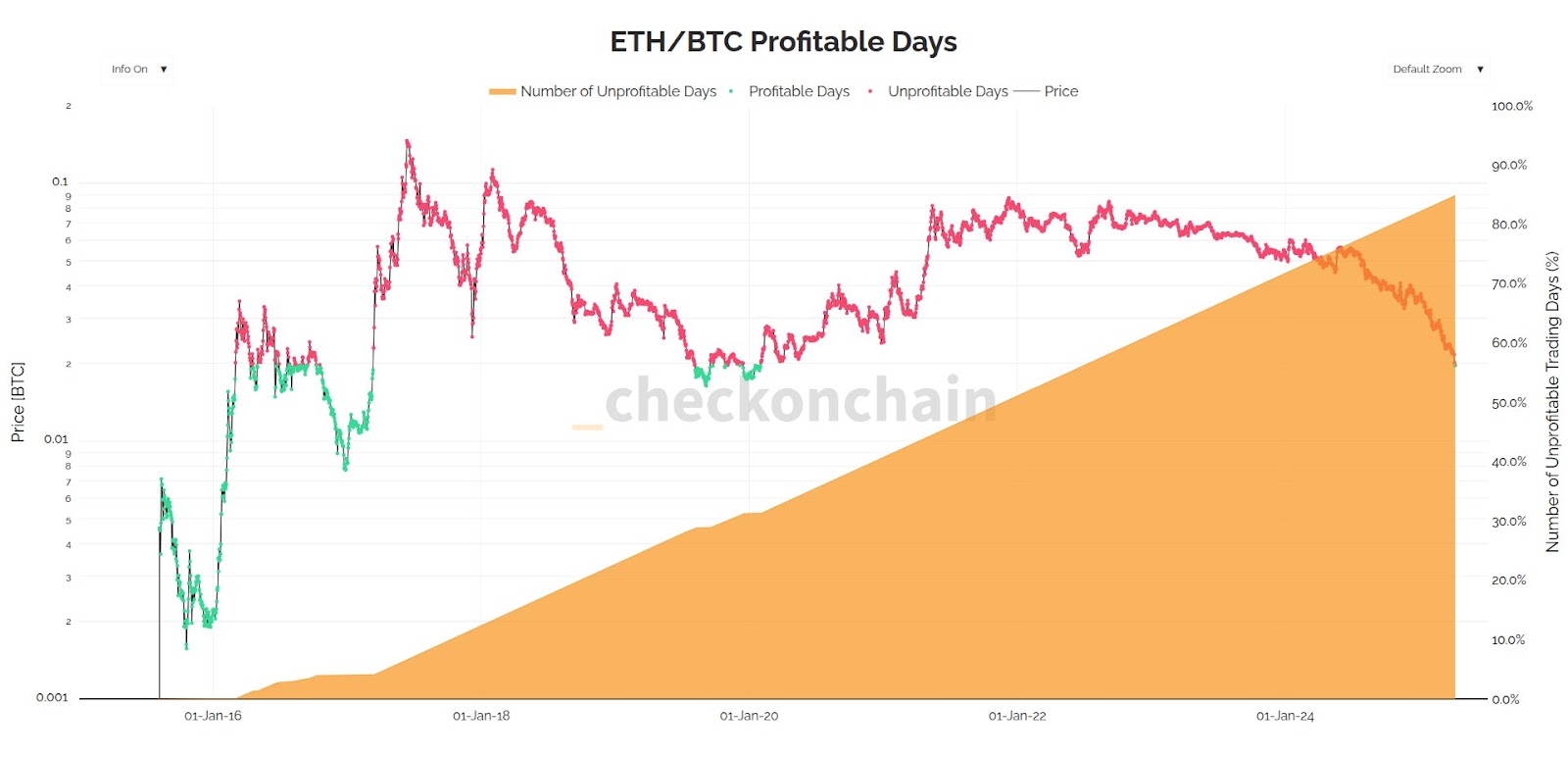

Since its inception nearly ten years ago, Ethereum has outperformed Bitcoin on only 15% of all trading days, as indicated by analysts.

Mid-2015 marked the start of Ether (ETH) trading, and data analyzed by an expert shows it has lagged behind Bitcoin (BTC) 85% of the time. Historically, Ether enjoyed better performance in its early years, from mid-2015 to approximately mid-2017, with a couple of brief periods in late 2019 and early 2020 when the ETH to BTC ratio favored Ether.

However, for the past five years, Bitcoin has consistently outperformed Ether.

Days when ETH outperformed BTC.

As of April 9, the ETH/BTC ratio, which reflects the price of Ether in Bitcoin terms, dropped to a five-year low of 0.018, according to market data.

The last instance when the ratio dipped below this level was in December 2019, when Ether fell to $125 while Bitcoin was around $7,000.

Currently, Ether has erased seven years of growth, sliding an additional 10% in the last 24 hours to below $1,450, thus falling beneath its market cycle peak from 2018.

On April 9, ETH fell to $1,400 in early trades, whereas Bitcoin experienced a 6% decline, settling at $75,000, which still represents a 275% increase from its peak seven years ago during the market boom.

Concerns of “stagnation” among Ethereum supporters

Supporters of Ethereum have expressed unease over the network’s development, especially as the token struggled to gain momentum earlier this year, coinciding with Bitcoin’s new price highs.

“I have a strong appreciation for Ethereum. Nevertheless, we must face the facts: the active address count has remained relatively stable for the past four years,” commented a Web3 researcher on social media.

Related: Ethereum price dips to a two-year low, yet some traders remain optimistic

Conversely, some analysts highlighted that the majority of new addresses are linked to Ethereum layer-2 scaling solutions, which have seen significant growth in locked value over the past couple of years.

While many long-term ETH holders are currently at a loss, technical indicators resembling those seen in 2018 and 2022 suggest that the asset is nearing oversold conditions, hinting at a potential bottom around the $1,000 mark, based on recent analyses.

Magazine: Three reasons why Ethereum could see a positive turnaround: Insight from an industry expert