The daily revenue for Virtuals Protocol has fallen to less than $500, as the VIRTUAL token approaches an oversold condition.

Recent analysis reveals that since its launch, Virtuals Protocol (VIRTUAL) has been earning under $500 daily from launch and swap fees for much of late March and early April.

Back in early January, Virtuals Protocol experienced robust revenue, with daily earnings from launch and swap fees soaring between $200K and $350K. However, this upward trajectory was short-lived. By mid-January, revenue began to decline consistently, dropping below $100K per day by the end of the month. By late February, daily revenue had plummeted to under $10K, and during the last days of March into early April, the platform’s earnings fell to below $500 daily. For context, Virtuals Protocol generated over $500K in daily revenue on January 2, coinciding with VIRTUAL reaching an all-time high of $5.07. This signifies a staggering 99% decrease in daily revenue from that peak to early April.

As for the VIRTUAL token’s market price, it currently stands at $0.45, reflecting a 91% decline from its all-time high. Following its peak, the value of VIRTUAL entered a prolonged downtrend, falling below crucial moving averages and stabilizing around $0.45 by early April. A significant technical movement occurred when the 20-day Exponential Moving Average dropped below the 50-day Simple Moving Average, bolstering the bearish sentiment.

Momentum indicators support this downward trend. The MACD line remains beneath the signal line, and while the histogram has begun to stabilize, it persists in negative territory. The Relative Strength Index is at 31.06, marginally above the oversold threshold of 30.

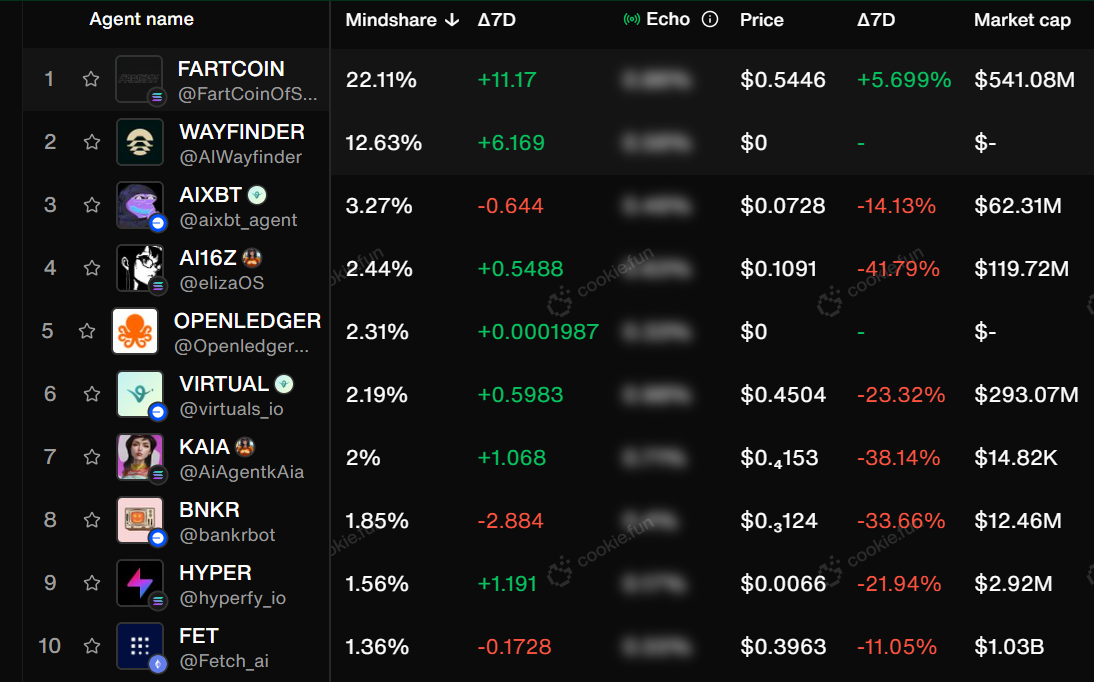

On a positive note, Virtuals Protocol remains among the top 10 projects in the AI agent sector, ranked as the sixth most-discussed project by mindshare, holding a 2.19% share.