The sweeping tariffs introduced during the Trump administration may lead to a significant drop in the demand for Bitcoin mining rigs in the United States. This shift could advantage mining operations located abroad, as manufacturers seek to sell their surplus stock at lower prices outside the U.S., according to the CEO of Hashlabs Mining, Jaran Mellerud.

“While prices for machines in the U.S. may rise, they could conversely decrease in other parts of the world,” Mellerud stated in an April 8th report. “The interest in shipping machines to the U.S. is expected to plummet, approaching zero.”

“Manufacturers will find themselves with an excess inventory that was originally meant for the U.S. market. To clear out this surplus, they’ll likely need to reduce prices to attract buyers in different regions,” he added.

Decreasing prices for mining rigs could encourage non-U.S. mining operations to expand, potentially capturing a larger share of Bitcoin’s total hashrate, according to Mellerud.

Image provided by Jaran Mellerud

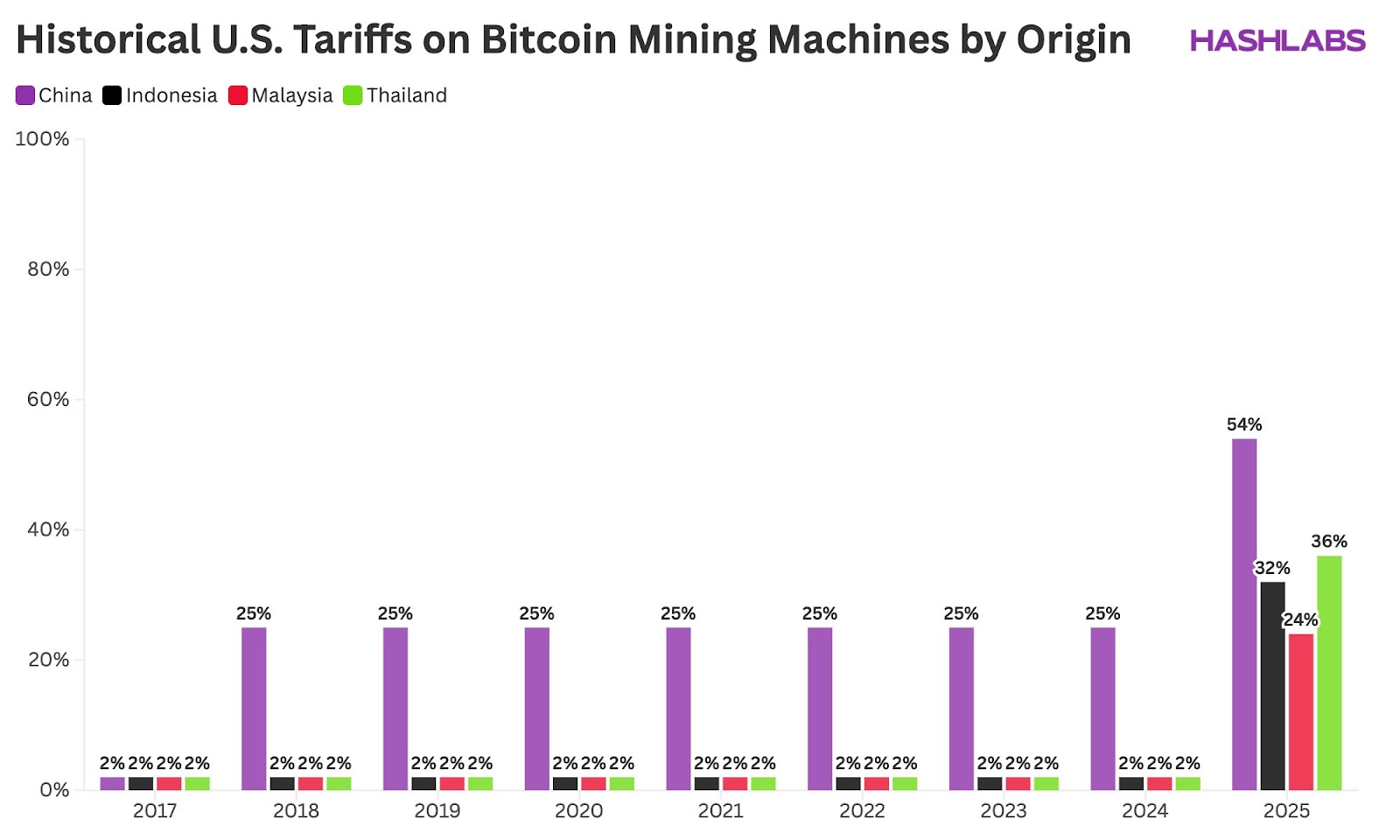

On April 2, President Trump introduced “reciprocal tariffs” affecting nearly every country. Many of the largest manufacturers of crypto mining machines are based in nations particularly impacted by these tariffs, such as Thailand, Indonesia, and Malaysia, which face tariffs of 36%, 32%, and 24%, respectively.

Companies like Bitmain, MicroBT, and Canaan relocated to these countries to evade a 25% tariff imposed on China during Trump’s previous term in 2018.

Annual tariff changes on China, Indonesia, Malaysia, and Thailand since 2017.

Mellerud pointed out that with the latest tariffs, a mining rig that costs $1,000 would be sold for $1,240 in the U.S.

“In contrast, in Finland and many other countries, there are no tariffs, so the price of a $1,000 machine remains the same.”

“In a price-sensitive industry like Bitcoin mining, a 22% increase in equipment cost can render operations financially unfeasible,” he added.

Permanent Impact of Tariffs — ‘The Damage is Done’

Mellerud is skeptical that any future rollback of the Trump administration’s tariffs would restore confidence among U.S. crypto mining operators.

“Even if these tariffs were reversed shortly, the damage would have been done — long-term planning confidence is shaken,” he stated. “Few would be willing to make significant investments in an environment where key conditions can change overnight.”

He noted that U.S. miners had felt encouraged when Trump returned to office, anticipating a more reliable regulatory framework.

Related: Bitcoin’s hashrate surpasses 1 Zetahash for the first time, according to trackers

“However, they are now encountering the downside of his unpredictable policy changes,” Mellerud remarked.

The U.S. contributes nearly 40% of the Bitcoin network’s hashrate. Mellerud mentioned that there’s little reason for American miners to shut down their operations, and he does not foresee a decrease in the overall Bitcoin hashrate originating from the U.S.

Nevertheless, he indicated that the route to expansion is now “steep and uncertain,” which could lead to substantial losses of hashrate share for the U.S.

The tariffs have disrupted virtually every market, including cryptocurrencies, with Bitcoin (BTC) experiencing a 4% drop in the past 24 hours, now priced at $76,470, according to data from CoinGecko.

Bitcoin is currently 30% below its all-time high of $108,786 reached on January 20 — the same day Trump resumed his presidency.

Magazine: Crypto enthusiasts are focused on longevity and biohacking: Here’s the reason why