- Tether, the leading stablecoin issuer globally, has minted an additional $1 billion in USDT on the Tron blockchain this past Friday.

- Significant inflows into stablecoins during a market upswing typically signal new buying pressure.

- As investors anticipate inflation reports from the U.S. and China, tokens such as BNB, BGB, and TRX may benefit from the ensuing market volatility.

New $1B USDT Issuance Indicates Increased Liquidity on Tron Network

Tether has issued another $1 billion worth of USDT on the Tron blockchain, as indicated by data released on Friday.

This latest issuance drives Tether’s total USDT supply on Tron above $50 billion, further solidifying its leadership in the stablecoin market.

Interestingly, Tether’s recent minting coincides with vital macroeconomic reports from both the U.S. and China, suggesting that traders may be gearing up to enter cryptocurrency positions in anticipation of potential short-term gains.

Conversely, this $1 billion inflow may also enable investors to capitalize on potential dips if inflation metrics from either of the top two global economies turn out to be hawkish.

This influx aligns with Bitcoin’s recent price surge, which briefly crossed $83,600 following an announcement from former U.S. President Donald Trump about a rollback on global tariffs. With CPI and PPI data on the horizon, Tether’s liquidity addition could provide directional momentum based on the reports’ outcomes.

Tron On-chain Activity Rises as Tether Mints Additional $1B in USDT

Tron’s blockchain fundamentals are exhibiting promising signs, driven by an influx of significant on-chain activity amid current market fluctuations.

Data from Tronscan noted that Tether executed a $1 billion USDT issuance on its network on Wednesday.

This aligns with the prevailing trend of investors reallocating funds toward riskier crypto assets.

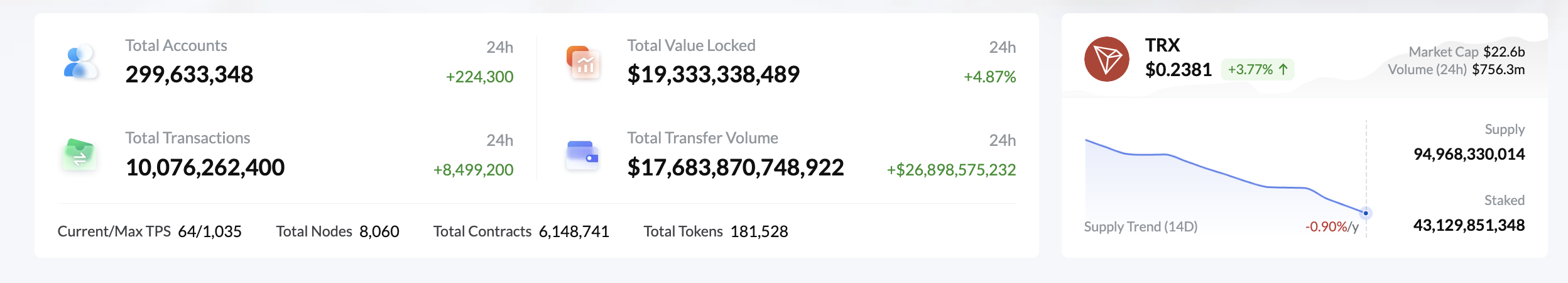

Supporting this view, the expansion of Justin Sun’s Tron network has noticeably accelerated. Real-time data reveals that new TRX accounts surged by 224,300 in a mere 24 hours, pushing the total accounts to 299.63 million. This highlights a significant rise in user engagement and stablecoin activity as market conditions remain turbulent.

Moreover, Tron’s daily transaction volume has spiked by 8.5 million, surpassing 10.07 billion in total all-time transactions. Simultaneously, the Total Value Locked (TVL) in the ecosystem rose by 4.8% to reach $19.33 billion, indicating a substantial infusion of new capital into Tron’s DeFi landscape.

These impressive metrics are complemented by deeper liquidity indicators. In just 24 hours, Tron’s transfer volume jumped by $26.89 billion, bringing the cumulative transfer volume to a remarkable $17.68 trillion. This suggests that capital is actively circulating within the ecosystem rather than remaining stagnant, which typically precedes upward demand for TRX.

Essentially, the supply dynamics of TRX present a scenario of tightening supply and improved investor sentiment following Trump’s announcement to suspend tariffs on all U.S. trade partners, excluding China.

TRX Price Set for a Breakout Amidst Liquidity Surge

Thus, in times of marked market volatility, with traders frequently switching between stablecoins, there tends to be increased traction for TRX token holders’ incentives, leading to sustained buying pressure.

