As the cryptocurrency landscape evolves, sophisticated trading mechanisms like perpetual swap contracts are playing an increasingly significant role in shaping the value of alternative coins, as noted by an industry expert.

Perpetual swap contracts represent a unique kind of crypto trading agreement that enables traders to speculate on the price movements of a coin without needing to own it. They share similarities with futures contracts, but unlike those, they do not have an expiration date, allowing traders to maintain their positions indefinitely.

The expert explained that keeping an eye on perpetual swap contracts is crucial because recently launched swaps permit traders to short the underlying altcoin for the first time, marking the beginning of “true price discovery.” He emphasized:

“Perpetual swaps are essential for determining the prices of newly launched altcoins and serve as a strong indicator of market sentiment, as they are often the first derivative products introduced."

He mentioned that these swaps facilitate both long and short positions, enabling traders to hedge or speculate effectively. “Monitoring these positions can help reveal directional bias,” he noted.

This implies that tracking the movements in perpetual swaps could provide traders with deeper insights into how the market assesses an altcoin’s worth.

The Influence of Exchange Listings on Perpetual Swap Contracts

It was highlighted that perpetual swaps can significantly influence spot price fluctuations. Due to the high liquidity and leverage associated with these contracts, price surges or declines can create a ripple effect on spot prices. Thus, analyzing the details of perpetual swap data can also aid spot market traders.

Much like traditional spot crypto markets, perpetual swap contracts are affected by exchange listings. However, the impact varies across centralized finance (CeFi) trading platforms when it comes to perpetual swaps.

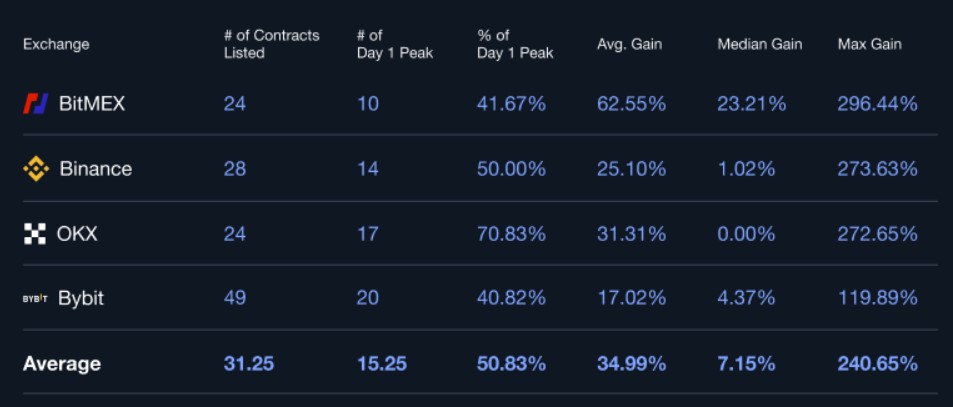

In a recent analysis of how exchange listings influence perpetual swap contracts, it was pointed out that different exchanges show varying results for their inaugural listings of perpetual swaps.

Data from early 2025 through March 18 indicated that around 70% of contracts on one notable exchange achieved a new all-time high on their initial listing day.

In contrast, another exchange along with BitMEX showed similar results at about 41%, while yet another exchange exhibited an even split of 50%, indicating that some contracts reached their peak on the first day, while others did not.

“For traders, strategically choosing which exchange to utilize when trading perps can significantly affect return on investment and help mitigate the risks associated with common practices like pump and dumps,” the expert advised.