The market capitalization of Circle’s Euro Coin (EURC), a stablecoin pegged to the euro, is rapidly increasing as the persistent trade war drives down the value of the US dollar.

“In recent weeks, interest in the euro has surged significantly,” and “this surge hasn’t gone unnoticed by the Circle EURC stablecoin,” stated Alex Obchakevich, founder of Obchakevich Research, in a recent post.

The euro has appreciated by 2.2%, reaching its highest value since February 2022 at approximately $1.13.

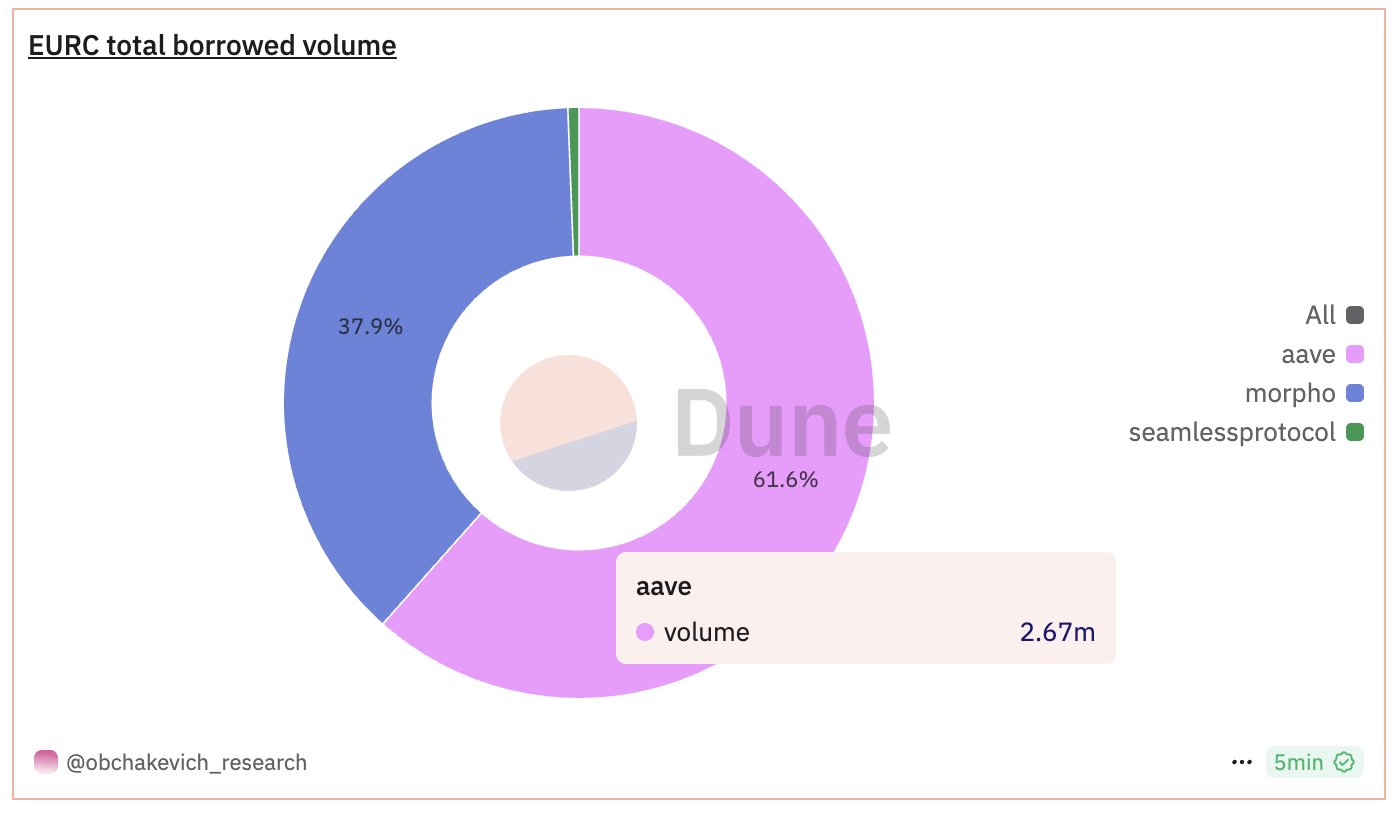

Obchakevich noted that during this period, the decentralized finance (DeFi) protocol Aave experienced inflows of €2.3 million in Euro Coin in April alone. He emphasized that the capitalization of EURC is expanding at a remarkable speed.

Image source

According to data, EURC’s market cap increased from below $84 million at the end of 2024 to over $198 million by mid-April, marking a 136% rise year-to-date.

The euro rises amid escalating trade tensions

The recent surge of the euro coincides with a weakening US dollar amid rising trade conflicts. Since December 31, 2024, the dollar has fallen from 0.97 euro to 0.88 euro, representing a decline of 9.3% against the euro.

“The US and European Union are likely to reach a trade deal that could stabilize the euro at $1.11 against the dollar,” stated Obchakevich. However, he anticipates continued growth for Euro Coin:

“EURC will keep expanding as it integrates with various payment systems and blockchains.”

The analyst mentioned that after its launch on Ethereum, Euro Coin has also been deployed on Avalanche, Base, Stellar, Sonic, and Solana, contributing to an increasing supply. He shared his forecast for future market trends:

“I expect EURC to reach 400 million euros by the end of this year, further influenced by MiCa regulatory support and economic challenges.”

Regulatory environment favors Circle

Tether currently leads the stablecoin market, with its USDt (USDT) boasting a market cap of $144 billion. This figure significantly overshadows USDC’s $60 billion market cap.

Nonetheless, many predict that this gap may narrow as USDt faces challenges in the European market due to non-compliance with MiCA regulations. This trend escalated when the world’s leading cryptocurrency exchange, Binance, removed USDt for its users based in the European Economic Area to adhere to compliance rules in March.