Austrian fintech company Bitpanda has achieved its third license under the European Union’s Markets in Crypto-Assets Regulation (MiCA) framework, further broadening its regulatory presence throughout the region.

On April 10, Bitpanda revealed that it had received a new MiCA license from Austria’s Financial Market Authority (FMA), following previous approvals from German and Maltese regulators.

This latest license is seen as “another step toward establishing the most regulated crypto platform in Europe,” the exchange commented in a post on X.

Image details omitted

MiCA, which fully came into force on December 30, 2024, aims to establish a unified legal framework for crypto asset service providers (CASPs) across the EU. However, Bitpanda’s drive to obtain multiple licenses raises concerns regarding the uniformity of MiCA’s interpretation and enforcement within the union.

Bitpanda’s Journey through MiCA Licenses

Based in Vienna, Bitpanda was among the early adopters of MiCA licensing once the framework became fully operational on December 30, 2024.

The company announced that Germany’s Federal Financial Supervisory Authority (BaFin) was the first to grant it a MiCA license on January 23.

Following this, Bitpanda confirmed via LinkedIn that it had also obtained another MiCA license from the Malta Financial Services Authority (MFSA).

Related: Malta regulator fines OKX crypto exchange $1.2M for past AML breaches

“With the announcement of our first MiCAR license yesterday, this second license reinforces our commitment to establishing Bitpanda as Europe’s most secure and well-regulated crypto platform,” the firm stated.

Details regarding Bitpanda’s licensing announcement are sourced from LinkedIn.

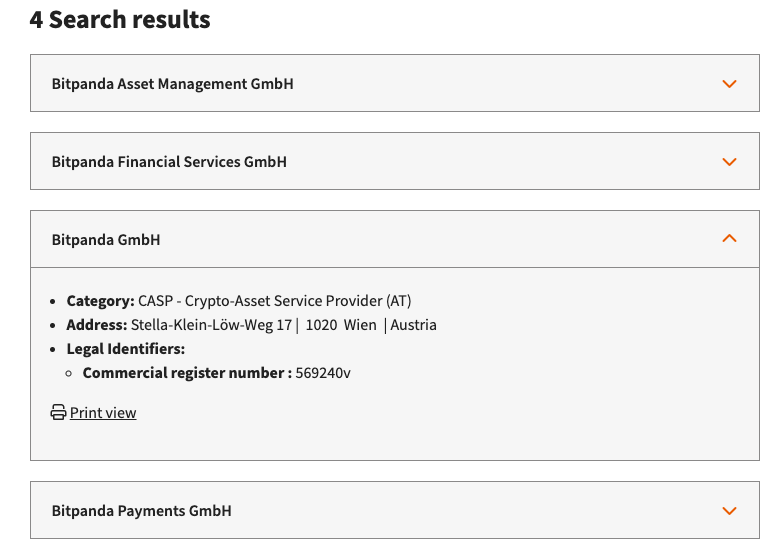

At the time of writing, Austria’s FMA, Germany’s BaFin, and Malta’s MFSA do not provide publicly available registries listing firms licensed under MiCA.

Data on Bitpanda’s licensing from Austria’s Financial Market Authority.

As per the records of Austria’s FMA, Bitpanda currently holds four different approvals in Austria and Germany for entities including Bitpanda Asset Management GmbH, Bitpanda Financial Services GmbH, Bitpanda GmbH, and Bitpanda Payments GmbH.

Does MiCA Support Multiple Licenses in EU Member States?

Originally proposed in 2020, the MiCA framework aims to establish extensive regulations for CASPs throughout the EU, thereby creating “standardized EU market rules for crypto-assets,” as noted by the European Securities and Markets Authority, a key regulator of MiCA.

Despite MiCA’s objective of harmonizing crypto regulation across Europe, Bitpanda’s strategy of acquiring multiple licenses indicates that regulatory discrepancies may persist among member states.

The firm was approached for comments regarding its strategy in obtaining several MiCA licenses, but no response was received by the time of publication.

Magazine: How crypto regulations are evolving globally in 2025