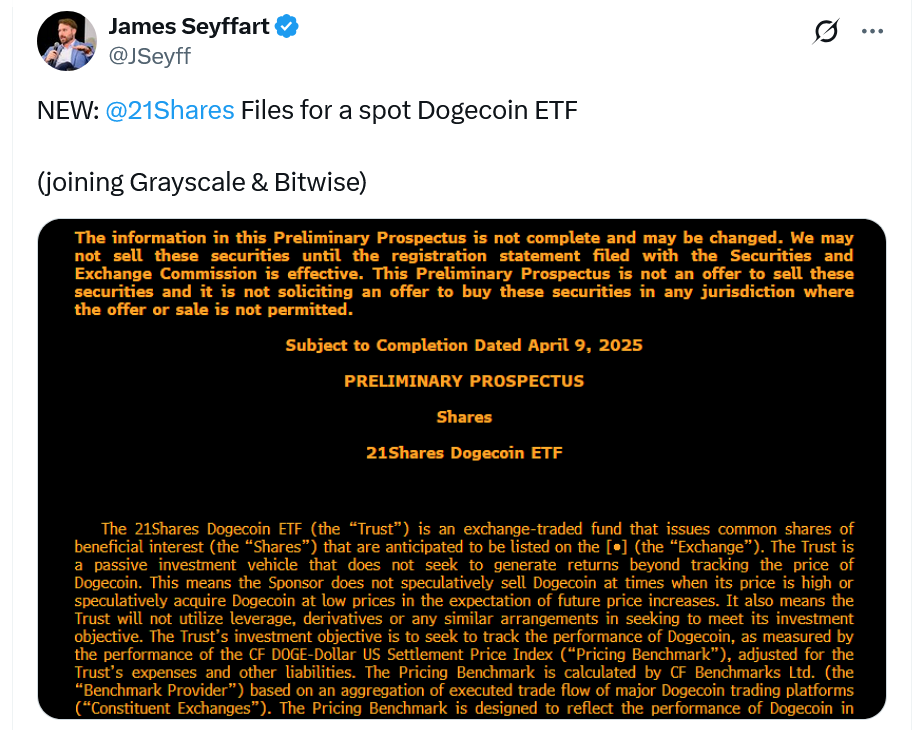

A digital asset management firm has submitted an application to the US Securities and Exchange Commission to introduce a spot Dogecoin exchange-traded fund, following similar submissions from competitors in the market.

The proposed Dogecoin ETF aims to mirror the price movements of Dogecoin (DOGE), as outlined in the firm’s recent registration statement. The corporate arm of the Dogecoin Foundation intends to support marketing efforts for the fund.

The firm has indicated that Coinbase Custody would serve as the custodian for its Dogecoin ETF, although details about fees, ticker symbols, or the specific stock exchange for listing have not been disclosed.

Source: James Seyffart

Additionally, the firm must submit a 19b-4 filing with the SEC to initiate the approval process for the fund.

Currently, Dogecoin boasts a market capitalization of $24.2 billion, ranking as the eighth-largest cryptocurrency. Initially created in 2013 as a joke, it is a fork of Lucky Coin, which itself originated from Bitcoin.

This proposed Dogecoin ETF represents the latest strategy to broaden the firm’s offerings in the spot crypto ETF space, which currently includes only spot Bitcoin (BTC) and Ether (ETH) funds.

Previously, the issuer filed applications with the SEC to establish a spot Polkadot (DOT) ETF and a spot XRP (XRP) ETF last year.

Related: Dogecoin millionaires are capitalizing on dips as DOGE eyes a 30% increase

The uptick in crypto ETF applications is part of a broader “spaghetti cannon approach,” where issuers aim to see which products might gain favor with the new SEC leadership, according to an ETF analyst.

“Issuers are attempting to launch a variety of products to see what resonates,” the analyst noted.

Market analysts have predicted a 75% likelihood of SEC approval for a spot Dogecoin ETF this year, while one betting platform currently estimates the chances of approval at 64%.

Partnership to Introduce DOGE Products in Switzerland

On April 9, the firm announced a partnership with another organization to launch a fully backed Dogecoin exchange-traded product on Switzerland’s SIX Swiss Exchange.

The new Dogecoin product will trade under the ticker “DOGE” and feature a 2.5% fee.

The firm’s president stated that Dogecoin has evolved beyond just a cryptocurrency, signifying a cultural and financial movement that is fostering mainstream adoption, offering investors a regulated way to engage with this exciting project.

Magazine: Memecoin enthusiasm is fueling innovative anti-aging research