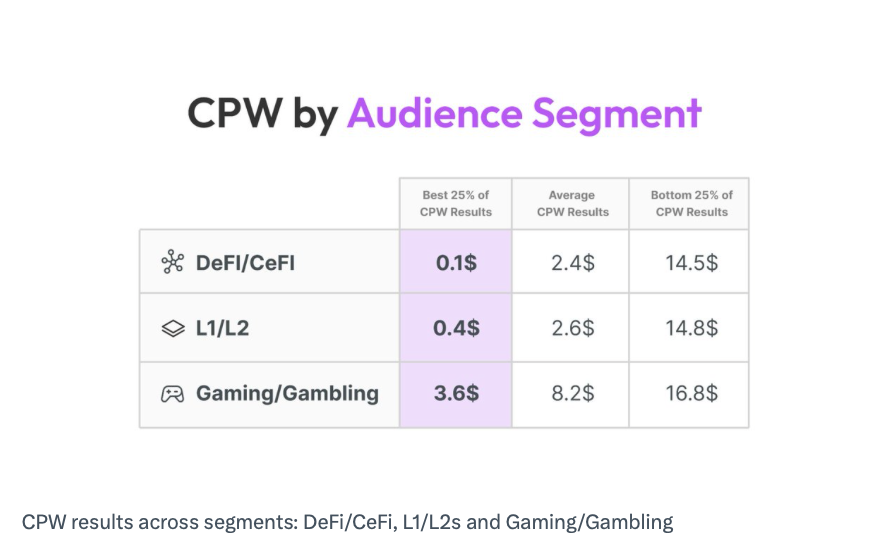

Recent insights indicate that campaigns focused on crypto gaming and gambling represent the most costly method of acquiring users who already have crypto wallets, making them the highest in terms of expense across the entire crypto sector.

“Gaming and gambling initiatives are the priciest, with a median cost per wallet (CPW) of $8.74 and a lower quartile of $3.40,” stated one of the co-founders of a Web3 marketing agency. CPW is regarded as a premium metric because it measures the cost associated with attracting visitors who have a crypto wallet installed in their browser.

“Higher churn” rates might be a contributing factor

The co-founder previously mentioned that their analysis indicated users with a crypto wallet are more likely to transition into using crypto products.

