The following is a guest contribution and analysis from a marketing professional in the blockchain space.

DeFi has evolved into a multifaceted network of lending markets, stablecoin systems, and liquidity pools. While this expansion offers a myriad of opportunities, it also introduces unique risks that can arise unexpectedly, demanding a high level of expertise to manage effectively.

The Increasing Complexity and Volatility of DeFi Markets

The DeFi market has experienced significant growth in recent years, currently holding around $88 billion in total value locked. However, the landscape is fragmented, consisting of numerous DeFi protocols across various chains, with some boasting robust user bases and established track records while others have taken on more experimental forms. This complexity necessitates a carefully structured risk management framework that evaluates prevalent economic risks from multiple perspectives. To illustrate this, let’s examine several potential risk events that could manifest.

- Sudden Liquidity Shortages: During periods of market pressure, lenders frequently rush to withdraw their funds, leading to soaring utilization rates in lending pools. For instance, in March 2023, the DAI market on Aave approached nearly 100% utilization, prompting interest rates to jump sharply to encourage repayments and new deposits—this was a crucial mechanism that barely prevented a liquidity crisis. Without such measures, users who remained in the pool could have faced challenges withdrawing their assets as liquidity diminished.

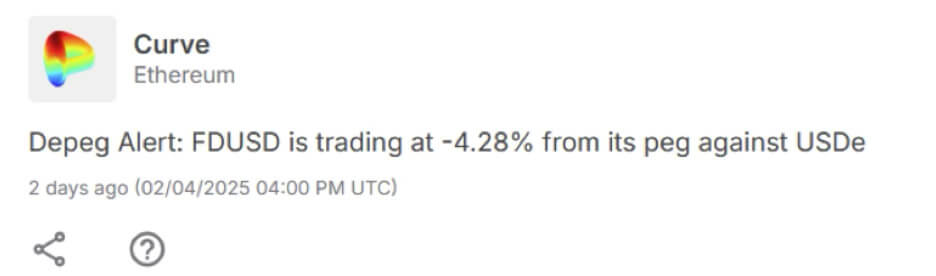

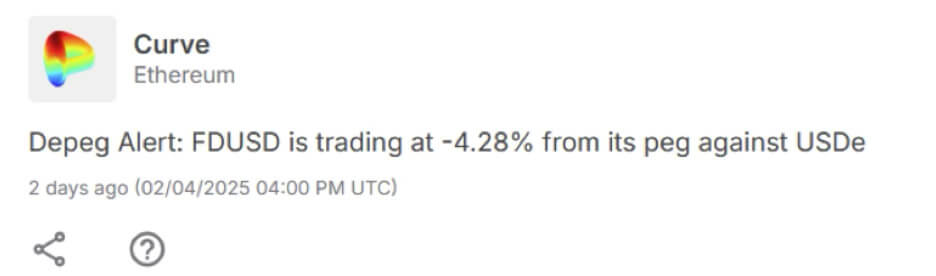

- Stablecoin Depegs: Stablecoins can break their peg with little warning, causing significant disruption in the market. A striking example occurred on April 2, 2025, when First Digital USD (FDUSD) – which typically maintains a 1:1 valuation to the dollar – plummeted to $0.93 following insolvency allegations against its issuer. Such depegging incidents not only undermine confidence but also jeopardize any protocols or liquidity pools that depend on that stablecoin (for example, causing imbalances in Curve pools and prompting panic withdrawals).

- Cascading Liquidations: A steep decline in the price of a major asset can initiate a domino effect of liquidations across DeFi lending platforms. Dropping prices compel leveraged positions to be unwound, potentially driving prices down further and triggering even more loan liquidations in a destructive cycle. A notable example is the “Black Thursday” event in 2020, where a 50% drop in ETH price within a single day led to a surge of liquidations and even protocol bankruptcies.

These instances illustrate how swiftly things can deteriorate if one is not vigilant about a variety of risk indicators pertinent to their positions. Sudden liquidity shortages, peg collapses, and mass liquidations underscore the necessity for ongoing, comprehensive risk assessment. In rapidly changing markets, timing is crucial—by the time a typical investor reacts to rumors or price trends, the repercussions may have already materialized.

Identifying Risks Early on Aave

Aave, one of the dominant money markets in DeFi, serves as an essential protocol to monitor when assessing risks within the market. If you are an institutional investor in the DeFi sector, you are likely already engaged with this protocol. However, even if you’re not utilizing Aave directly, its substantial market position can be critical for observing potential risk events in the wider ecosystem. Let’s look at a practical example of how to monitor risk on Aave.

