The sell-side risk ratio serves as a behavioral indicator meant to evaluate the probability of Bitcoin holders choosing to sell their assets, considering previous accumulation patterns and current market dynamics. A lower value indicates that holders are less likely to part with their coins, while a higher value signifies growing motivations to cash in on profits or minimize losses. By analyzing this ratio across different timeframes—long-term versus short-term holders—we can discern how various market segments react to fluctuations in price.

The sell-side risk ratio for long-term holders has experienced only a slight increase, moving from 745.8μ on March 23 to 0.001679 by April 10. This incremental rise is statistically negligible, especially in contrast to the notable shifts observed within short-term cohorts. This trend implies that long-term holders are not engaging in panic selling or strategic withdrawals, even amid rising geopolitical tensions and intensified market activity in derivatives and ETFs.

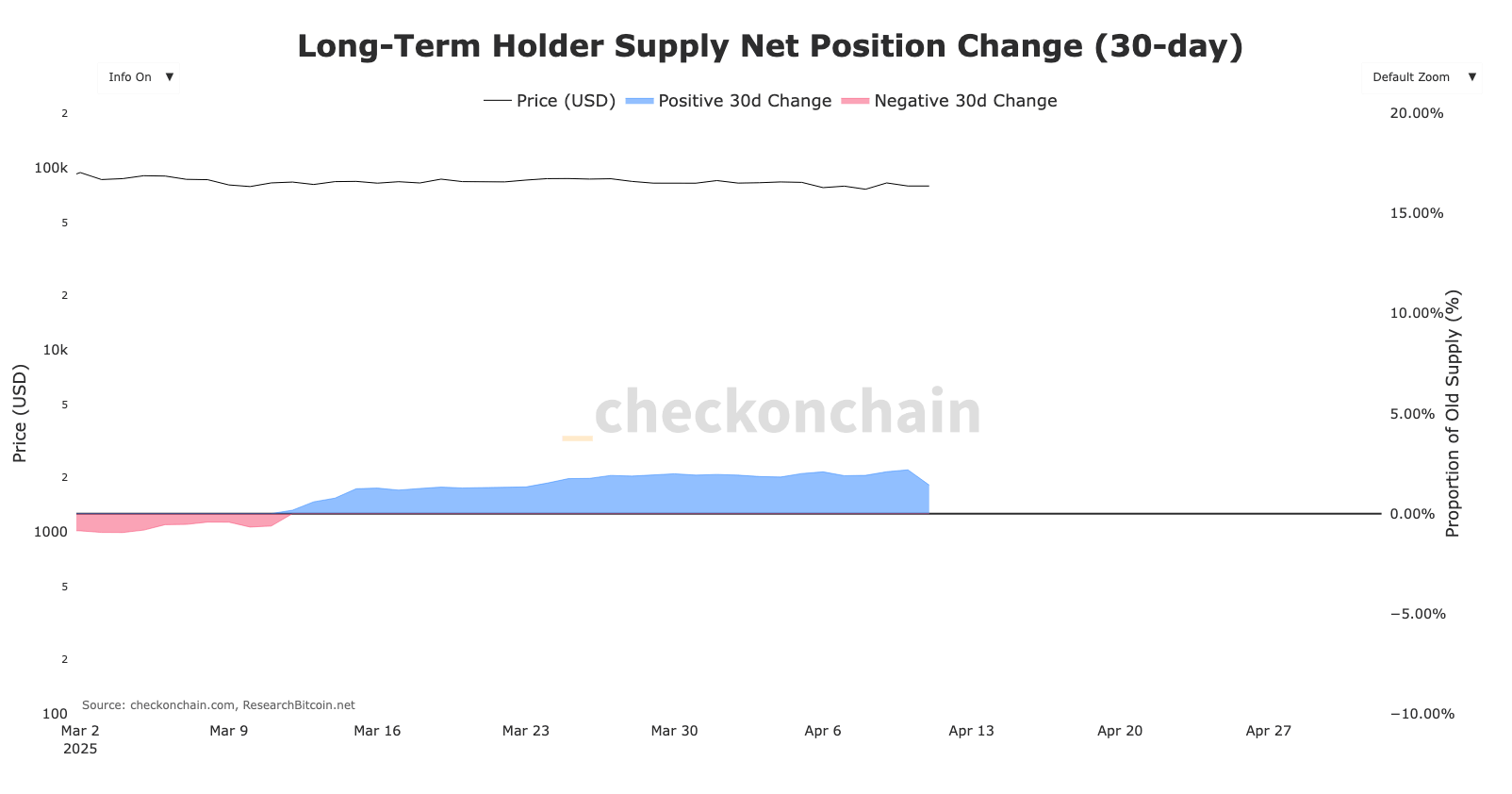

Interestingly, this behavior aligns with a phase of continued accumulation. Over the past month, this group’s 30-day net position change has remained positive, climbing from 0.17% on March 12 to 2.19% by April 10. This indicates that long-held coins are increasingly shifting into more resilient hands, whether through direct purchases or simply through the passage of time.

This trend of accumulation stands out, especially when compared with price movements. Leading up to April 10, Bitcoin reached levels above $82,000, only to experience a sharp decline toward the $76,000 mark. The fact that long-term holders are still augmenting their positions amid this price instability indicates that they remain undeterred by current pullbacks and perceive the existing market environment as part of a broader accumulation strategy. Historically, long-term holders tend to sell during euphoric periods and aggressive price ascents, rather than during corrections driven by geopolitical or macroeconomic factors.

Conversely, the behavior of short-term holders presents a different narrative. This group has shown greater reactivity, with the sell-side risk ratio experiencing wider fluctuations. Since the start of the year, this metric has varied between 425μ and 0.001855.

In the latest period from April 6 to April 10, the ratio surged from 713μ to 0.001302, coinciding with heightened tensions between the US and China, a broad sell-off of risk assets, and significant outflows from Bitcoin ETFs. This sharp uptick in short-term sell-side risk indicates a heightened sensitivity to price shifts and macroeconomic triggers.

Unlike long-term holders, short-term participants typically display weaker conviction, greater leverage exposure, and shorter investment horizons. Their tendency to sell in response to market volatility amplifies intraday price swings and adds to short-term liquidity challenges. This is particularly significant as the overall market witnessed a $450 million outflow from Bitcoin ETFs over a few sessions. The convergence of selling pressure from short-term holders and ETF redemptions creates a feedback loop, where declining prices are intensified by anxious selling.

Nonetheless, the structural implications of this divergence are stabilizing, rather than destabilizing. Short-term selling alone does not inherently threaten Bitcoin’s long-term trajectory. What truly matters is the reaction of long-term holders to these sell-offs. Thus far, they have not reduced their exposure. The ongoing accumulation among long-term holders, even as the market corrects, suggests a steadfast belief in the long-term viability of Bitcoin and indicates that the market is undergoing a phase of short-term rebalancing.

To better understand these behaviors, it’s essential to consider the broader macroeconomic environment. China’s recent announcement regarding a 125% tariff on US goods has sharply increased geopolitical tensions, further pressuring global risk markets.

While gold has surged as investors seek safety, oil prices have dropped amid waning demand, and US equity futures have declined. Concurrently, Bitcoin has struggled to establish a clear direction, acting both as a speculative risk-on asset and a hedge against macroeconomic uncertainty. In this scenario, it is to be expected that participants with shorter time horizons would exit while more strategic investors consolidate their positions.