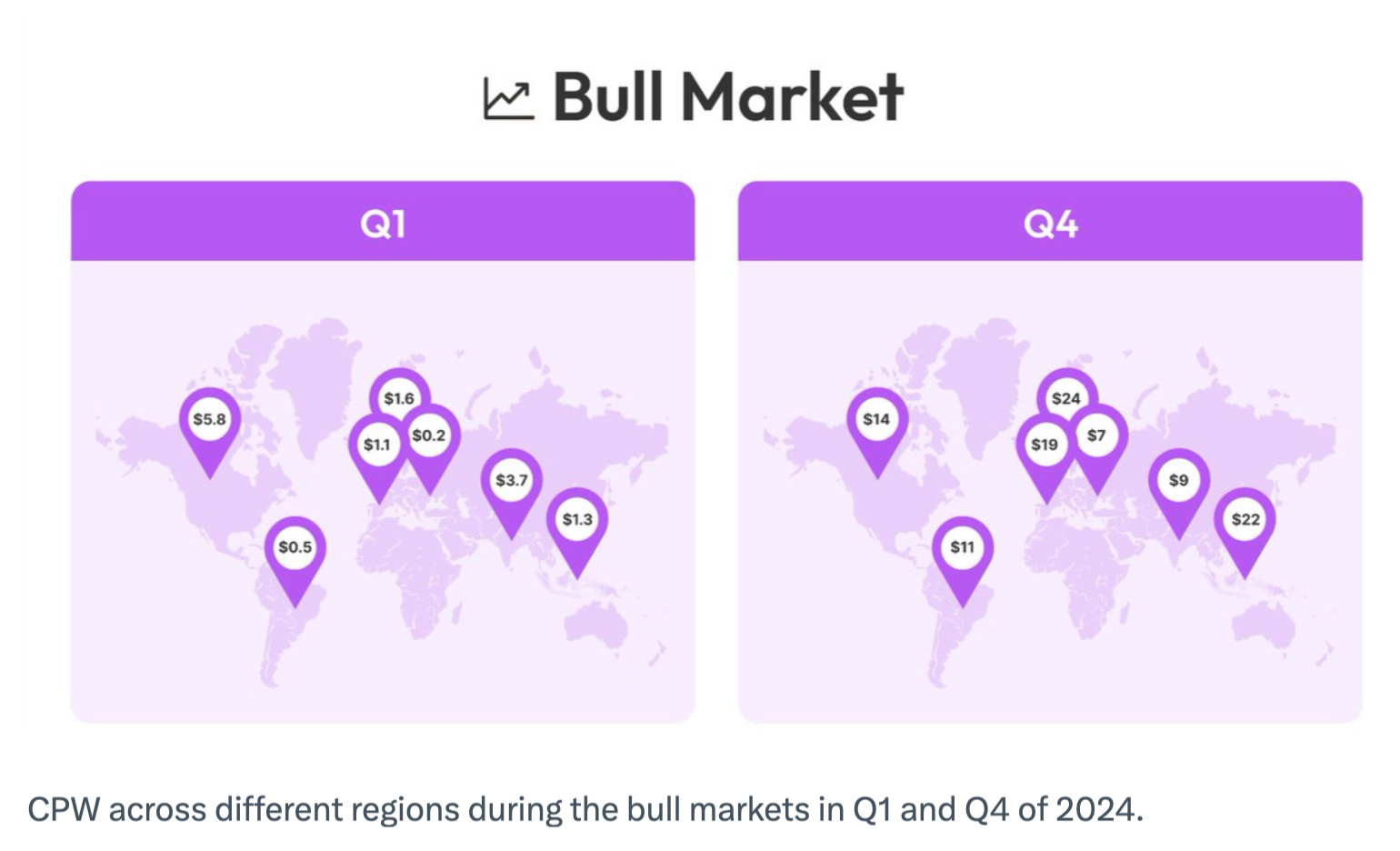

CPW across various regions during the bull markets in Q1 and Q4 of 2024.

The co-founder attributed the high cost-to-return ratio for crypto gaming and gambling to factors such as “higher churn, speculative behavior, and fierce competition.” They emphasized:

“If Web3 gaming is genuinely ‘inevitable,’ we need to develop a more effective user acquisition engine to ensure its sustainability akin to Web2.”

However, a co-founder from Axie Infinity suggested that times of elevated CPW present opportunities for experimentation.

“Develop new games or product lines, strengthen our market share, and prepare for the next market growth phase,” they advised. “Recognize when it’s time to build up and when it’s time to take off,” they added.

In contrast, decentralized finance (DeFi) and centralized finance (CeFi) campaigns have a much easier time attracting new crypto users. “DeFi/CeFi initiatives are the most cost-effective, with a median CPW of $2.79 and a lower quartile of merely $0.10,” the findings revealed.

The data is derived from 200 programmatic campaigns conducted by over 70 advertisers, targeting an estimated 9.5 million users around the globe.

CPW results across various segments of the crypto industry.

This information illustrates the fluctuation of CPW across different market cycles, regions, campaign strategies, and audience segments.

Reaching crypto users in premium markets costs more during downturns

The co-founder noted that while premium markets offer lower-cost conversions for existing crypto wallet holders during bull markets, capturing their attention becomes far pricier during market downturns.

Related: Trump eliminates DeFi broker regulation in a significant win for crypto: Finance Redefined

They pointed out that in 2024, CPW in the US and Western Europe surged four times and 27 times, respectively, from Q1 to Q3, as the markets consolidated and interest from crypto wallet holders diminished.

“While these markets provide depth and quality during bull runs, they become greatly more expensive when market sentiment turns negative, rendering them less sustainable during downturns,” they indicated.

Conversely, emerging markets like Latin America and Eastern Europe “offer remarkably low CPW in favorable conditions but can see extreme fluctuations in costs.”

Magazine: Bitcoin aims for $100K by June, Shaq resolves NFT lawsuit, and more: Hodler’s Digest, April 6 – 12