A cryptocurrency investor has recorded a nearly $10 million loss after selling a CryptoPunk non-fungible token (NFT), highlighting the ongoing downturn in the previously thriving blue-chip NFT market.

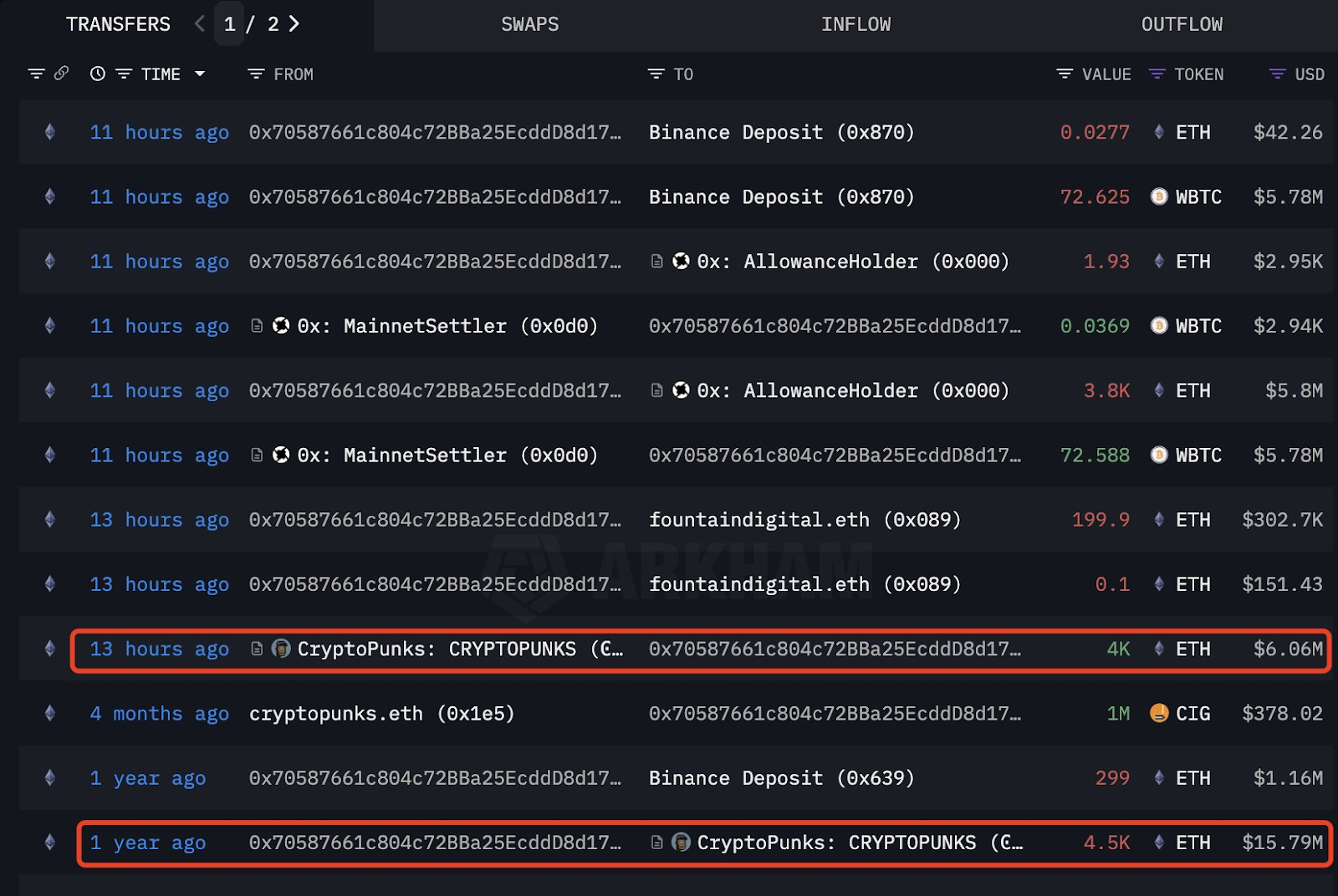

The individual, a significant player in the crypto space, exchanged a CryptoPunk NFT for 4,000 Ether (ETH), translating to more than $6 million at the time of the transaction.

This NFT was acquired for 4,500 ETH, approximately $15.7 million, a year earlier, as analyzed by blockchain tracking services.

