The financial regulatory body in Ukraine has suggested imposing a tax on specific cryptocurrency transactions as personal income, potentially reaching up to 23%. Notably, this proposal would exclude transactions involving crypto-to-crypto exchanges and stablecoins.

Under the proposed framework, a standard tax rate of 18% would apply to crypto transactions, with an additional 5% military tax, according to details unveiled on April 8.

The chairman of the regulatory body stated in an April 8 announcement that “the topic of crypto taxation is no longer a theory but an imminent reality.”

He mentioned that the framework was established to assist lawmakers in making an “informed decision,” weighing the pros and cons of each option since these factors could significantly influence the market and tax obligations.

According to the proposed regulations, tax would be applied when cryptocurrencies are converted to fiat currency or used to purchase goods and services.

Crypto-to-crypto exchanges would not incur taxes, aligning Ukraine with the practices of several European nations, such as Austria and France, as well as crypto-savvy regions like Singapore.

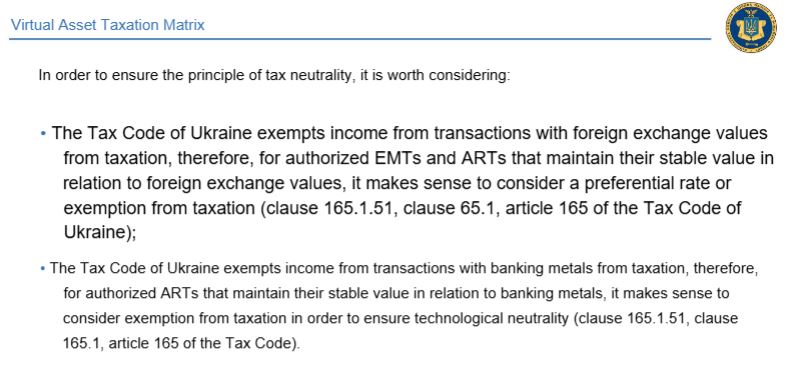

The regulator argues that it is “logical” to exclude stablecoins tied to foreign currencies or to apply a reduced tax rate of either 5% or 9%, given that Ukraine’s tax regulations already exempt income derived from transactions in “foreign exchange values.”

A translated section of the report noted that stablecoins linked to foreign currencies could be exempt from taxation. Source: Regulatory Body

Taxation of Mining, Staking, Hard Forks, and Airdrops

The framework also considers other cryptocurrency activities such as mining, staking, and airdrops, offering several potential taxation options.

The regulatory body stated that mining is typically viewed as a business operation, but there could be a general tax-free threshold for certain crypto activities, including mining.

Per the proposed guidelines, staking might be treated as “business-derived income” or taxed only when converted into fiat currency. Meanwhile, hard forks and airdrops could be subjected to tax as either regular income or when the tokens are exchanged for cash.

Related: Ukrainian officials receive training on investigating crypto and virtual assets

The agency proposes that a tax-free ceiling could aid in “alleviating the pressure on small investors,” which is a common practice in various jurisdictions.

In December of last year, the head of Ukraine’s tax committee mentioned that a draft legislation to legalize cryptocurrencies was being reviewed and was anticipated to be finalized shortly.

The legal groundwork for a regulated crypto market was first established in March 2022 when the president signed a law to that effect.

Magazine: A new ‘MemeStrategy’ Bitcoin firm by 9GAG, and the jailed CEO’s $3.5M bonus: Asia Express