Funding for blockchain gaming dropped significantly in Q1, with total investments decreasing by 71% compared to the previous quarter, according to recent data.

The first quarter was tough for Web3 gaming as global markets were impacted by trade disputes and escalating geopolitical issues. Recent analytics reveal that investments in Web3 gaming fell to $91 million, a substantial 71% decline quarter-over-quarter, despite a 35% increase in the number of deals made.

In Q1, the blockchain gaming sector saw 5.8 million daily unique active wallets, marking a 6% decline from the last quarter. Nevertheless, an analyst noted that opBNB continued to be “clearly the leading blockchain for gaming this quarter.”

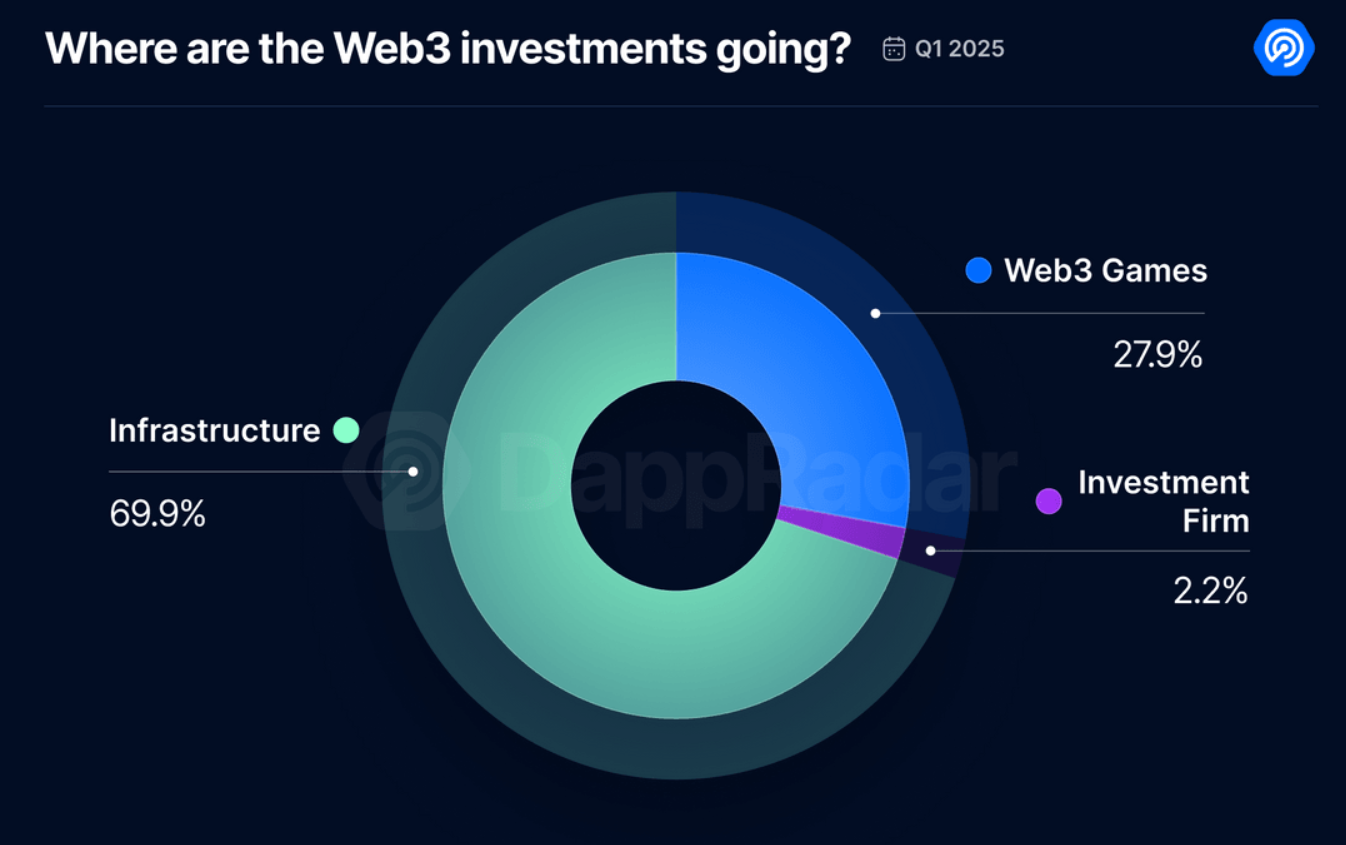

It wasn’t just gaming investments that cooled; metaverse engagement also slowed, with NFT trading volumes plummeting by 28%, as mentioned by the analyst. Even so, investments focused on infrastructure remain a high priority. Significant rounds this quarter included $20 million for MARBLEX, $13.5 million for Beamable, and $10 million for The Game Company, all aimed at enhancing tools and back-end systems for scalable gameplay.

The analyst emphasizes that most funding during this quarter “was directed towards infrastructure-driven projects, underscoring a well-established reality in Web3 gaming: robust infrastructure is crucial for scalable, high-quality gaming experiences.”

While overall activity and capital inflows “dipped due to wider market challenges,” the analyst points out that “the increase in deal numbers, continuous infrastructure development, and the stable performance of leading games” indicate a “resilient and evolving ecosystem.”

As previously noted, the broader NFT market experienced challenges in 2024 as well. Trading volume fell to $13.7 billion, a decrease from $16.8 billion in 2023—marking the lowest levels since 2020. Trading activity dropped by 19%, and total NFT sales decreased from over 60 million to 49.8 million year-over-year.