A prediction marketplace has begun accepting Bitcoin (BTC) deposits to attract more users from the cryptocurrency space.

The platform, which allows users to bet on various events such as election results and movie ratings, has reported growing interest from crypto traders, noting significant activity in Bitcoin-related event contracts. According to a representative, trading volume for bets on Bitcoin’s price fluctuations by the hour has reached $143 million to date.

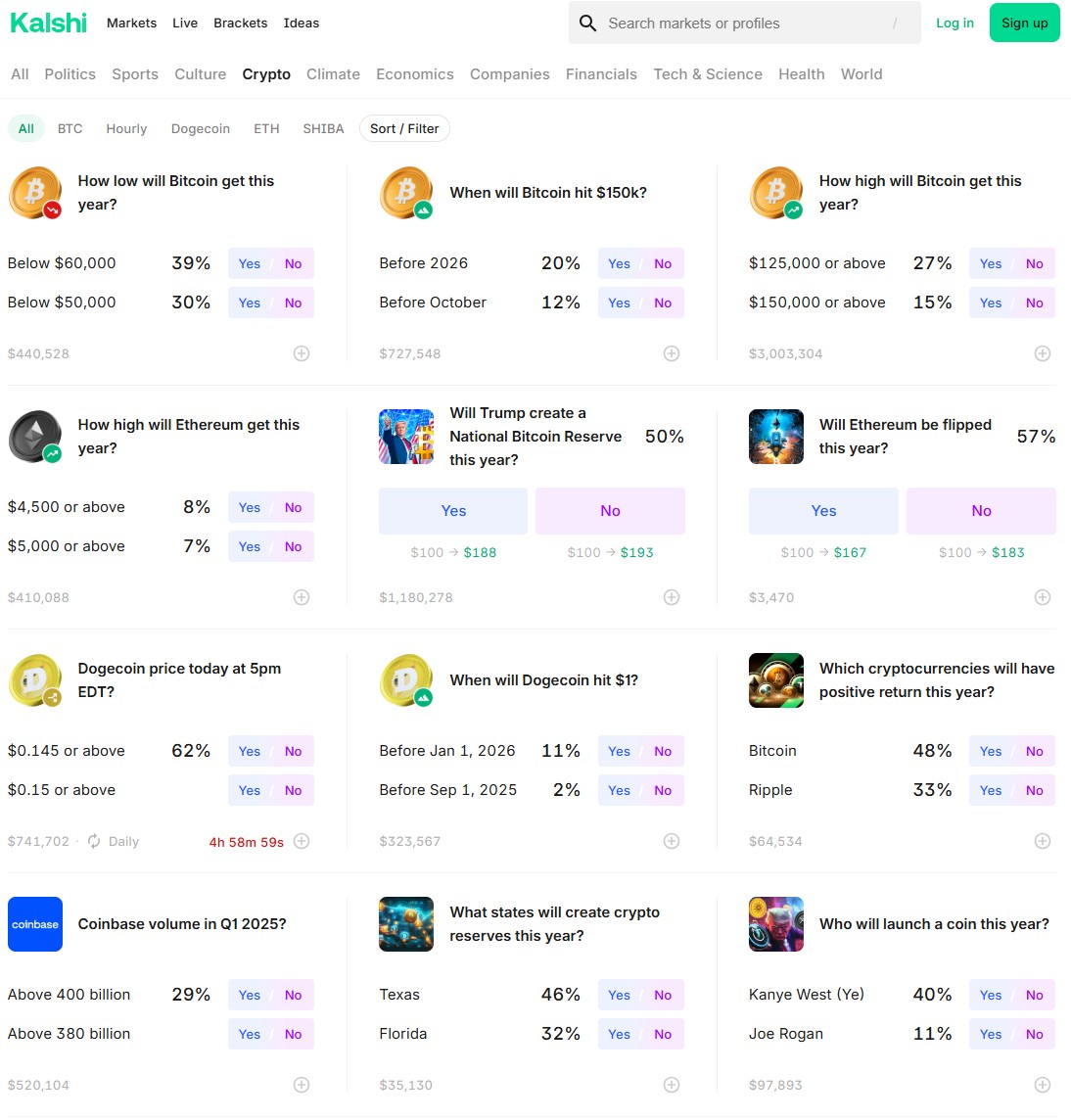

This derivatives exchange is regulated by the US Commodity Futures Trading Commission (CFTC) and currently offers around 50 event contracts linked to cryptocurrencies, including markets that speculate on price extremes for coins in 2025 and notable events like the proposal for a National Bitcoin Reserve by former President Trump.

The platform has significantly enhanced its offerings in crypto event contracts.

The acceptance of cryptocurrency payments began in October, when the platform introduced USD Coin (USDC) deposits alongside BTC.

For processing Bitcoin and USDC, the exchange partners with a crypto payments infrastructure provider that facilitates the conversion of these funds into US dollars. Notably, it only accepts BTC deposits via the Bitcoin network.