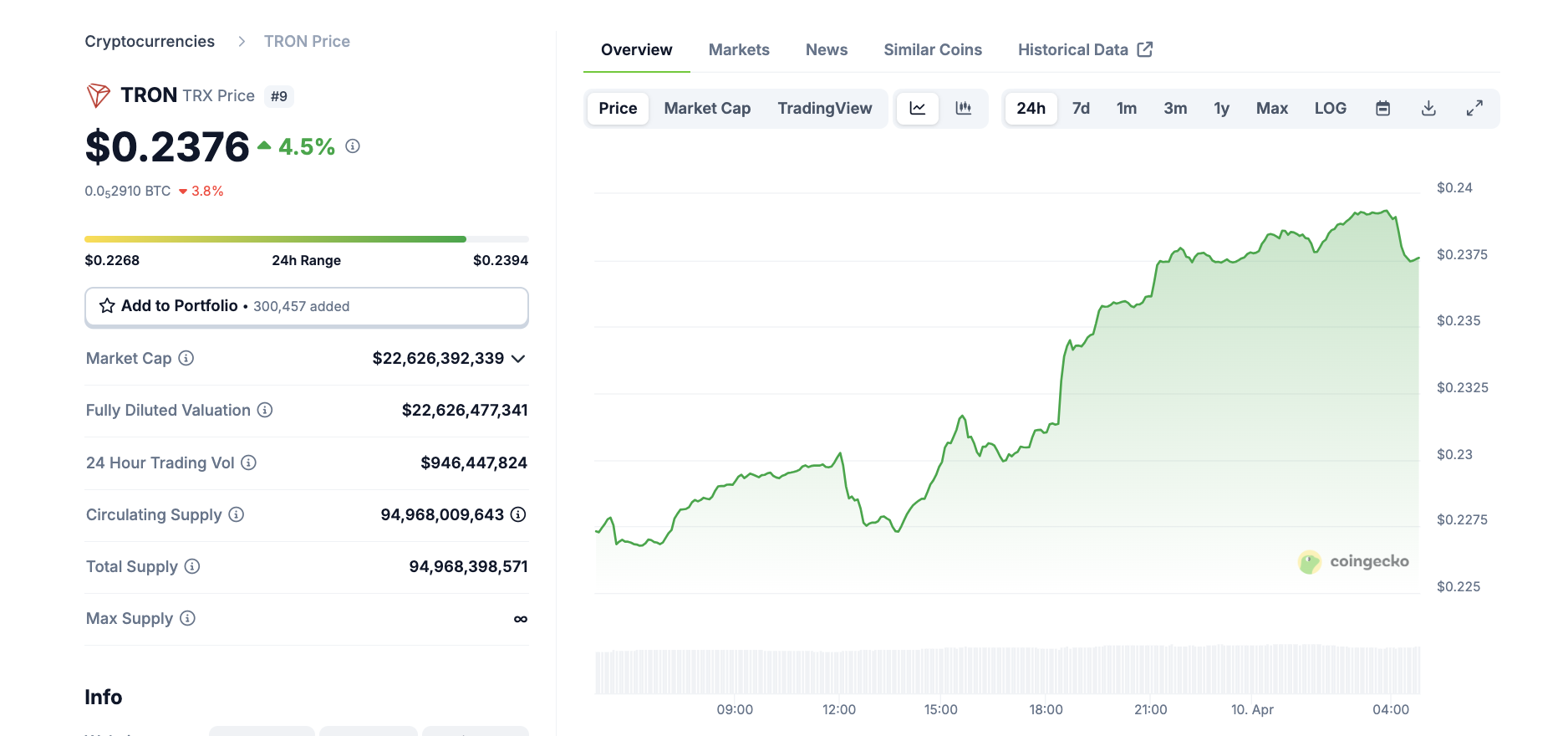

Tron (TRX) Price Action, April 10

Currently, with TRX up 4.5% as of Thursday, trading at $0.2831 and a 24-hour trading volume hitting $946 million, market sentiment appears to be aligning with the observed on-chain strength.

Additionally, TRX balances on exchanges have sharply declined over the past 48 hours, as investors are transferring tokens to personal wallets or staking them—another indication of reduced selling pressure and a shift towards long positions.

If forthcoming macroeconomic indicators reveal favorable inflation trends, TRX may breach short-term resistance around $0.135, a level not experienced in the past 30 days, potentially allowing current TRX holders to realize an additional 4.7% profit in the short term.