The Illinois Senate has approved a regulatory bill with a vote tally of 39 to 17, targeting cryptocurrency fraud and aiming to safeguard investors from deceitful practices such as rug pulls and ambiguous fee structures.

On April 10, the chamber endorsed Senate Bill 1797 (SB1797), also referred to as the Digital Assets and Consumer Protection Act, which was introduced by Senator Mark Walker in February.

This legislation grants the Illinois Department of Financial and Professional Regulation the power to oversee digital asset business operations across the state.

Per the legislation, any organization conducting digital asset business with residents of Illinois must register with the state’s financial regulator. Additionally, the bill mandates that cryptocurrency service providers must disclose user fees and charges in advance.

Bill SB1797. Source: Ilga.gov

“No individual shall engage in digital asset business activities, nor advertise their ability to do so on behalf of a resident, unless they are registered in this State by the Department under this Article […],” the bill stipulates.

Related: Increased SEC scrutiny expected due to Trump family memecoins

Walker has previously emphasized the necessity of tackling crypto-related fraud in Illinois. In an April 4 post on social media, he remarked:

“The rise of digital assets has introduced opportunities for financial gain, yet it has also brought risks of bankruptcy, fraud, and misleading practices. We need to establish standards for crypto businesses to ensure they are credible and trustworthy.”

The push from Illinois for more robust oversight comes on the heels of numerous high-profile memecoin collapses and insider scams that have left retail investors with significant losses.

Recently, New York proposed Bill A06515, which aims to impose criminal penalties to deter cryptocurrency fraud and protect investors from rug pulls.

Related: Trump’s tariff increases reveal deeper issues in the global financial system

Regulatory momentum fueled by memecoin scams

One of the most infamous recent incidents involved the downfall of the Libra token, a memecoin that was supposedly supported by Argentine President Javier Milei. In March, insiders reportedly withdrew over $107 million in liquidity, leading to a staggering 94% price drop and wiping out around $4 billion in market value.

Libra token crash. Source: Kobeissi Letter

The prevalence of insider scams and “outright fraudulent activities” such as rug pulls, which are “both unethical and clearly illegal, with supporting case law for enforcement,” warrant more rigorous regulatory focus, according to Anastasija Plotnikova, co-founder and CEO of a blockchain regulatory firm, who further commented:

“In my view, these actions should fall squarely under the jurisdiction of law enforcement agencies.”

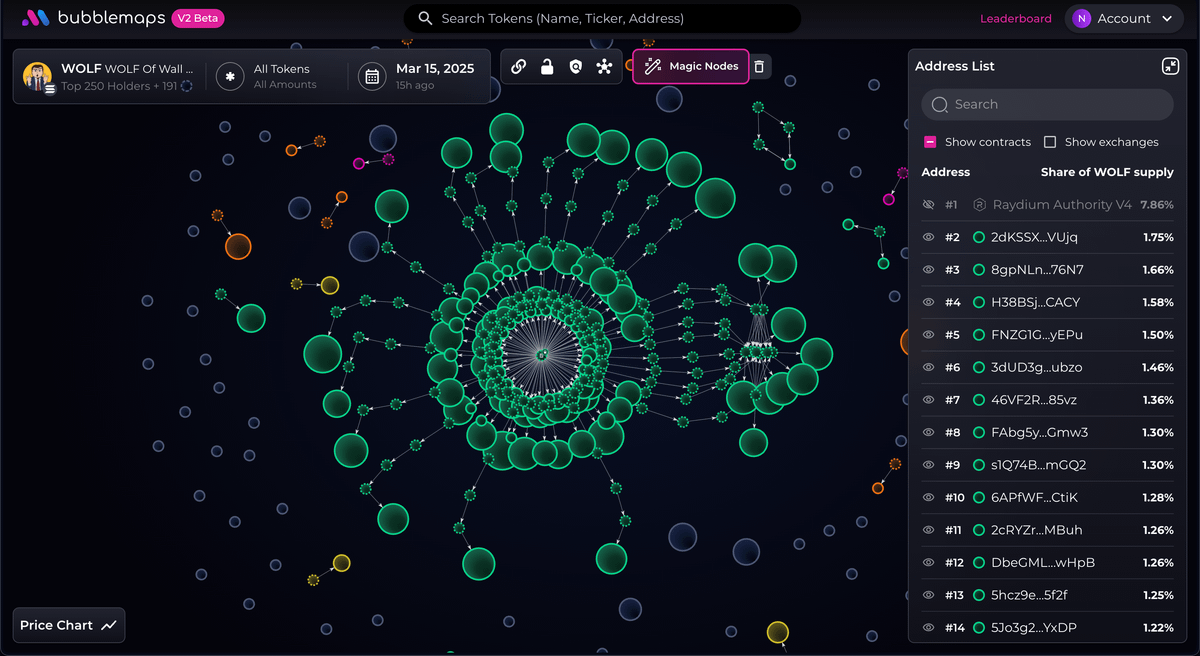

The latest incident occurred on March 16, when Hayden Davis, a co-creator of the Official Melania Meme (MELANIA) and the Libra token, launched a Wolf of Wall Street-inspired token (WOLF).

Source: Bubblemaps

More than 82% of the token’s supply was controlled by a single entity, leading to a 99% price decline after the token had reached a peak market capitalization of $42 million.

An Argentine attorney, Gregorio Dalbon, has requested an Interpol Red Notice for Davis, citing a “procedural risk” as Davis remains free and could access large sums of money that may enable him to flee the US or go into hiding.

Magazine: Price list of Caitlyn Jenner memecoin ‘mastermind’ leaked