The Dollar Index (DXY) dropping below 100 has historically coincided with Bitcoin (BTC) bullish trends, resulting in increases exceeding 500% during the last two occurrences. As trade conflicts escalate and US Treasurys experience declines, some analysts theorize that China might be making efforts to devalue the US dollar. This added strain on the dollar raises the possibility of it once more acting as a trigger for a notable Bitcoin surge.

Is China actively trying to weaken the US dollar?

A recent report highlights that China’s central bank has instructed state-run lenders to “cut back on dollar purchasing” amid substantial downward pressure on the yuan. Major banking institutions were said to have been told to enhance scrutiny when processing dollar purchase requests from their clients, indicating a move to “limit speculative trading.”

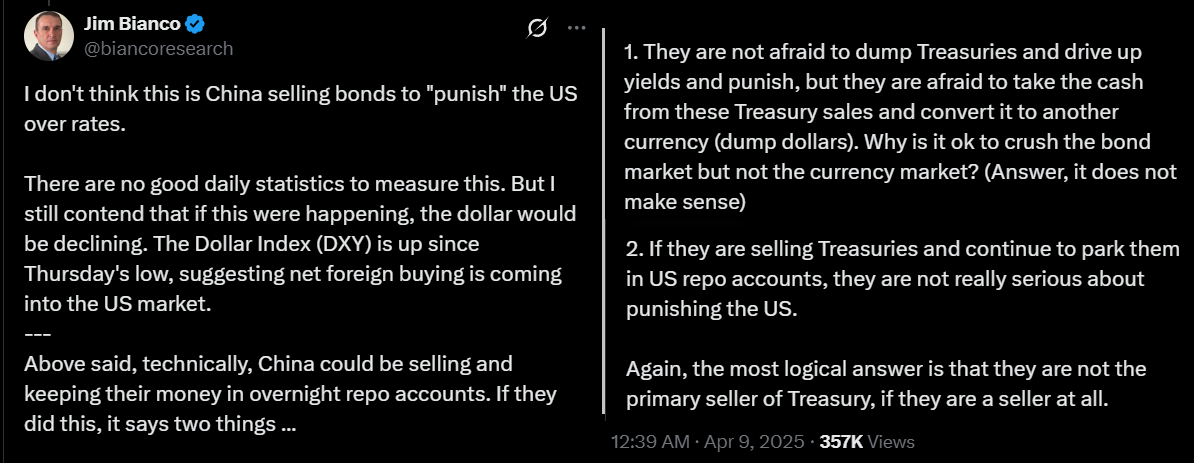

Some experts have speculated that China could be seeking to weaken the dollar in response to recent increases in US import tariffs. Yet, Jim Bianco, the president of Bianco Research, offers a different perspective.

Source: X/Jim Bianco

Bianco expresses skepticism that China is selling US Treasurys with the intention of harming the US economy. He notes that the DXY has remained relatively stable around the 102 mark. While China could unload bonds without converting the proceeds into other currencies—thus affecting the bond market without jeopardizing the dollar—this strategy appears counterproductive. Bianco suggests it is unlikely that China is a notable seller of Treasurys, if it is selling them at all.

US Dollar Index (DXY). Source: TradingView / Cointelegraph

The DXY Index sits near the 104 level observed on March 9 and has consistently fluctuated within the 100-110 range since November 2022. Consequently, assertions that its current status reflects widespread distrust in the US dollar or suggests an impending collapse seem misplaced. In reality, the performance of the stock market is not a reliable indicator of investors’ perceptions of economic risk.

DXY falling below 100 is often followed by Bitcoin bull markets

The last occasion the DXY Index dipped under 100 was in June 2020, coinciding with a Bitcoin bull market. Over the subsequent nine months, Bitcoin surged from $9,450 to $57,490. In a similar vein, when the DXY fell below 100 in mid-April 2017, Bitcoin’s value soared from $1,200 to $17,610 within eight months. Whether or not this is mere coincidence, the 100 mark has historically been associated with substantial Bitcoin price increases.

A declining DXY suggests that the US dollar has depreciated against a mix of major currencies such as the euro, the Swiss franc, the British pound, and the Japanese yen. This drop adversely affects US companies by decreasing the amount of dollars earned from foreign sales, subsequently lowering tax contributions to the US government. Given that the US is currently operating with an annual deficit exceeding $1.8 trillion, this issue is particularly pressing.

Moreover, when the dollar weakens, US imports for consumers and businesses become costlier, even if the prices in foreign currencies remain constant. Despite being the world’s largest economy, the US relies on imports totaling $160 billion in oil, $215 billion in passenger vehicles, and $255 billion in computers, smartphones, data servers, and other similar goods each year.

Related: China’s tariff reaction may lead to increased capital flight into crypto: Hayes

A weakening US dollar presents a double-edged sword for the economy. It tends to dampen consumer spending as imports escalate in price, while simultaneously reducing tax revenue derived from the global earnings of US companies. For instance, over 49% of the revenues for major corporations like Microsoft, Apple, Tesla, Visa, and Meta come from outside the US. Similarly, companies like Google and Nvidia generate around 35% or more of their revenues internationally.

Bitcoin could potentially return to the $82,000 threshold, regardless of movements in the DXY Index. This might occur as investors start to worry about possible liquidity injections from the US Federal Reserve aimed at preventing an economic downturn. Nevertheless, if the DXY Index falls below 100, investors might be more inclined to seek out alternative hedge vehicles like Bitcoin.

This article is meant for general information and should not be construed as legal or investment advice. The views and opinions expressed herein are those of the author alone and do not necessarily reflect the views of any specific organization.