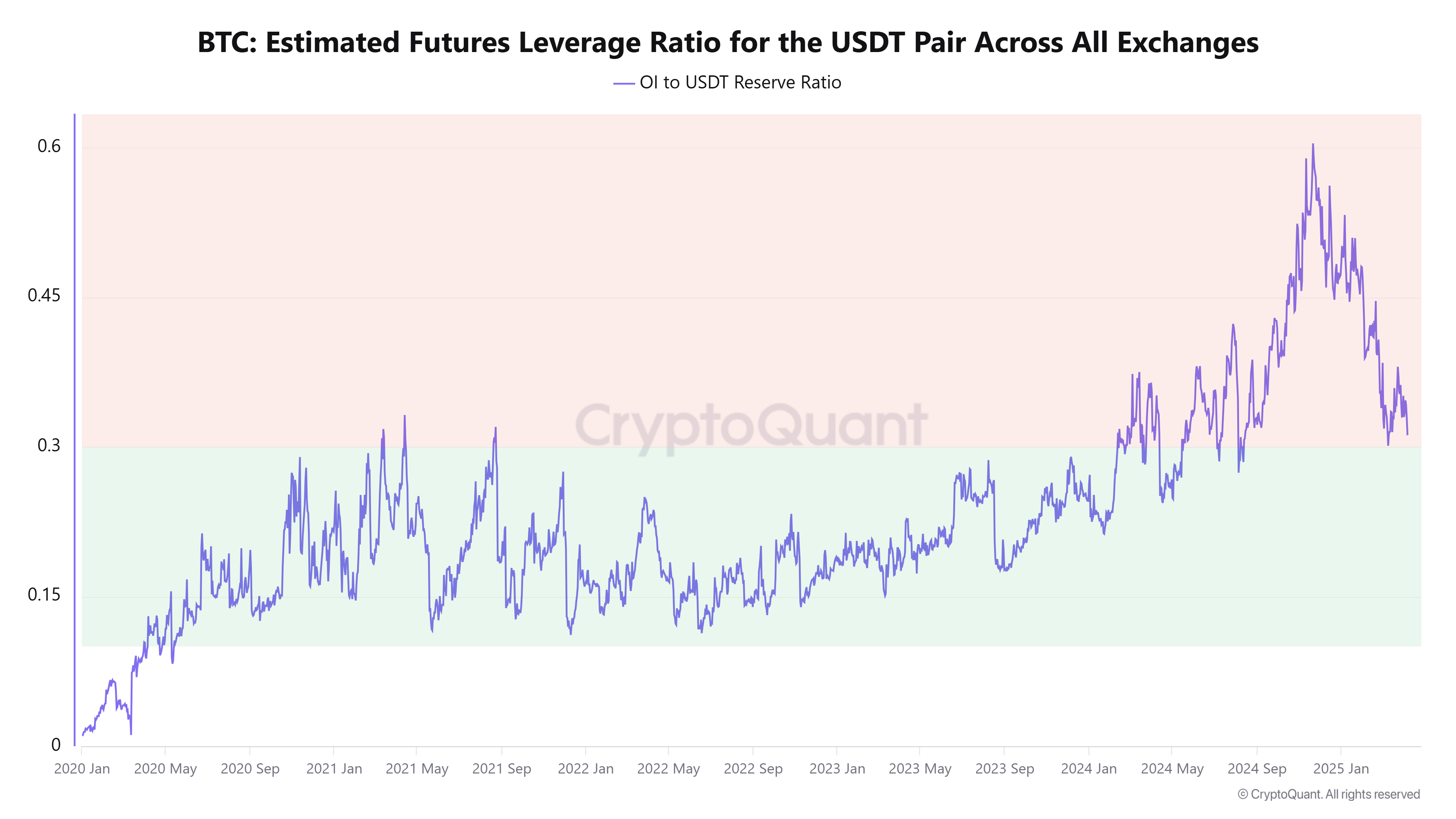

The Bitcoin (BTC) futures market suggests a potential price cooling after a prolonged period of correction for the cryptocurrency. Recent data has shown that the BTC-USDT futures leverage ratio in relation to open interest (OI) has dropped by half since hitting its peak in early 2025.

Estimated futures leveraged ratio for Bitcoin.

This significant reduction in leverage is mainly due to extensive liquidations that have occurred in recent weeks, resulting in a majority of traders being sidelined. Consequently, the current market dynamics suggest a healthier reset, free from overheating, which might contribute to a gradual price recovery.

Bitcoin’s open interest has seen a 28% decline, falling from $71.8 billion on December 18 to $51.8 billion on April 8. This highlights the scale of the ongoing de-leveraging event. While this may lead to short-term volatility, as fewer market participants could sway the price, it also sets BTC up for potential stability in the long run, offering a favorable position in the current unpredictable climate.

