An NFT trader may face a prison sentence of up to six years after admitting to underreporting nearly $13 million in profits from CryptoPunks trading, as stated by the US Attorney’s Office for the Middle District of Pennsylvania.

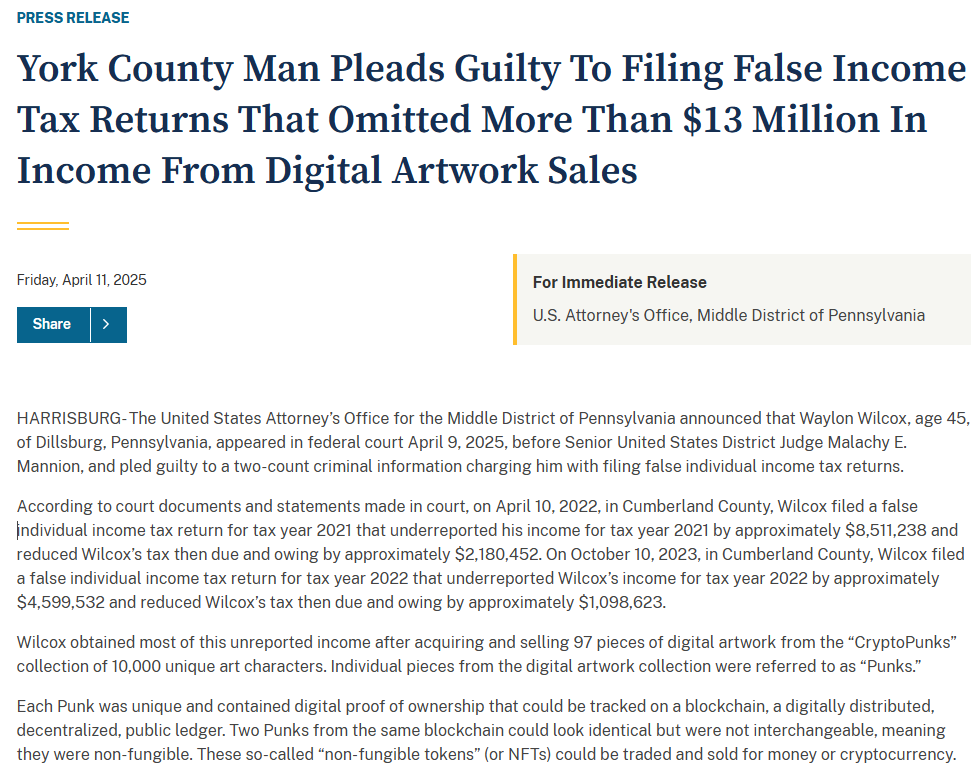

Waylon Wilcox, 45, confessed to submitting incorrect income tax returns for the 2021 and 2022 tax years. Wilcox pled guilty on April 9 to two charges of filing false individual income tax returns, according to federal prosecutors in a statement released on April 11.

In April 2022, Wilcox submitted a fraudulent individual income tax return for 2021, which significantly understated his income tax by approximately $8.5 million, resulting in a tax reduction of around $2.1 million.

Later, in October 2023, he filed another incorrect individual tax return for the 2022 fiscal year, underreporting his income tax by an estimated $4.6 million and decreasing his tax liability by nearly $1.1 million.

Wilcox pleads guilty to false tax filing.

According to the statement, “The maximum possible penalty for these offenses under federal law is up to six years in prison, followed by a term of supervised release and a fine.” The specifics of his sentencing are still uncertain.

Related: NFT trader offloads CryptoPunk after suffering a nearly $10M loss

Wilcox traded a total of 97 CryptoPunk NFTs, part of the largest NFT collection in the industry, valued at $687 million.

Source: CryptoPunks

In 2021, Wilcox sold 62 CryptoPunk NFTs for a profit of approximately $7.4 million, but reported a much lower figure on his tax returns. In 2022, he sold an additional 35 CryptoPunks for $4.9 million. The Department of Justice indicated that Wilcox deliberately answered “no” to questions about conducting digital asset transactions on both tax filings.

“The IRS Criminal Investigation is dedicated to exposing intricate financial schemes related to virtual currencies and NFT transactions aimed at hiding taxable income,” stated Yury Kruty, Special Agent in charge of the Philadelphia Field Office. He emphasized:

“In today’s economic climate, it’s crucial for the American public to trust that everyone is adhering to the rules and paying the taxes they owe.”

This case was investigated by the Internal Revenue Service and its Criminal Investigation Division.

Related: CZ counters allegations regarding a ‘baseless’ US plea deal

Crypto Tax Regulations on the Rise

Global interest in crypto tax laws surged in June 2024 after new regulations were introduced, making US crypto transactions subject to third-party tax reporting requirements for the first time.

Since January, centralized crypto exchanges and other brokers must report the sales and exchanges of digital assets, including cryptocurrencies.

On April 10, former President Trump signed a congressional resolution to reverse a regulation from the Biden administration that would have imposed similar reporting requirements on decentralized finance (DeFi) protocols.

This so-called IRS DeFi broker rule, set to be implemented in 2027, would have broadened the tax authority’s reporting requirements to encompass DeFi platforms, necessitating disclosure of gross proceeds from crypto sales along with taxpayer information.

However, some advisors in the crypto regulatory space argue that prioritizing legislation related to stablecoins and crypto banking is more pressing than new tax laws in the US.

A focused regulatory strategy concerning areas like securities laws and removing banking barriers is seen as more beneficial for the industry, according to Mattan Erder, general counsel at a decentralized blockchain network.

Magazine: SEC’s reversal on crypto leaves significant questions unanswered