Growing trade tensions and renewed uncertainties in the global markets are steering investors towards alternative assets, such as Bitcoin and tokenized real-world assets (RWAs), as worries about the long-term stability of the financial system intensify.

Investor sentiment remains under pressure from global trade issues despite the announcement on April 9 that a 90-day halt on increased reciprocal tariffs would be implemented, reverting most tariffs to the 10% baseline.

In contrast, tariffs on Chinese goods were raised from 104% to 125%, as reported on April 9.

“The escalation of tariffs by President Trump signifies a pivotal moment for global markets,” noted a co-founder of a blockchain focused on tokenized real-world assets, indicating this situation is indicative of “more than just a trade spat.” He remarked:

“It reveals deeper fractures within the global monetary system.”

In light of both the United States and China dealing with what he described as unsustainable levels of debt, he warned about an increasing reliance on inflationary mechanisms, including the potential devaluation of the Chinese yuan.

“These factors will challenge the durability of every asset class” and could lead to greater adoption of tokenized credit and private yield products that are “not subject to the games of sovereign devaluation,” he stated.

Related: Bitcoin ETFs experience $326M decline amidst evolving relationship with traditional finance markets

The apprehension around tariffs triggered a spike in tokenized gold trading volume, which reached a two-year peak this week, surpassing $1 billion for the first time since the banking crisis in early 2023, as reported.

Leading tokenized gold assets, trading volume. Source: CoinGecko, Cex.io

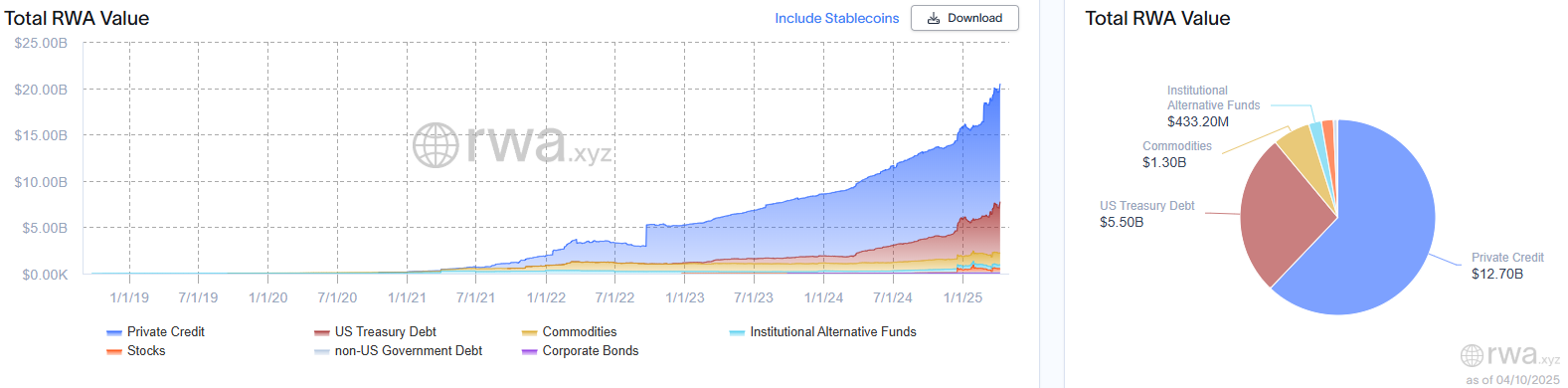

On-chain real-world assets (RWAs) crossed the $20 billion mark on April 9, with tokenized private credit making up the bulk of that figure, totaling $12.7 billion of the overall RWA value, according to recent data.

RWA global market dashboard. Source: RWA.xyz

Some market analysts speculate that Bitcoin’s lack of upward momentum may allow RWAs to reach a $50 billion all-time high before the end of 2025, as their enhanced liquidity could draw a substantial portion of the $450 trillion global asset arena.

Related: Bitcoin’s appeal as a safe-haven asset rises during trade conflict uncertainties

Tariffs viewed as “US negotiating leverage,” not enduring policy change

Amid investor concerns, analysts from a cryptocurrency exchange suggest that the tariff increase may not signify a permanent shift in policy.

“We believe that the existing US administration’s threat of tariffs serves more as a bargaining chip to encourage other nations to lower tariffs on American products and services rather than indicating a lasting change in policy,” they communicated.

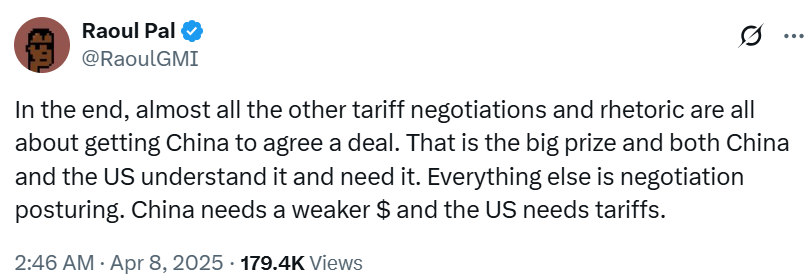

Source: Raoul Pal

Raoul Pal, founder and CEO of a macroeconomic investment firm, also noted that the tariff discussions might merely be “posturing” aimed at securing an agreement with China.

The atmosphere of the negotiations could influence the recovery of global risk assets, including cryptocurrencies, with analysts predicting a 70% chance for the market to reach its bottom by June 2025 before beginning a recovery.

Magazine: Could Bitcoin reach an all-time high sooner than anticipated? XRP may fall 40%, and more: Hodler’s Digest, March 23 – 29