Related: Divergences in Bitcoin futures suggest a market transition — Are BTC bulls accumulating?

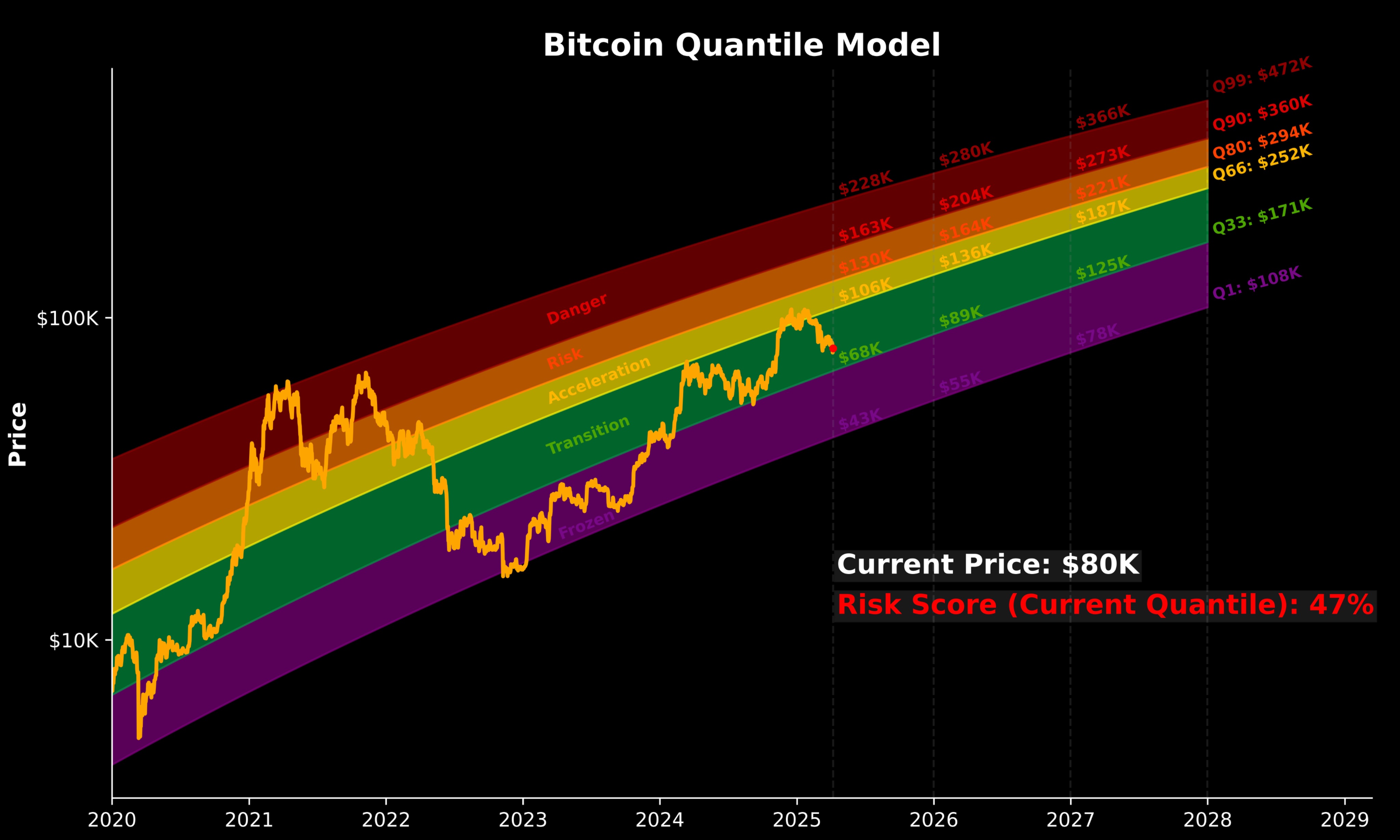

Analyst suggests $70K Bitcoin as the worst-case scenario

Bitcoin Quantile Model analysis.

The analyst noted that Bitcoin may have already experienced 75-80% of its corrective phase, having declined from $109,000 to $74,500. Historically, such trends have seen price drops as steep as 34% over a span of six to eight weeks. Currently, after a 31% drop from its all-time high, a further decline to $72,000-$70,000 would align with the historical 34% loss. The analyst remarked,

“Assuming no recession occurs, $70K stands as my worst-case projection. Despite a challenging macro environment and the potential for additional sell-offs, we believe Bitcoin is significantly undervalued for long-term investors.”

