- XRP bulls are actively working to defend the $2.00 support level as the cryptocurrency market recovers from recent downturns prompted by tariffs.

- Whales are entering a new risk-on phase, acquiring more XRP tokens in anticipation of a potential rise to $3.00.

- A MACD buy signal and an increasing RSI signal bolster the bullish momentum observed on Monday.

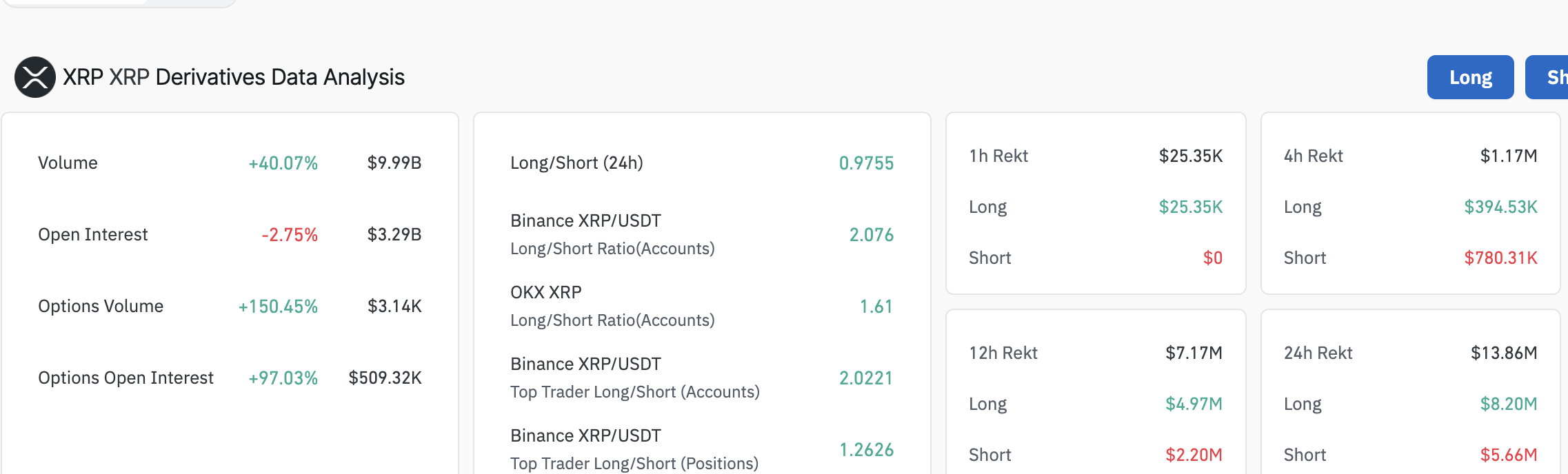

- A 2.75% fall in open interest for derivatives urges caution among traders and hints at potential downside risks.

The price of Ripple (XRP) is gradually climbing, trading at $2.15 during the early European session on Monday. The cryptocurrency held a positive outlook over the weekend after regaining support above $2.00 on Friday. Given the prevailing fundamentals and technical aspects, XRP demonstrates considerable potential to maintain its upward trajectory, aiming for crucial resistance levels at $2.75 and $3.00.

XRP whales increase their purchases as risk-averse sentiment diminishes

However, the President escalated the tariff conflict with China, imposing a 145% duty on goods imported from the Asian country. In response, China retaliated with a 125% tariff on US goods, vowing to continue the fight.

On Friday, the President made another unexpected move by exempting certain items, including smartphones, computers, and semiconductor devices, from his reciprocal tariffs.

The cryptocurrency market maintained a positive trajectory over the weekend, despite the President clarifying that these exemptions are not permanent and that existing 20% fentanyl tariffs would still apply to other goods.

XRP whales reacted positively to the tariff updates from the middle of last week, increasing their holdings. Data reveals that wallets containing between 1 million and 10 million XRP now hold 9.27% of the total supply. Similarly, addresses with between 10 million and 100 million XRP account for 11.61% of the total supply. This steady growth suggests an increasing risk appetite among whales. If this trend continues, bullish momentum could propel XRP’s price towards the $3.00 mark.

XRP price on the verge of a breakout

XRP is currently situated between two critical levels defined by the 200-day Exponential Moving Average (EMA) at $1.95, serving as support, and the short-term confluence resistance marked by the 50-day EMA and 100-day EMA at $2.25.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator further supports the bullish perspective. As the MACD approaches the mean line and the histograms turn green, the path towards previously tested resistance levels at $2.75 and $3.00 appears clearer.

The Relative Strength Index (RSI), which is currently neutral at 49.95 and trending upwards, also supports the bullish outlook. Traders might seek increased exposure as the RSI stabilizes in the upper neutral zone. Notably, breaking through the descending trendline resistance on the RSI would solidify the bullish sentiment.

XRP/USD daily chart

Conversely, traders should remain cautious not to overexpose their capital, especially given the 2.75% decrease in derivatives’ Open Interest (OI) over the last 24 hours, now at $3.29 billion. A significant 40% decline in volume to $9.99 billion during the same period indicates that many existing positions may be closing, which could dampen bullish momentum.

XRP derivatives data

Liquidations reached $13.86 million in the past 24 hours, with long positions facing the most impact at $8.2 million, while short positions accounted for $5.66 million. As the price rises, holders of long positions may opt to take profits, reducing their exposure. Additionally, the decrease in OI suggests that traders may lack confidence in initiating new positions.