High-Risk Loan Alerts on Aave

Loans on Aave can be classified according to a health factor (derived from collateral versus debt); as this health factor nears 1.0 (the liquidation threshold), the loan’s risk of liquidation significantly increases.

A sudden spike in high-risk loans could result from drastic price fluctuations, causing the value of the collateral to decrease. When this depreciation is severe enough, it can lead to liquidations and potentially induce cascading liquidations as previously discussed. While it’s challenging to continuously track high-risk loans, it’s nonetheless vital. Tools like the risk Pulse tool can help identify these situations automatically, as illustrated in the example below.

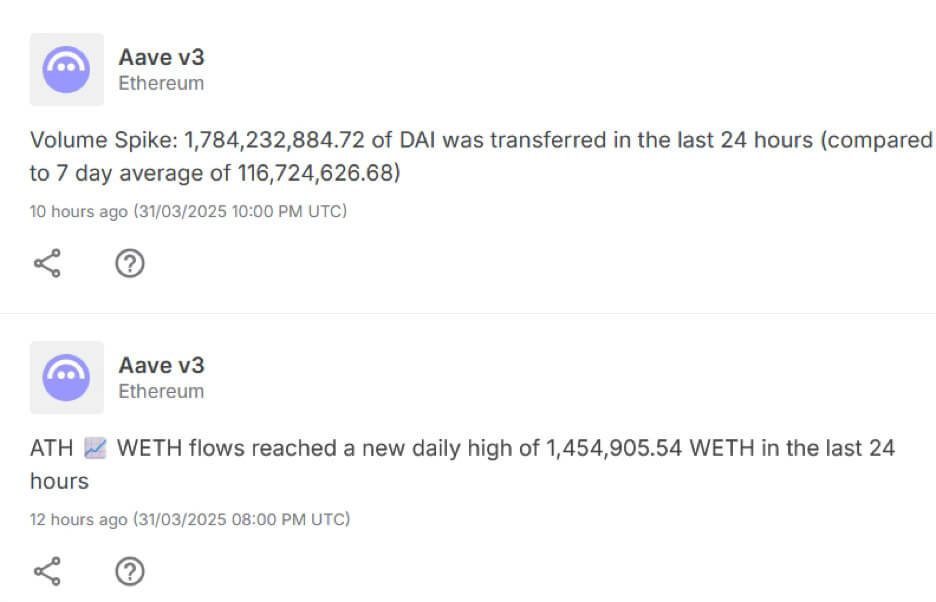

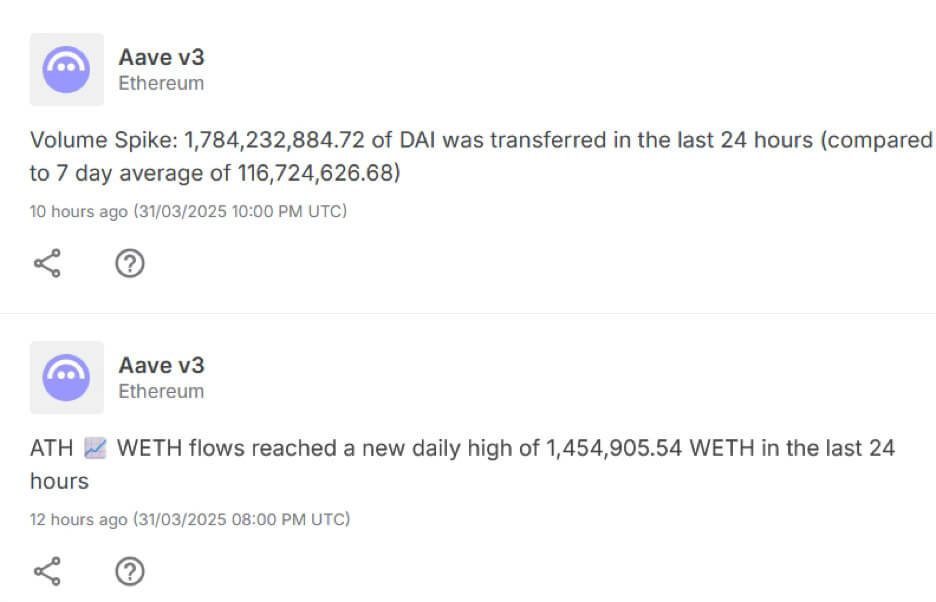

Monitoring Liquidity Movements

Another significant indicator on Aave is noteworthy asset movements into or out of the protocol. Spikes in liquidity flows, particularly outflows, can signal risk factors. For instance, a significant withdrawal of WETH from Aave could imply that a large holder is retracting collateral, potentially due to concerns regarding market volatility or to allocate resources elsewhere.