Nonetheless, the possibility of a swift recovery appears low, as a Bitcoin researcher anticipates that BTC will remain in a “volatility corridor.”

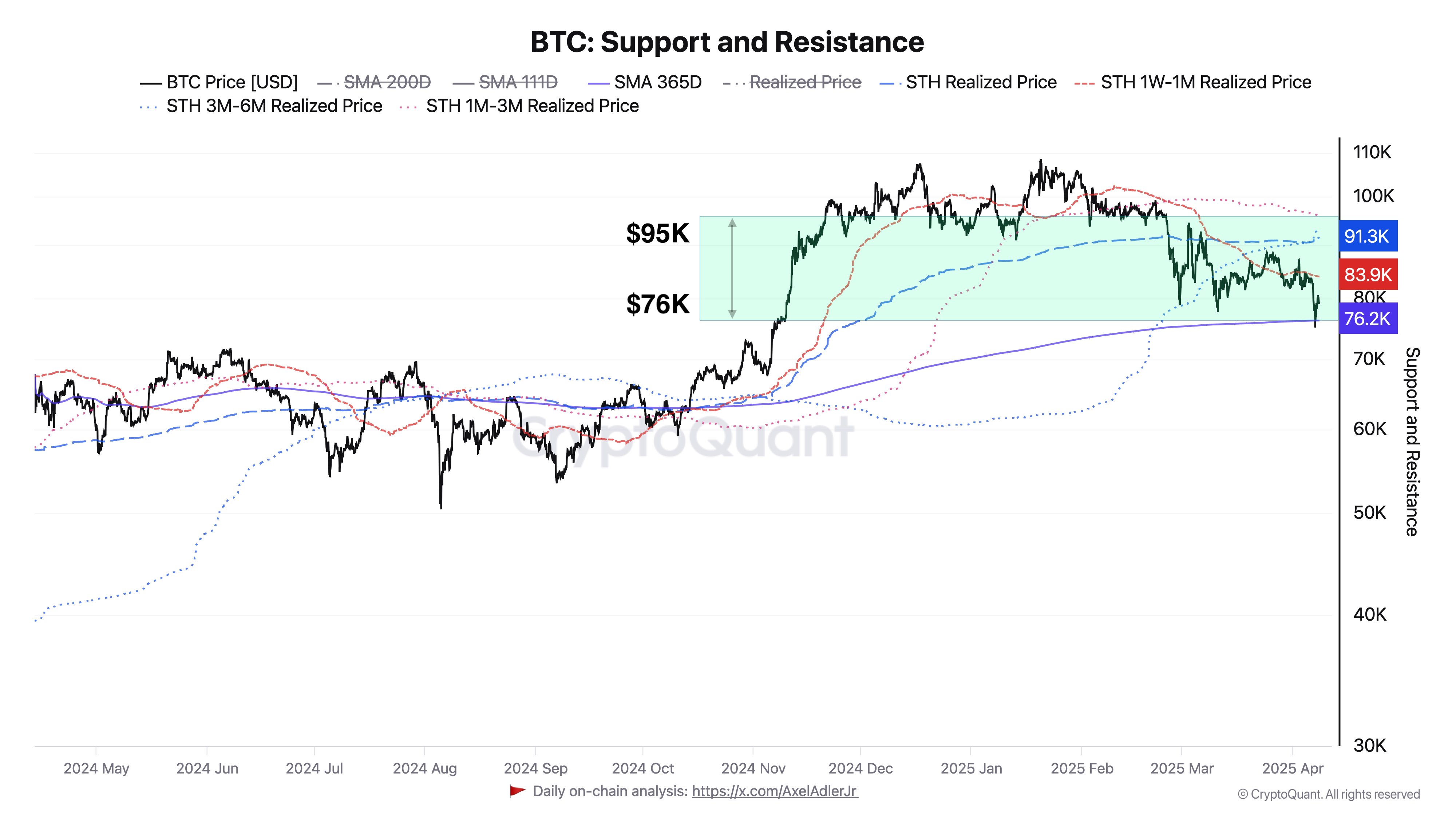

Support and resistance levels for Bitcoin.

The identified volatility corridor indicates a price range of $75,000 to $96,000, derived from short-term holders’ realized prices across various periods.

The researcher suggested that BTC might consolidate within these levels in the forthcoming weeks but cautioned that the price must remain above the 365-day simple moving average. Dropping below this crucial indicator could risk new yearly lows below the $74,500 mark, with the previously mentioned $70,000 acting as an ideal target.

Related: Renewed discussions on Bitcoin’s durability against the US dollar following Trump tariffs

This content does not offer investment advice or recommendations. All investment and trading actions carry risk, and readers should conduct their own research before making decisions.