The President of the United States has granted exemptions on a variety of technology products, such as smartphones, chips, computers, and certain electronics from tariffs, providing the tech sector with a crucial break from trade challenges.

According to authorities, storage cards, modems, diodes, semiconductors, and additional electronic items have also been exempt from the current trade tariffs.

“Major technology corporations are likely to emerge stronger once this situation resolves,” noted a recent social media post.

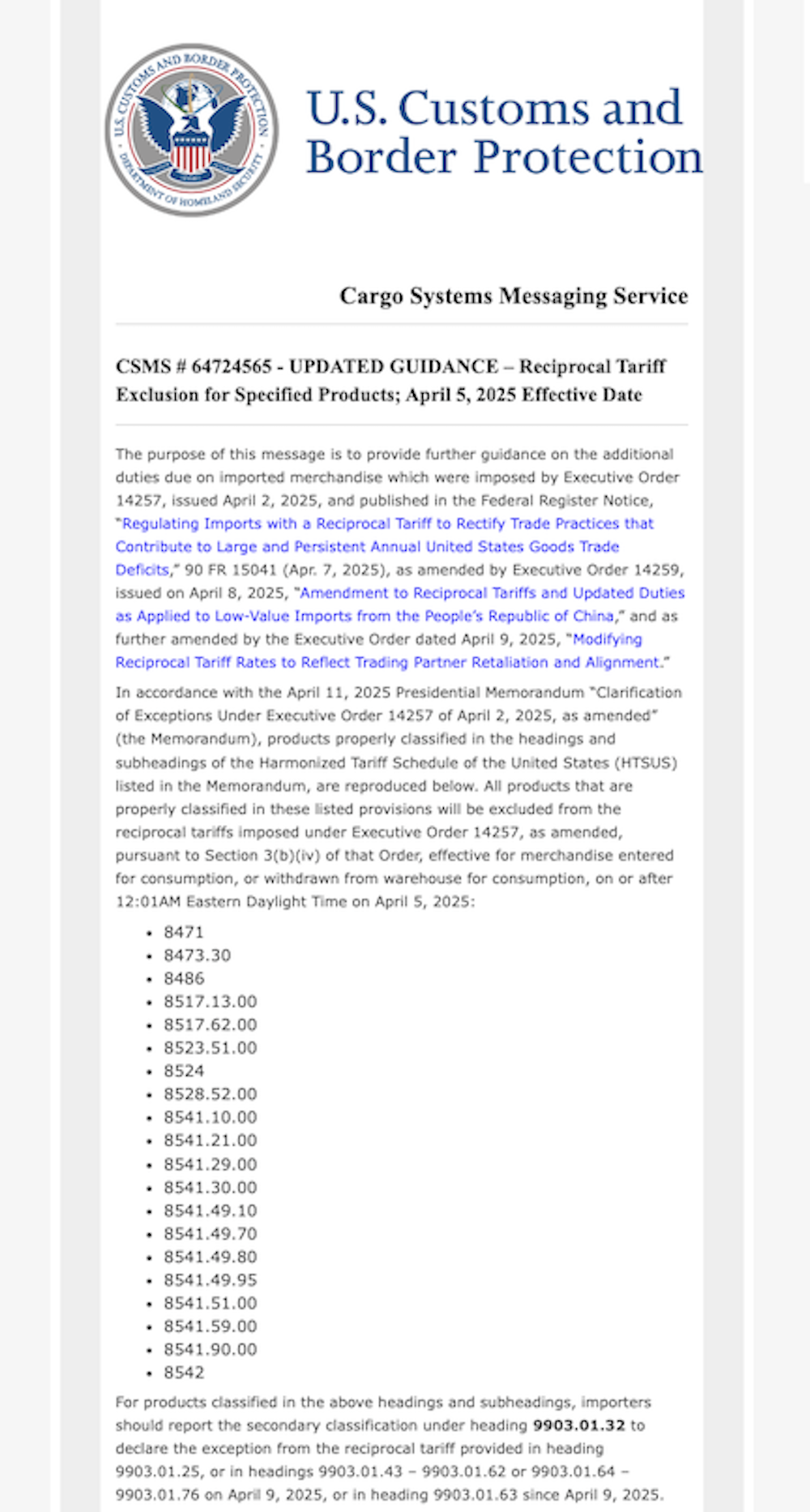

Announcement of tariff exemptions on selected tech products. Source: US Customs and Border Protection

This relief from tariffs should alleviate some pressures on technology stocks, which have been significantly impacted by the trade conflict. The cryptocurrency markets are closely linked to tech stocks and may also see gains as investor confidence grows in light of favorable trade news.

In the wake of the tariff exemption announcement, Bitcoin’s price exceeded $85,000 on April 12, suggesting a positive reaction from the crypto market to the recent macroeconomic changes.

Related: Investor speculates that the President may delay tariff implementation

Markets are sensitive to the President’s communications amid economic uncertainty

The President reassessed the extensive tariff policies on April 9, initiating a 90-day suspension of the reciprocal tariffs and reducing tariff rates to 10% for countries that refrain from implementing counter-measures on US goods.

Bitcoin experienced a 9% increase, with the S&P 500 rising by over 10% on the same day the tariff pause was announced.

Macroeconomic analyst Raoul Pal described the tariff policies as negotiation tactics in pursuit of a trade agreement with China, labeling the current trade dialogue as “posturing.”

Bitcoin advocate Max Keiser contended that exempting certain tech products from import tariffs would not lead to a decrease in bond yields nor support the administration’s aims of lowering interest rates.

Yield on the 10-year US government bond rises sharply following recent trade policies. Source: TradingView

The yield on the 10-year US Treasury Bond surged to around 4.5% on April 11, as bondholders reacted to the economic uncertainty created by a prolonged trade war.

“The recent concessions made to China regarding tech exports won’t reverse the trend of increasing rates. Trust in US bonds and the Dollar has been diminishing for years, and that trend is unlikely to change,” Keiser remarked on April 12.

This article does not serve as investment advice or endorsements. All investment and trading actions carry risks, and readers should perform their own due diligence prior to making any financial decisions.

Magazine: Questions arise about potential conflicts of interest related to the President’s crypto endeavors