The President of the United States has exempted a variety of technology products, including smartphones, chips, computers, and certain electronics, from tariffs, providing the tech industry with much-needed relief amidst ongoing trade challenges.

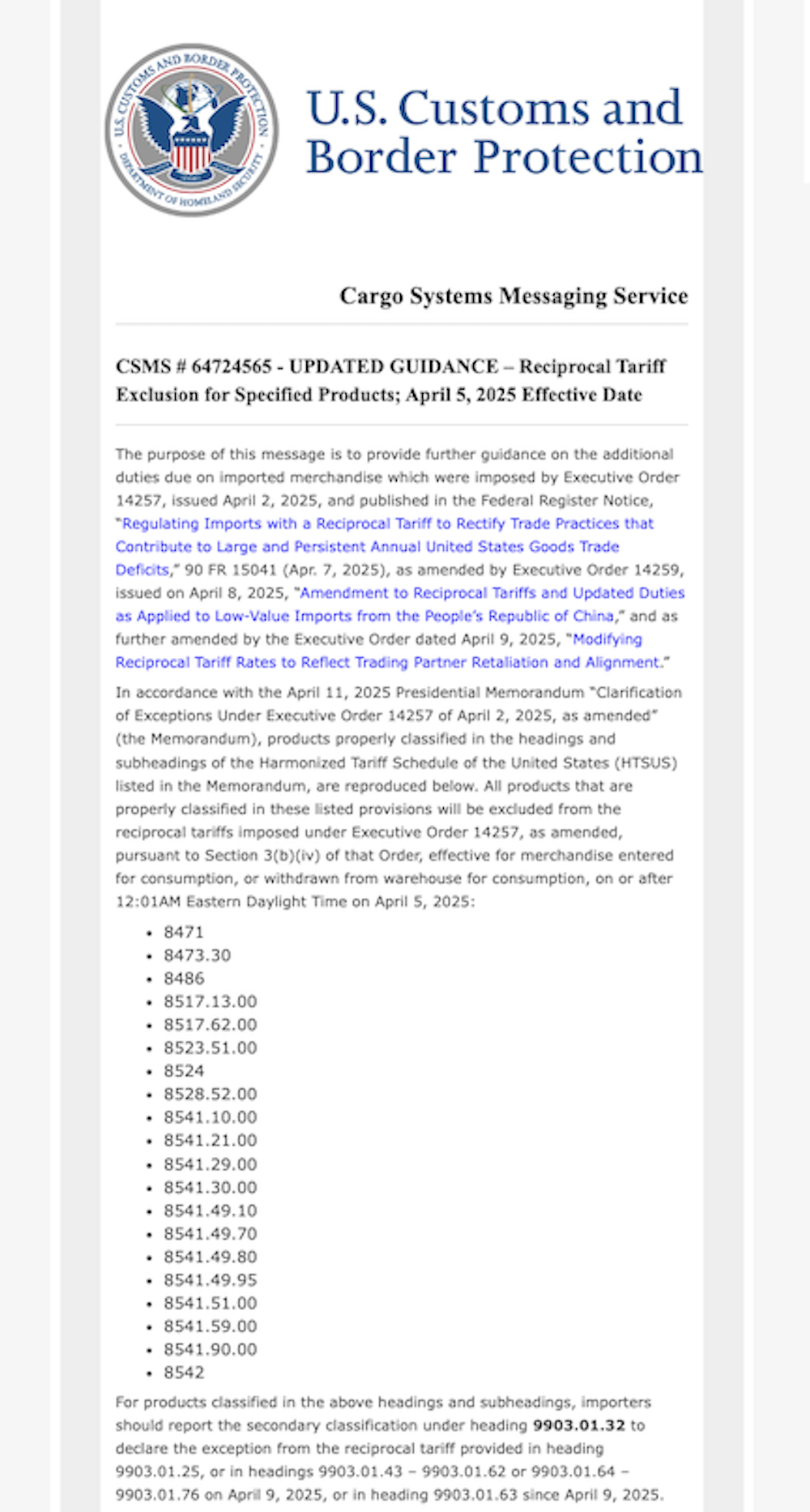

According to US Customs and Border Protection, items such as storage cards, modems, diodes, semiconductors, and various other electronics were also left out of the current trade tariffs.

“Large-cap technology companies will ultimately come out ahead when this is all said and done,” a recent analysis stated on April 12 via social media.

US Customs and Border Protection announces tariff exemptions on select tech products. Source: US Customs and Border Protection

This tariff reprieve is expected to alleviate some pressure on tech stocks, which have been among the hardest hit during the trade conflict. The cryptocurrency markets, which often show correlation with tech stocks, could also experience a rally as risk sentiment improves driven by favorable trade news.

After the announcement of the tariff exemptions, Bitcoin’s price surged past $85,000 on April 12, indicating that cryptocurrency markets are already reacting positively to this latest macroeconomic shift.

Related: Prominent investor expresses no surprise if Trump postpones tariffs

Markets react to Trump’s statements amid economic uncertainty

On April 9, the President rolled back extensive tariff policies by announcing a 90-day pause on reciprocal tariffs and reducing rates to 10% for countries that had not implemented counter-tariffs on US goods.

Following this tariff pause, Bitcoin experienced a 9% increase, while the S&P 500 rose by more than 10% on the same day.

Macroeconomic analyst Raoul Pal described the tariff policies as a maneuver for negotiation aimed at establishing a trade agreement between the US and China, characterizing the administration’s trade rhetoric as strategic posturing.

Bitcoin advocate Max Keiser asserted that exempting certain tech products from import tariffs would not lead to a decrease in bond yields or advance the administration’s objectives of reducing interest rates.

The yield on the 10-year US Treasury Bond rises sharply following the administration’s trade policies. Source: TradingView

The yield on the 10-year US Treasury Bond surged to a peak of around 4.5% on April 11 as bond investors reacted to the prevailing trade war uncertainties.

“The concessions recently granted to China regarding tech exports won’t reverse the trend of rising rates. Confidence in US bonds and the US dollar has been waning for years and won’t be changing anytime soon,” Keiser stated on April 12.

This article does not provide investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct thorough research prior to making any decisions.

Magazine: Trump’s crypto ventures raise concerns over conflicts of interest and insider trading