This unexpected outflow can constrict the available liquidity on Aave. If a substantial amount of WETH is withdrawn, the remaining liquidity available for borrowing diminishes, resulting in heightened utilization for what remains and consequently pushing interest rates up.

In contrast, an influx of WETH deposits could temporarily enhance Aave’s liquidity and suggest that key players are preparing to lend or provide collateral for borrowing.

Monitoring Liquidity Movements

Another significant indicator on Aave is noteworthy asset movements into or out of the protocol. Spikes in liquidity flows, particularly outflows, can signal risk factors. For instance, a significant withdrawal of WETH from Aave may suggest that a large holder is retracting collateral, potentially due to concerns regarding market volatility or to allocate resources elsewhere.

This unexpected outflow can constrict the available liquidity on Aave. If a substantial amount of WETH is withdrawn, the remaining liquidity available for borrowing diminishes, resulting in heightened utilization for what remains and thus driving interest rates up.

Conversely, a large influx of WETH deposits could temporarily boost Aave’s liquidity and indicate that key players are gearing up to lend or provide collateral for borrowing.

Both these situations come with implications: a drop in liquidity increases the risk of higher slippage or the inability of other users to withdraw, whereas a significant influx may precede increased borrowing (and leverage in the system).

Curve: Depeg Alerts and Changes in Market Depth for Stablecoin Pools

Another prominent DeFi protocol is Curve, which serves as the backbone of stablecoin liquidity in the DeFi space, with pools enabling users to trade and stake stablecoins and other pegged assets. Curve pools are specifically designed to facilitate stable swaps, maintaining equal asset values, making any occurrence of a depeg or imbalance especially alarming. Risk monitoring on Curve emphasizes peg stability and market depth—essentially assessing whether the assets within the pool are maintaining their expected value and if there is adequate liquidity on either side of the pool.

Depeg Risks

When a token in a Curve pool veers away from its intended peg, liquidity providers (LPs) are typically the first to bear the consequences. A minor price fluctuation can swiftly escalate into a pool imbalance — with the depegged asset overwhelming the pool as others withdraw, leaving LPs exposed to greater risk.

Recent incidents, such as the FDUSD depeg on April 2, 2025, underscore the necessity for rapid detection. As redemptions surged and speculation grew, Curve pools heavily weighted with FDUSD suffered sharp distortions. LPs caught off guard faced escalating impermanent loss and inadequate exit liquidity.

Early alerts regarding the initial drift (e.g., FDUSD ) are critical to mitigate losses.

And it’s not just fiat-backed stablecoins at risk. Staked tokens like sdPENDLE have also displayed price inconsistencies in Curve. When these derivatives weaken in value against their underlying assets, their representation in pools can swell, indicating a rapid rise in LP risk.

Liquidity Depth as a Signal

Curve’s risks are not solely tied to price; liquidity depth is also a critical factor. When the liquidity in a pool thins out, slippage worsens, and the ability to execute swaps becomes constrained. It is imperative to keep an eye on sudden shifts in pool liquidity. Such shifts may originate from market events causing extreme price movements that induce uncertainty and prompt liquidity withdrawals.

Another important but often overlooked factor is that pool liquidity may rely heavily on a few large providers, meaning that withdrawals by just a handful of entities can significantly impact market depth, thereby exposing you to added risks.

For funds managing liquidity on Curve, receiving real-time alerts that merge significant transactions with liquidity depth changes is crucial. These notifications offer an opportunity to exit, rebalance, or even inject capital to stabilize the peg, before the broader market reacts.

Whale Concentration: Major Players That Influence Markets

A recurring theme in these discussions is the dominant role of whale investors—entities or addresses controlling substantial positions. The behavior of whales can sway markets or distort liquidity due to their significant scale.

On-chain analytics can reveal these “whale concentration” risks by identifying pools where a few large lenders are predominant. If just a handful of addresses supply the majority of a pool’s liquidity, then that pool is vulnerable; the first whale to exit could leave everyone else stranded until new capital enters or until elevated rates compel borrowers to repay their loans.