“Did the investor only incur a loss of 500 ETH ($774K)? Not at all—his actual loss was $9.73 million!” the analysis noted on a social media post. “When he bought it, ETH was trading at $3,509. By the time of selling, ETH had plummeted by 57%,” they added.

CryptoPunk transaction details. Source: Arkham Intelligence / Provider

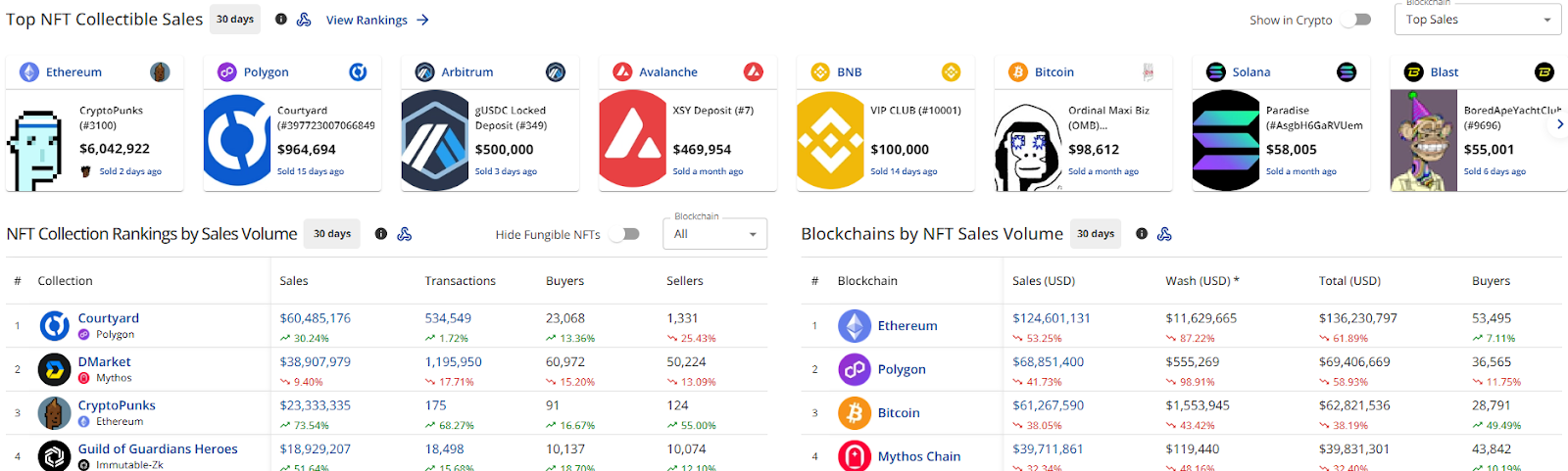

Despite the significant loss, the $6 million sale is still noted as the largest NFT transaction in the past 30 days, according to statistics from the analytics service.

Overview of top NFT sales in the last month. Source: Analytics Service

This sale occurs during a stagnant phase for NFTs, with diminished interest from traders. NFT trading volume on Ethereum has decreased by over 53% in the past month, while Polygon’s numbers dropped by 41%.

CryptoPunks recently experienced a temporary surge in floor prices of 13% following rumors about their owner, Yuga Labs, possibly being “in the process” of selling the collection’s intellectual rights, as reported earlier.

Related: Sentient completes a record-setting 650K NFT mint for a decentralized ‘loyal’ AI model

