- Bitcoin is nearing its crucial resistance level of $85,000 on Monday, with a potential breakout signaling a bullish trend ahead.

- Metaplanet reported the acquisition of an additional 319 BTC, raising its total holdings to 4,525 BTC.

- Data indicates that the $100,000 strike price holds the highest open interest, suggesting a positive sentiment among traders.

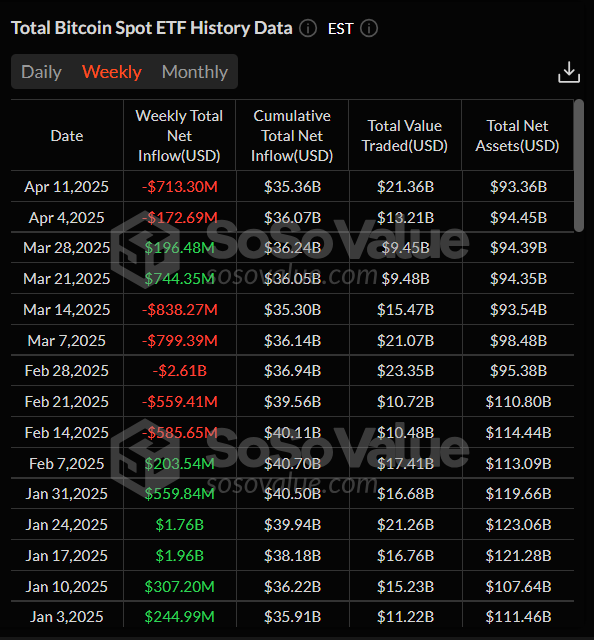

- US spot Bitcoin ETFs experienced a total net outflow of $713.30 million last week.

The price of Bitcoin (BTC) is inching higher, approaching the pivotal resistance point at $85,000 on Monday. This breakout could indicate a forthcoming bullish trend. On the same day, Metaplanet disclosed it had acquired another 319 BTC, bringing its overall holdings to 4,525 BTC. Moreover, current data suggests that the $100,000 strike price has the highest open interest, reflecting a bullish outlook from traders. Nevertheless, interest from institutional investors appears to be diminishing, as the Bitcoin spot Exchange Traded Funds (ETFs) marked a total net outflow of $713.30 million last week.

Metaplanet expands its BTC holdings

Metaplanet, a Japanese investment firm, announced on Monday that it acquired an additional 319 BTC for $26.30 million, averaging $82,549 per coin. This follows their previous purchase of 160 BTC on April 2. Currently, the firm’s total BTC holdings stand at 4,525.

Growing interest from public companies in Bitcoin signifies a rising acceptance of BTC as a strategic asset, enhancing its legitimacy and possibly driving long-term adoption. This trend is generally seen as positive for Bitcoin’s price, driven by increased demand, a shrinking circulating supply, and favorable market sentiment. If this momentum continues, Bitcoin could experience more stable price growth in the long run; however, short-term volatility is likely as the market adjusts to an influx of institutional participation.

Amberdata’s analysis of open interest by strike price reveals that BTC call options at the $100,000 strike surpass $1.19 billion in notional terms, marking it as the most significant single-strike open interest. This notable concentration and significant activity at further out-of-the-money strikes suggest a strong bullish sentiment and speculative positioning for substantial upward movements.

BTC calls open interest by strike notional chart.

Decrease in institutional demand for Bitcoin

Institutional demand has diminished amidst market volatility and uncertainty in the past week. According to recent data, the US spot Bitcoin ETF saw a net outflow totaling $713.30 million last week, following a $172.69 million outflow the previous week. The data indicates consistent weakness in weekly net flows since mid-February, following the inauguration of Donald Trump on January 20. If this trend persists and worsens, Bitcoin’s price may face further corrections.

Total Bitcoin Spot netflow weekly chart.

Bitcoin Price Outlook: Will it surge to $90,000 or drop to $78,000?

Bitcoin recently broke and closed above its downward trendline—established from several highs since mid-January—on Friday, rising by 2.22% the following day. Yet, on Sunday, BTC encountered resistance at the $85,000 mark, which aligns with the 200-day Exponential Moving Average (EMA) and the daily resistance level. As of Monday, the price hovers around $84,500.

A sustained close above $85,000 could propel BTC to the significant psychological threshold of $90,000, with a successful breakout above this level potentially leading to a challenge of its March 2 peak at $95,000.

The Relative Strength Index (RSI) on the daily chart is currently flat at the neutral level of 50, indicating uncertainty among traders. The RSI will need to rise above this level to maintain bullish momentum.

BTC/USDT daily chart

If BTC is unable to close above $85,000 and continues along its downward trajectory, it could test the next daily support level at $78,258.

FAQs about Bitcoin, Altcoins, and Stablecoins

Bitcoin is the largest cryptocurrency by market capitalization, functioning as a digital currency meant to act as money. It is designed to operate independently of any central authority, which eliminates the need for intermediary involvement in financial transactions.

Altcoins refer to any cryptocurrencies other than Bitcoin, although some consider Ethereum a non-altcoin due to its foundational role in creating other cryptocurrencies. If this holds true, then Litecoin would be recognized as the first altcoin, created as a fork of Bitcoin.

Stablecoins are cryptocurrencies that aim for price stability, with values supported by reserves that correspond to the asset they represent. To maintain this stability, a stablecoin’s value is typically pegged to a specific commodity or financial instrument, such as the US Dollar (USD), and its supply is managed through algorithms or demand fluctuations. Their primary purpose is to provide a reliable entry and exit point for those looking to invest in cryptocurrencies, while also offering a means to preserve value amidst general market volatility.

Bitcoin dominance measures the ratio of Bitcoin’s market capitalization relative to the combined market capitalization of all cryptocurrencies. This metric provides insight into Bitcoin’s appeal among investors. Typically, a high Bitcoin dominance is seen ahead of or during a bull market when investors tend to favor relatively stable cryptocurrencies like Bitcoin. Conversely, a decline in dominance usually indicates that investors are reallocating their funds into altcoins in search of greater returns, often leading to significant altcoin rallies.