The S&P 500 Index experienced a moment of volatility reminiscent of Bitcoin following the U.S. President’s “Liberation Day” tariff announcement on April 2, highlighting the anxiety and uncertainty affecting traditional markets amid ongoing trade tensions.

An analyst noted on X that the volatility of the S&P 500, as depicted by the “SPY US Equity Hist Vol” chart, hit 74 in early April, surpassing Bitcoin’s (BTC) level of 71.

Image Source: Original Analyst Insights

This uptick indicates a notable departure from the S&P 500’s long-term volatility average, which typically sits below 20.

In contrast, extreme volatility has been a characteristic of Bitcoin since its launch.

According to one financial firm, “Bitcoin’s volatility remains 3.9 and 4.6 times higher than that of gold and global equities, respectively.”

Although Bitcoin’s average volatility has lessened over time, it continues to experience price fluctuations that outpace more established assets. Source: Financial Analysis Firm

Equities are facing unprecedented volatility levels amid the trade war instigated by the President, which has threatened tariffs ranging from 10% to 50% on imports from major trading partners. Though a portion of the tariffs has been paused for 90 days, duties on Chinese imports have significantly increased by at least 145%.

This volatility also impacted other markets, particularly U.S. Treasuries, which saw a significant sell-off this week. The yield on the 10-year Treasury bond is poised for its largest rise since 2001.

Related: As market tensions affect Bitcoin, follow-up insights offer a guide to the future

Despite “macro relief,” Bitcoin remains under pressure

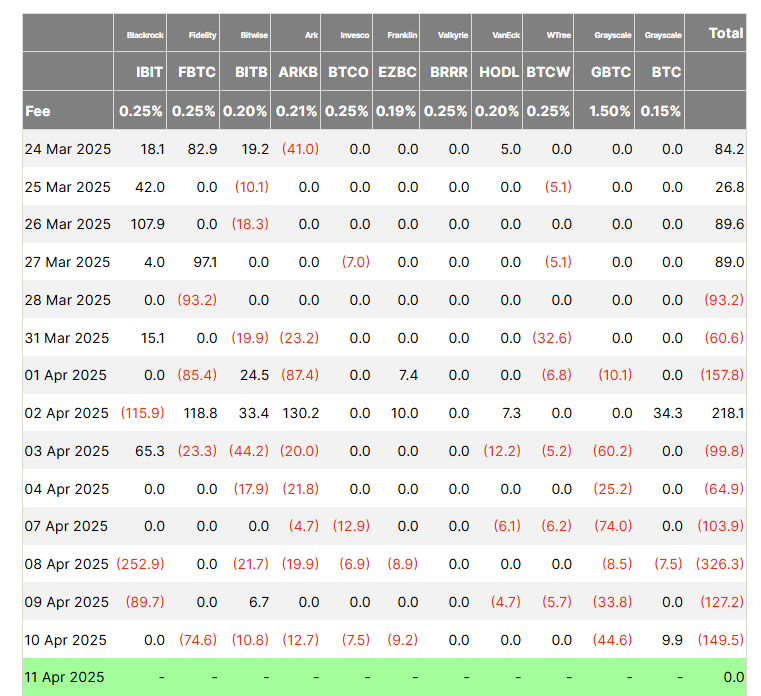

The U.S. equity markets experienced a historic rebound on April 9 after the tariff delay. However, this “macro relief” did not translate to any substantial recovery for Bitcoin or its spot exchange-traded funds (ETFs), suggesting that “institutional confidence remains cautious in the near term,” according to insights from market analysts.

“After January’s record inflows, demand for ETFs has slowed, with several funds reporting net outflows in recent weeks,” the analysts remarked. “This reflects a reluctance among large investors who may be waiting for more favorable entry points or clearer regulatory clarity.”

U.S. spot Bitcoin ETFs have witnessed six consecutive days of outflows. Source: Market Tracking Service

Despite Bitcoin’s underwhelming performance, analysts believe the second quarter through the end of 2025 could be optimistic for the asset class as “new narratives emerge,” such as state-level accumulation and growth in the tokenization of real-world assets.

The director of market research at another firm echoed this perspective, stating that Bitcoin possesses features that appeal to long-term investors concerned about government policies and the risks associated with traditional currencies affecting their investments.

While the volatility spike of the S&P 500 may prove to be temporary, some suggest that its recent trend “challenges the long-standing notion that traditional markets are safer, less risky, or more stable.”

Related: A weaker yuan is ‘bullish for BTC’ as Chinese investments turn to crypto — Market Insights