Last week, digital asset exchange-traded products (ETPs) experienced nearly $800 million in outflows, marking the third consecutive week of losses, according to a report from a cryptocurrency asset management firm.

On April 14, the firm noted that crypto ETPs witnessed outflows totaling $795 million, with Bitcoin (BTC)-structured products accounting for $751 million and Ether (ETH)-linked products contributing $37.6 million.

Despite the significant outflows from the major cryptocurrencies, a few altcoins managed to buck the trend and reported small gains. Among those were XRP, Ondo Finance, Algorand, and Avalanche.

The report also highlighted that since February, the cumulative outflows from crypto ETPs have reached $7.2 billion, almost negating the year-to-date (YTD) inflows from these investment vehicles.

Tariff developments impact crypto ETPs

The head of research at the asset management firm attributed the outflows to recent tariff actions taken by the United States government, specifically initiated by former President Donald Trump.

On April 2, Trump enacted an executive order that imposed a 10% baseline tariff on all imports across the board. The administration also established reciprocal tariffs for countries that impose tariffs on U.S. imports, leading to ongoing shifts in tariff policy and increasing market uncertainty.

The head of research indicated that a “wave of negative sentiment” that began in February has led to unprecedented outflows of $7.2 billion, erasing nearly all of the YTD inflows, which now stand at just $165 million.

In addition to the significant outflows from Bitcoin and Ether, altcoins such as Solana, Aave, and Sui collectively faced over $6 million in outflows last week.

While Bitcoin products have also seen significant withdrawals, their YTD gains still total $545 million. Moreover, short-Bitcoin products recorded outflows amounting to $4.6 million.

iShares by BlackRock faces the largest outflows in crypto ETPs

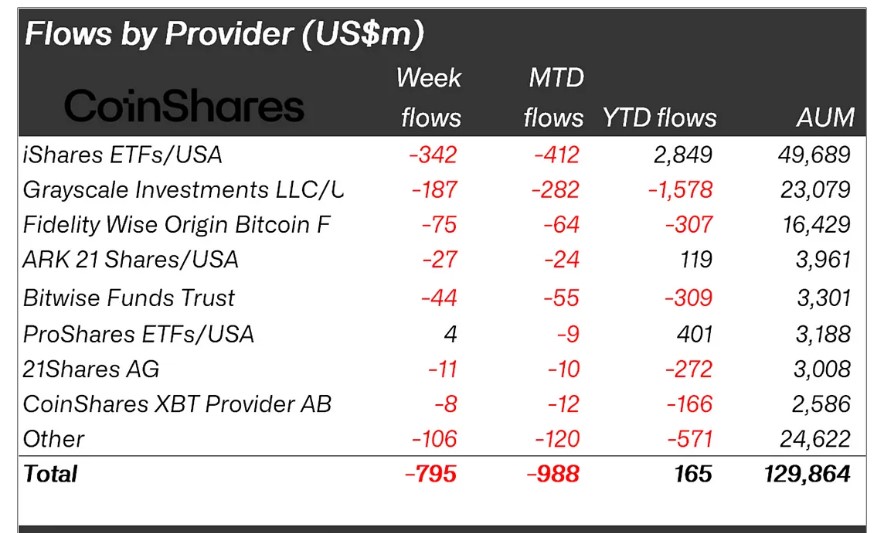

BlackRock’s iShares exchange-traded funds (ETFs) experienced the most outflows among ETP providers. Data indicated that iShares saw $342 million in outflows last week, bringing its month-to-date total to $412 million.

Crypto ETP flow chart by asset provider.

Despite the significant outflows, BlackRock has managed to retain approximately $2.8 billion in YTD inflows and currently oversees assets totaling over $49.6 billion.