Hedera’s HBAR token experienced a 22% increase today as investors responded to its expanding involvement in Nvidia’s initiatives to improve verifiable data integrity for AI systems.

The enthusiasm began when Anthony Rong, Nvidia’s regional vice president of Engineering, posted on LinkedIn about the collaboration between the two teams aimed at integrating AI with blockchain technology.

Rong indicated that Hedera’s public ledger, recognized for its speed, security, and energy efficiency, could significantly contribute to establishing trust in AI. The concept involves utilizing Hedera to authenticate AI-generated data in real time, which is becoming increasingly crucial as AI integrates into sectors such as healthcare, finance, supply chains, and autonomous vehicles.

He elaborated that Hedera simplifies the tracking of data origins, thereby minimizing misinformation, inaccuracies, and fraud within AI systems. Additionally, its low energy consumption aligns with Nvidia’s commitment to sustainable and high-performance technology.

This news propelled Hedera (HBAR) to an intraday high of $0.158 on April 8, elevating its market capitalization beyond $6.6 billion. Daily trading volume also surged by over 53%, surpassing $551 million.

The optimistic sentiment surrounding the AI-blockchain alliance also positively impacted other prominent players in the AI cryptocurrency space, with tokens such as Bittensor (TAO), Render (RENDER), Grass (GRASS), and Beldex (BDX) seeing significant gains ranging from 11% to 14%.

Further fueling the surge, The Hashgraph Group, a prominent supporter of Hedera, announced a new investment in Indian agritech company AgNext Technologies. This initiative will incorporate Hedera’s blockchain technology into AI-enhanced agricultural solutions, aimed at improving trust and traceability within the food supply chain.

HBAR price analysis

On the 1-day USDT price chart, the HBAR price is currently testing the upper limit of a falling wedge pattern that formed since early March. In technical analysis, a breakout from such a pattern usually indicates the potential for sustained gains ahead.

However, the bull-bear power (BBP) indicator, also known as the Elder-Ray index, has remained below the zero line since March 2, indicating persistent bearish pressure.

This indicator measures the strength of buyers compared to sellers, and a negative reading suggests that sellers are still dominating the market.

Additionally, the Aroon Down stands at 92.86%, while the Aroon Up is at 0%, indicating that selling pressure significantly outweighs buying activity at this time.

While the indicators suggest continued control by bears, some analysts believe a reversal could be on the horizon if key levels are maintained.

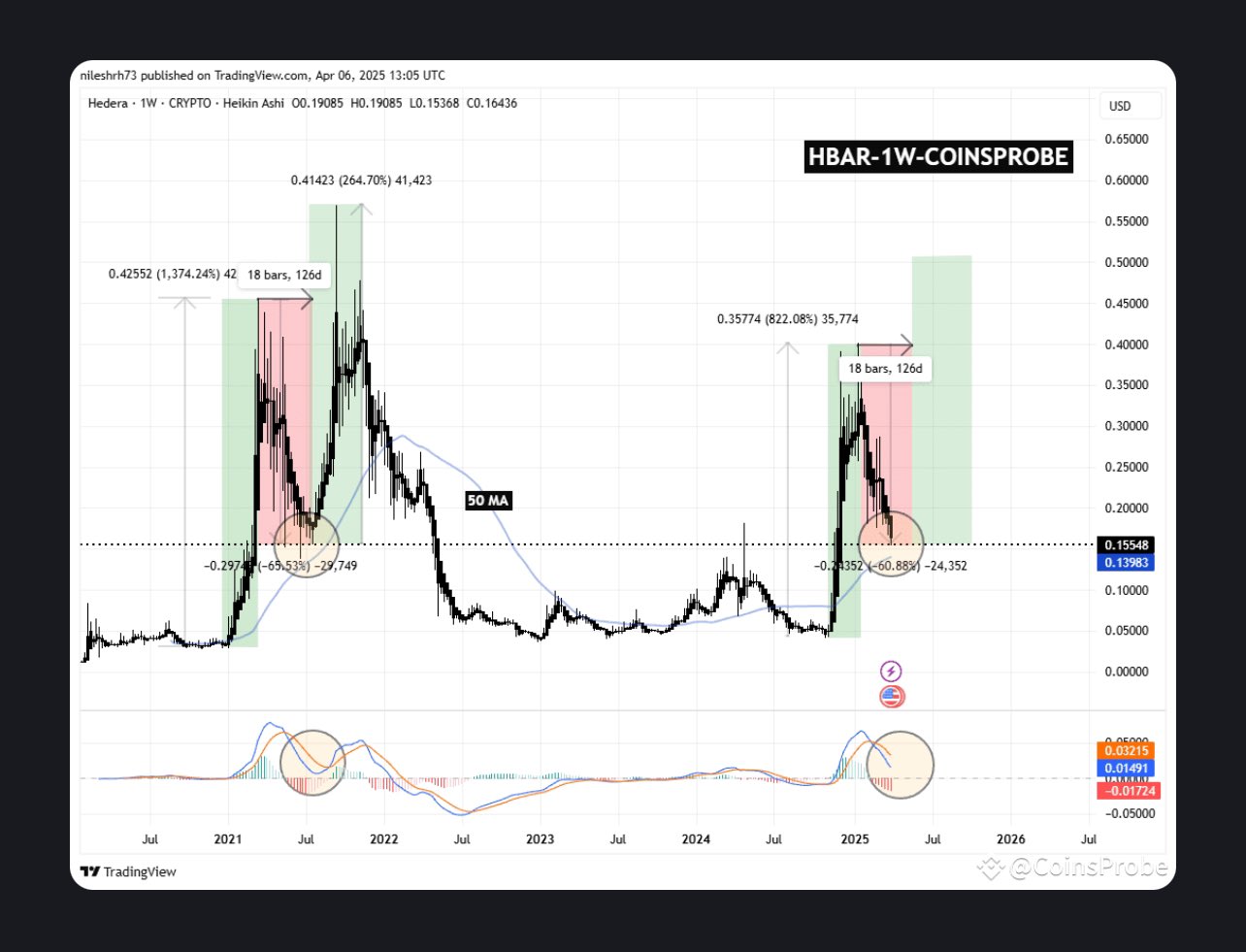

Crypto analyst Sunovam, who shared a weekly chart of HBAR’s price trends, noted that previous rallies have followed a consistent pattern: a parabolic increase, a 60% to 65% correction, followed by a consolidation phase before another major upswing.

The current situation bears a striking resemblance, with HBAR now down over 58% from its recent peak and nearing historical support areas.

However, for a bullish scenario to unfold, the price must hold above the $0.14 to $0.15 range, as per the analyst. If it drops below this threshold, it may decline towards the $0.10 mark.

Moreover, the MACD on the weekly chart is approaching a potential crossover, though it hasn’t yet turned bullish, indicating that momentum isn’t fully favoring buyers just yet.

If buyers manage to reclaim the $0.20 mark and break through $0.25, it might signal the onset of another rally phase, particularly as the AI narrative gains traction.

Disclaimer: This article does not constitute investment advice. The information and materials presented on this page are intended for educational purposes only.