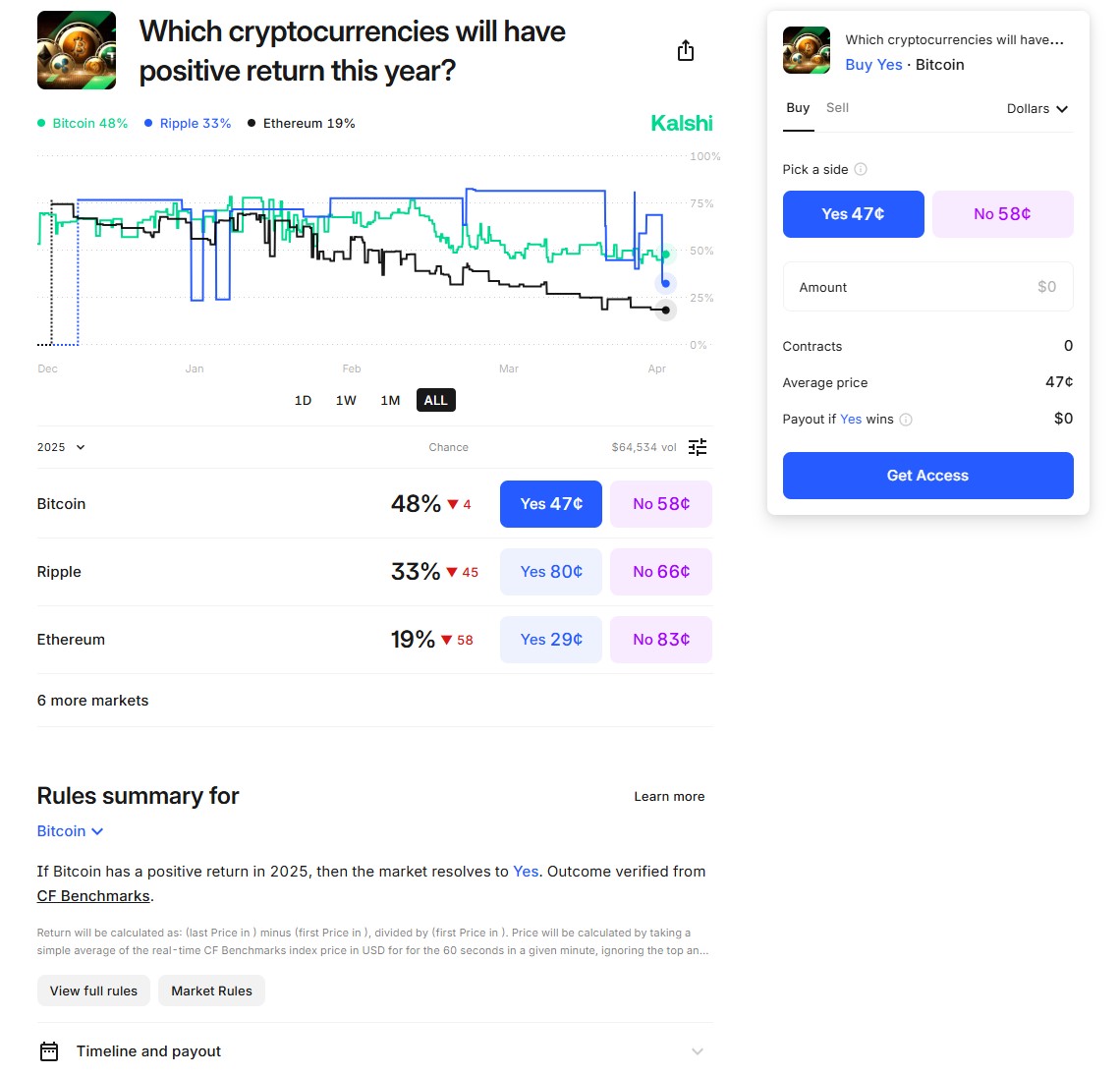

Traders on the platform have low expectations for major tokens yielding positive outcomes this year.

Related: Traders assess the likelihood of a US recession in 2025 at over 61%

More reliable than polls

It became a primary venue for trading on 2024 political events after successfully challenging a lawsuit from the CFTC, which sought to block its election-related contracts. The regulator contended that political prediction markets could undermine electoral integrity, while analysts believe these markets often provide a more accurate reflection of public sentiment than traditional polls.

For example, the marketplace accurately forecasted Trump’s presidential victory despite polling data suggesting a close race.

“Event contract markets serve as a beneficial public tool and there is no substantial evidence of serious manipulation or harmful usage as alleged by the Commission,” remarked Harry Crane, a statistics professor at Rutgers University, in a comment submitted to the CFTC.

As of April 9, traders on the platform estimate a 68% chance of the US entering a recession.

In March, a collaboration with a popular online brokerage platform was announced, aimed at integrating prediction markets, which led to an 8% increase in stock price for the brokerage.

The marketplace faces competition from a Web3 prediction platform that processed over $3 billion in trading volume related to the US presidential election, despite restrictions on US traders.

Magazine: Bitcoin testing $70K soon? A major backer funds SpaceX flight: Weekly Digest, March 30 – April 5