On April 11, the President of the Minneapolis Federal Reserve discussed the increasing Treasury yields, suggesting it may reflect a shift in investor attitudes towards U.S. government debt. He emphasized that the Federal Reserve possesses tools to increase liquidity if needed.

While stressing the significance of a strong commitment to controlling inflation, his comments may signify a pivotal moment for Bitcoin (BTC) investors amidst rising economic uncertainty.

US Treasury 10-year yields. Source: TradingView

The current yield on 10-year U.S. government bonds stands at 4.5%, which is fairly typical. Even if it approaches 5%, a figure last observed in October 2023, this does not necessarily indicate a loss of trust in the Treasury’s capability to fulfill its debt obligations. For instance, gold prices only exceeded $2,000 in late November 2023, after yields had already declined to 4.5%.

Will the Fed boost liquidity, and is this favorable for Bitcoin?

Increasing Treasury yields often raise concerns regarding inflation or economic instability. This is vital for Bitcoin traders, as higher yields can make fixed-income investments more attractive. However, if these rising yields are interpreted as indicative of deeper systemic flaws—like diminishing confidence in governmental fiscal policies—investors might turn to alternative hedges such as Bitcoin.

Bitcoin/USD (left) vs. M2 global money supply.

The path of Bitcoin will largely hinge on the Federal Reserve’s response. Strategies aimed at injecting liquidity tend to elevate Bitcoin prices, whereas persistently higher yields could amplify borrowing costs for both businesses and consumers, potentially hindering economic growth and adversely affecting Bitcoin’s price in the near term.

One tactic the Federal Reserve might employ is purchasing long-term Treasuries to bring down yields. To balance out the added liquidity from bond purchases, the Fed could simultaneously carry out reverse repos—borrowing overnight cash from banks in exchange for securities.

A weak U.S. dollar and banking challenges could elevate Bitcoin’s price

While this method could stabilize yields for a time, aggressive bond buying may signal a desperate attempt to manage rates. Such a message could heighten concerns about the Fed’s effectiveness in managing inflation. These apprehensions often undermine trust in the dollar’s worth, potentially prompting investors to seek refuge in Bitcoin.

Another potential strategy involves offering low-interest loans via the discount window to provide banks with immediate liquidity, thereby reducing their need to offload long-term bonds. To counterbalance this liquidity influx, the Fed might impose stricter collateral requirements, like valuing pledged bonds at 90% of their market price.

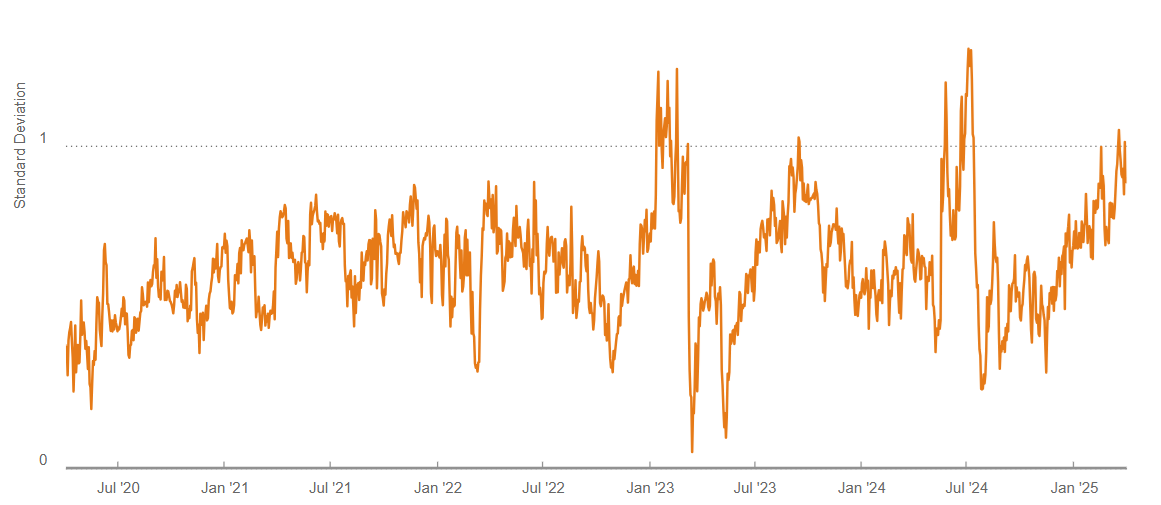

Systemic risk in the US financial services industry.

This alternative method restricts banks’ access to cash while ensuring that borrowed funds remain connected to collateralized loans. However, if collateral restrictions are overly stringent, banks could struggle to secure sufficient liquidity, even with access to discount window loans.

Related: Bitcoiners’ ‘bullish impulse’ on recession may be premature: 10x Research

While it remains uncertain which course the Fed will take, the recent deterioration of the U.S. dollar alongside a 4.5% Treasury yield may lead investors to feel cautious regarding the Fed’s actions. As a result, they might seek refuge in safe-haven assets like gold or Bitcoin.

Ultimately, rather than concentrating solely on the U.S. Dollar Index (DXY) or the U.S. 10-year Treasury yield, traders should pay closer attention to systemic risks in financial markets and the spreads on corporate bonds. As these indicators rise, confidence in the conventional financial systems diminishes, potentially paving the way for Bitcoin to recover the psychologically significant $100,000 price mark.

This article is for informational purposes only and should not be construed as legal or investment advice. The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of any organization.