Rising international trade tensions are sending shockwaves through cryptocurrency markets, but they may also serve to boost the uptake of digital assets among institutional investors, as noted by various industry leaders.

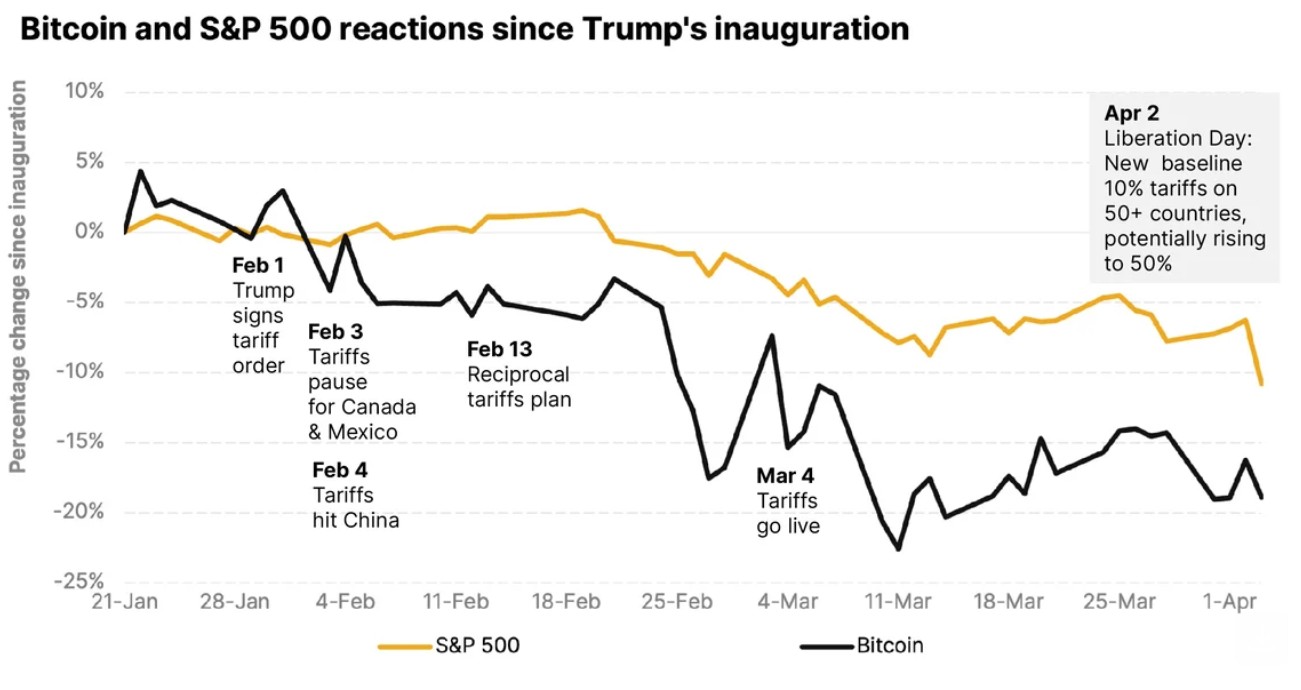

Following the announcement of sweeping tariffs on US imports by President Trump on April 2, major cryptocurrencies saw significant price fluctuations, exacerbating an ongoing decline that began earlier this year.

Nonetheless, David Siemer, co-founder and CEO of Wave Digital Assets, remarked that “the silver lining is that economic uncertainty has historically spurred increased institutional interest in digital assets as a strategy for diversification.”

A report from Binance on April 7 indicated that Bitcoin has exhibited “signs of resilience” during this period of market volatility, demonstrating its potential role as a safeguard against geopolitical instability.

Siemer further explained, “As traditional banking systems become intertwined with geopolitical issues, we’re seeing a surge in demand for blockchain-based settlement solutions that operate independently of conventional banking networks.”

Bitcoin and the S&P 500’s recent performance.

Tariff Turmoil

On April 9, Trump announced a pause on the implementation of certain tariffs while simultaneously pledging to raise levies on Chinese imports to 125%.

This news caused the S&P 500 — representing some of the largest US companies — to surge by over 8%, partially offsetting losses linked to the earlier tariff announcement, as reported by Google Finance.

According to CoinMarketCap, Bitcoin’s (BTC) spot price and the overall cryptocurrency market capitalization also saw an increase of approximately 8% following the news.

Crypto market caps are up on April 9.

Decentralized finance (DeFi) protocols are particularly well-positioned to thrive amid the trade upheaval, which underscores the segment’s “strategic value,” according to Nicholas Roberts-Huntley, co-founder and CEO of Concrete & Glow Finance.

“DeFi provides a neutral, borderless option for accessing credit, generating yield, and transferring capital,” Roberts-Huntley stated. “For developers, this represents an opportunity to reinforce interoperability and resistance to censorship.”

However, Aurelie Barthere, a research analyst at Nansen, warned that crypto prices are likely to continue tracking broader market trends for the foreseeable future. “If the market sell-off persists, expect cryptocurrencies to act as a higher beta risk asset correlated with other risk assets,” Barthere indicated.