Trading volumes for tokenized gold soared to a two-year peak this week, exceeding $1 billion as investors gravitated towards safe-haven assets amid the global uncertainty spurred by U.S. President Donald Trump’s import tariffs.

This marked the first time since March 2023 that tokenized gold trading volumes surpassed the billion-dollar threshold, a period marked by a banking crisis in the U.S. that included the abrupt downfall of Silicon Valley Bank and the voluntary liquidation of Silvergate Bank. Additionally, New York regulators mandated the closure of Signature Bank on March 12, just two days following Silvergate’s collapse.

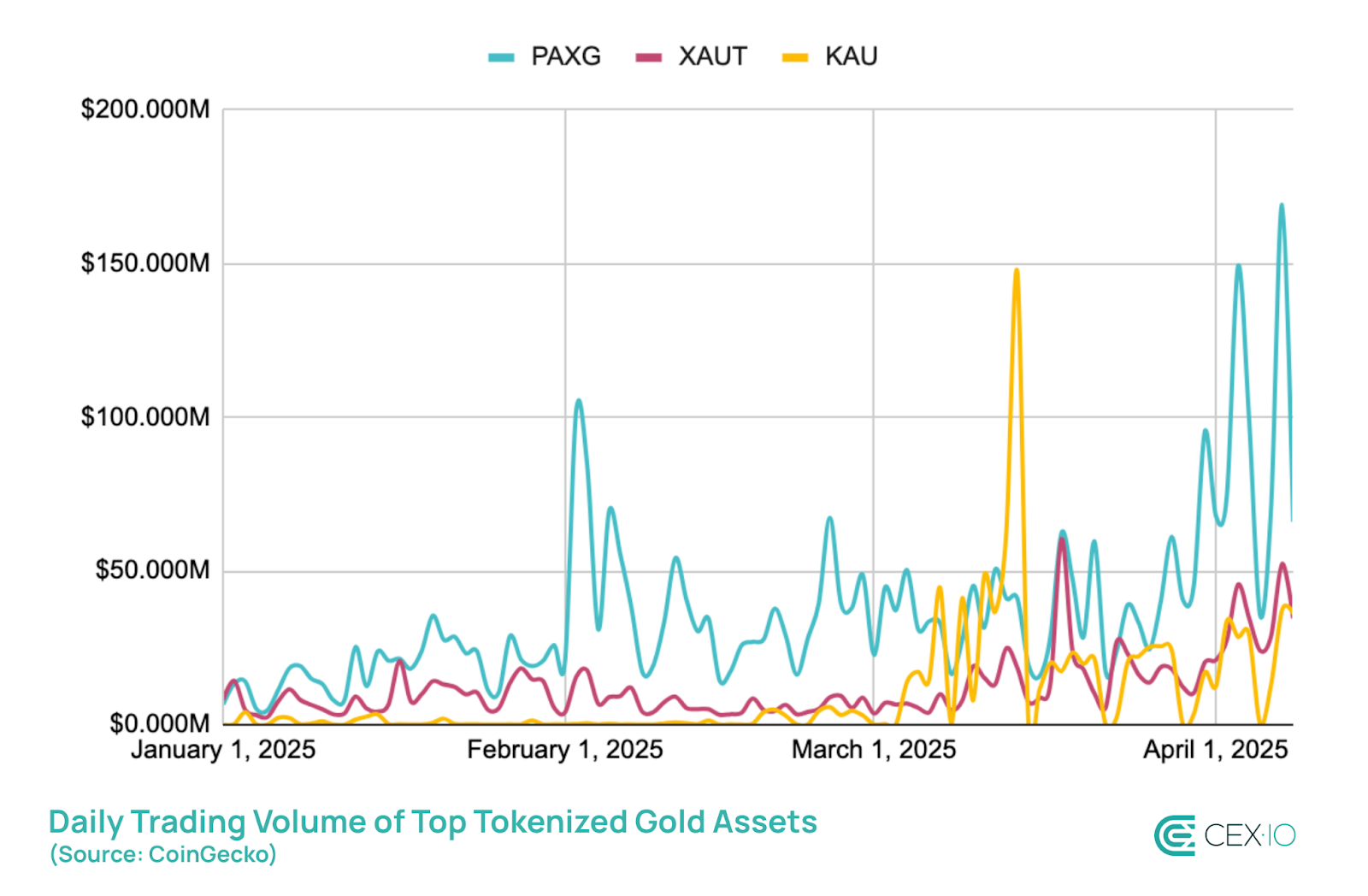

Since early February, interest in trading tokenized gold has surged significantly, driven largely by rising fears of a global trade war affecting digital markets, as outlined in a research report from CEX.io.

Leading tokenized gold assets and their trading volumes.

Following Trump’s initial tariff announcement on January 20, trading volumes for Paxos Gold (PAXG) skyrocketed by over 900%, while Tether Gold (XAUT) saw more than a 300% increase, and Kinesis Gold (KAU) experienced over an astonishing 83,000% growth.

Tokenized gold has emerged as one of the standout performers in the crypto arena since Trump’s inauguration, with its market cap rising by more than 21% and trading volume experiencing a remarkable increase of over 1,000%. In contrast, stablecoins recorded an 8% market cap rise and a 285% expansion in trading volume during the same timeframe.

Market cap of tokenized gold.

Part of the expanding real-world asset (RWA) tokenization landscape, tokenized gold includes financial products and tangible items, such as real estate and fine art, that are represented on the blockchain.

Gold Prices Reach New Heights

The uptick in tokenized gold coincides with record performances in physical gold. On March 31, gold surged to an all-time high of over $3,100 per ounce, trading above $3,118 at the time of this writing.

Year-to-date performance of BTC and gold.

Since the start of 2025, gold prices have risen over 18%, outpacing Bitcoin (BTC), which has dropped more than 12% year-to-date, as reported by TradingView.

The strong performance of gold prices following key tariff-related incidents underscores a growing demand for safe-haven assets, notes Illia Otychenko, lead analyst at CEX.io.

Nonetheless, tokenized gold is still far from becoming a direct competitor to physical gold in the current “stage of RWA development,” the analyst commented, adding:

“Tokenized gold offers an attractive alternative for crypto investors who might otherwise consider Bitcoin or stablecoins.”

“In this context, tokenized gold primarily functions as a diversification tool, gaining more prominence in investor portfolios as market conditions become more uncertain,” he stated.

Geopolitical tensions stemming from Trump’s import tariffs are driving crypto investors towards safer options, particularly stablecoins and tokenized assets.

In response to the 2023 banking crisis, the Federal Reserve instituted the Bank Term Funding Program, providing banks with loans for up to a year in exchange for acceptable collateral.

This emergency initiative was regarded as the catalyst for the Bitcoin bull run in 2023, according to BitMEX co-founder and former CEO Arthur Hayes.

Magazine: Ripple reports SEC lawsuit ‘over,’ Trump at DAS, and more: Hodler’s Digest, March 16 – 22