Leading collections face significant declines

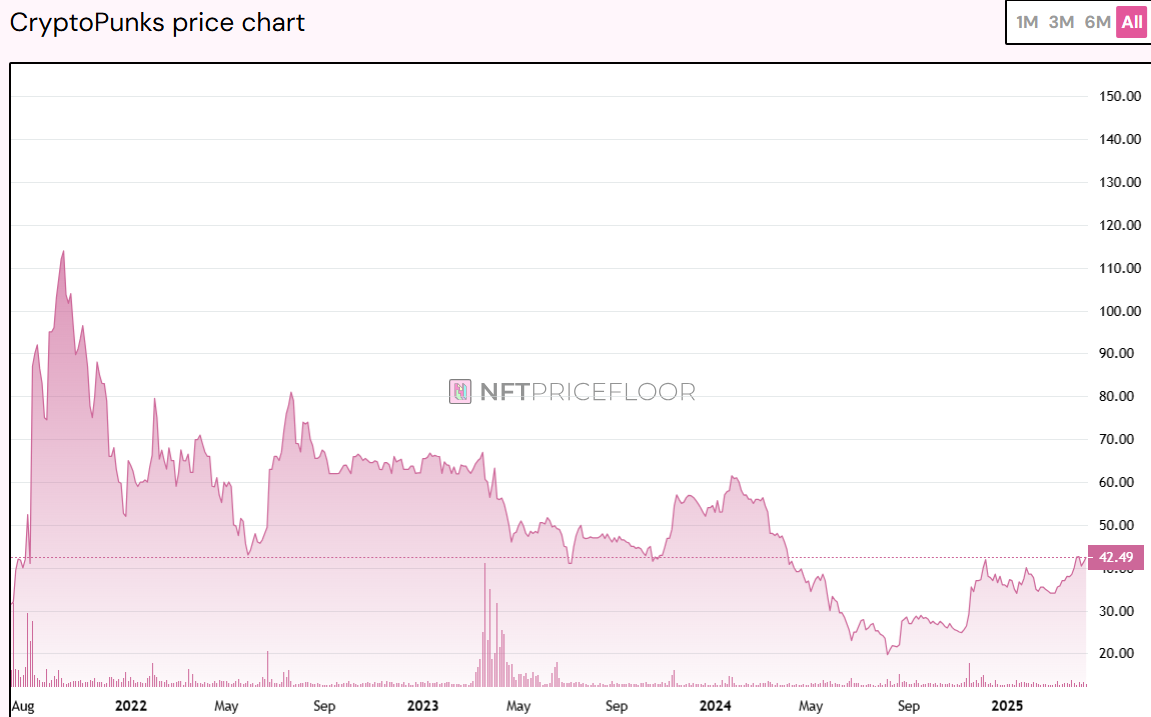

The premier blue-chip NFT collections have seen sharp drops from their peaks in 2021 due to a lack of trading activity.

Currently, CryptoPunks have a floor price around 43 ETH, approximately $68,000, indicating a decline of more than 61% from their all-time high of 113.9 ETH recorded in October 2021.

CryptoPunk floor price timeline. Source: Market Data Service

The floor price for the Bored Ape Yacht Club has also decreased by 89%, while the Mutant Ape Yacht Club collection has fallen by 93%, as shown by data from the market analytics service.

Related: Trump family memecoins may prompt increased SEC scrutiny on cryptocurrencies

Conversely, the Pudgy Penguin collection stands out, recently achieving a new all-time high of over 25 Ether on December 16, 2024, with the highest sales volume exceeding $72 million in the first quarter of 2025.

Source: Source Provider

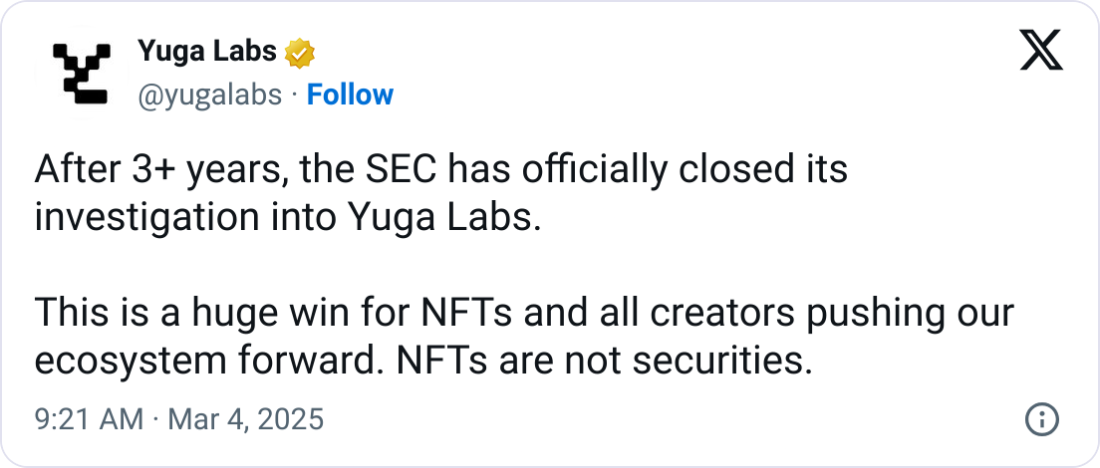

At the beginning of March, the US Securities and Exchange Commission concluded a three-year investigation into Yuga Labs. This probe, which started under former Chair Gary Gensler, focused on whether some NFTs, particularly fractional ones, should be classified as securities.

Magazine: Memecoin innovation is enabling pioneering anti-aging research