An institutional cryptocurrency investment firm has reaffirmed its ambitious forecast for Bitcoin’s price in 2025, maintaining its stance despite rising global trade tensions.

“In December, we forecasted that Bitcoin would finish the year at $200,000. I believe that expectation remains viable,” stated the firm’s chief investment officer in an April 9 blog update.

He posited that the consequences of the recent global tariff initiatives could surprisingly benefit Bitcoin (BTC) and the broader crypto market, as the current administration “seems to favor a weaker dollar, even at the cost of diminishing its status as the world’s reserve currency.”

The CFO referenced a speech given by the chairman of the White House Council of Economic Advisers on April 7, which criticized the dollar’s reserve status for inducing “ongoing currency distortions” and “unsustainable trade deficits” that have led to significant declines in US manufacturing.

He suggested that a depreciating dollar could have both near-term and far-reaching effects on Bitcoin.

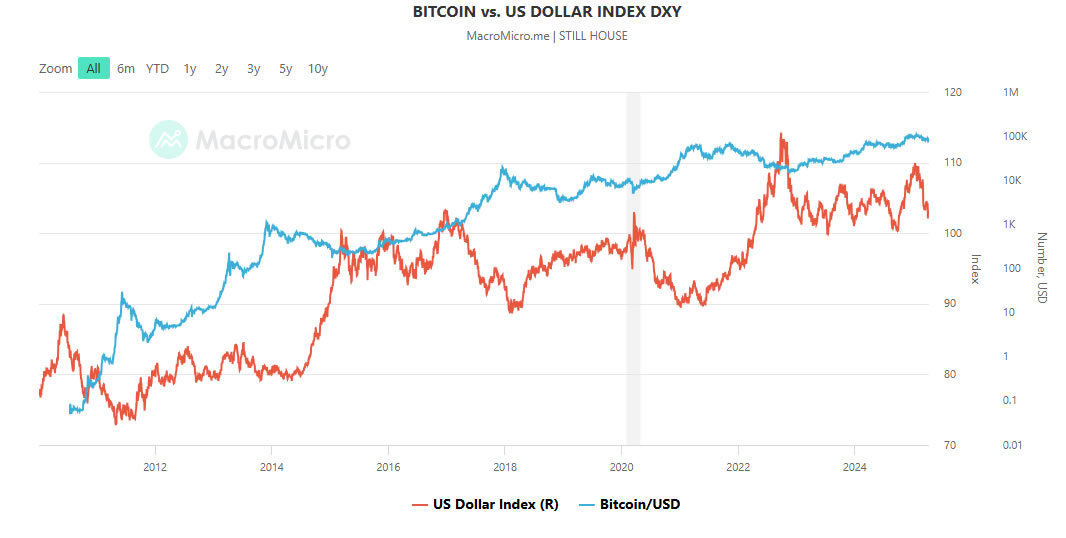

In the short term, historical patterns show that a weaker dollar often aligns with a stronger Bitcoin, as indicated by the US Dollar Index (DXY).

“A decrease in the dollar typically corresponds with an increase in Bitcoin’s value,” he remarked. “I anticipate this trend will persist.”

Bitcoin prices have generally been at historically elevated levels when the DXY has been low. Source: MacroMicro

Since the start of 2025, the DXY, which measures the US dollar’s value against a group of six major currencies, has dropped by more than 7%, as reported by a financial analytics site.

Looking ahead, the investment chief expressed that disruption in the global reserve currency structure opens doors for alternate reserve assets, including Bitcoin and gold.

“Governments and businesses utilize the dollar for international trade largely because of its reliability. When that reliability is in doubt, they must search for alternatives.”

The executive concluded that the global economic landscape would shift from a single reserve currency to a “more fragmented reserve system, where hard assets like Bitcoin and gold play a more significant role than they currently do.”

Earlier this week, another investment firm highlighted reports that China and Russia were beginning to conduct some energy trades using Bitcoin as the trade tension escalates.

On April 9, the President announced a temporary halt on nearly all previously planned “reciprocal tariffs,” maintaining a foundational 10% tariff on all countries except China, which remains subject to a hefty 125% tariff.

Bitcoin: The Fastest Participant

A crypto trader and analyst remarked on social media that “Bitcoin will emerge as the swiftest asset” from this market downturn.

Related: Is Now the Best Time to Invest in Bitcoin? Here’s Why

“It represents a pure reflection of liquidity without earnings. In fact, economic uncertainty and deglobalization trends may actually favor Bitcoin,” he added.

BTC experienced a 7.5% increase in the last 24 hours, reaching $81,700. It has encountered a 32% correction from its January 20 all-time high, paralleling pullbacks seen in prior bullish market cycles.

Magazine: Three Reasons Ethereum Might Turn a Corner: Insights from Industry Leaders