Bitcoin deposits to the cryptocurrency exchange Binance have dramatically increased over the last two weeks amid speculation regarding US President Donald Trump’s tariffs, as well as the pending US Consumer Price Index (CPI) results, according to an analyst.

Another expert contended that while this trend could suggest an upcoming sell-off, it might also reflect a bullish sentiment.

Investors are “actively transferring assets to Binance”

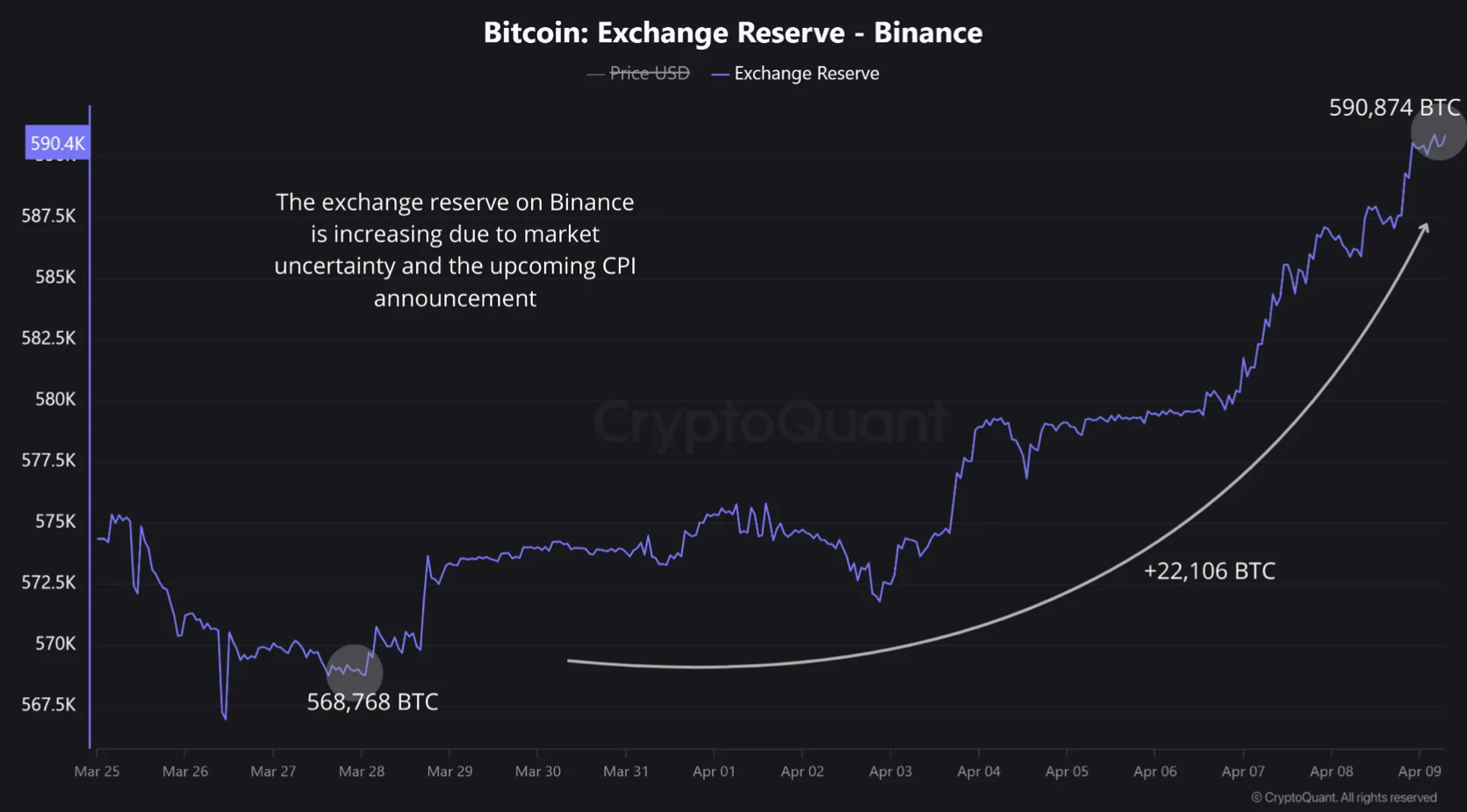

A contributor noted that Binance’s Bitcoin (BTC) reserve had risen by 22,106 BTC, valued at approximately $1.82 billion, within the past 12 days, bringing the total to 590,874 BTC.

“This indicates a significant uptick in BTC inflows to Binance. It’s probable that investors are migrating their funds to Binance in light of the macroeconomic uncertainties and the forthcoming CPI announcement,” the contributor stated.

As reported, Bitcoin is currently trading at $82,474, having increased by 8.8% in the last day, following the announcement of Trump’s 90-day tariff suspension on all countries except China.

Binance’s Bitcoin Reserve currently holds 590,874 Bitcoin.

The US Bureau of Labor Statistics is set to release the CPI results for March on April 10.

During times of uncertainty, traders frequently transfer their cryptocurrencies to exchanges with the intention to sell, leading to increased volatility as confidence wanes.

Nonetheless, a lead analyst indicated that such a situation may not necessarily point to a bearish outcome. “While significant inflows could be interpreted as a signal for selling, this is a fluid market. It’s quite possible that Binance is transferring assets into its hot wallets to accommodate heightened demand,” he mentioned.

“The coming days are crucial for gauging market sentiment towards cryptocurrency following Trump’s tariff adjustments,” he added.

Earlier on April 9, Trump announced a 90-day pause on his administration’s “reciprocal tariffs,” reducing the rate to 10% for all countries, except imposing a 125% tariff on China, citing their counter-tariffs on the US.

“Tensions between the US and China continue to pose a significant concern,” the analyst highlighted.

Related: Bitcoin’s price could hit a new five-month low near $71K if the tariff conflict and stock market instability persist

Meanwhile, another crypto analyst predicted that the March CPI results “will likely reveal inflation dropping to around 2.5%.”

“It looks like we have another intriguing day ahead,” he remarked.

Another analyst expressed that “if the CPI data comes in lower than anticipated, we could see a price increase.”

However, estimates from FactSet suggest that economists expect consumer prices to have risen by 0.1% month-over-month in March.

The CPI report released on March 12 had shown a lower-than-expected rate of 3.1%, compared to the anticipated 3.2%, leading to a 0.1% decrease in headline inflation figures.

Magazine: Funding for groundbreaking anti-aging research comes from memecoin enthusiasts

This article does not provide investment advice or recommendations. All investment and trading activities carry risks, and readers should do their own research before making any decisions.