After experiencing a staggering 90% decline over the weekend, Mantra’s OM (OM) token made a significant comeback, spurred by the project team’s proactive communication regarding accusations of a rug pull scam.

OM Recovering 200% as Co-Founder Responds to Issues

As of April 14, OM reached a peak trading price of $1.10, representing an almost 200% increase from its recent low of $0.37 just one day prior.

OM/USDT daily price chart. Image source: TradingView

This rebound followed the team’s efforts to clarify the situation amidst rising allegations of a scam.

Co-founder JP Mullin reassured the community about the project’s continuity, highlighting that the official Telegram group remains active.

In his words, “We are here and not going anywhere,” and he also shared a verification address to validate the team’s OM token holdings. Mullin attributed the token’s crash to “reckless forced closures initiated by centralized exchanges.”

Source: JP Mullin

This reassurance appeared to stabilize the selling frenzy around the OM token, which had wiped out over $5 billion in market capitalization and caused liquidations of $75.88 million in futures positions within a single day.

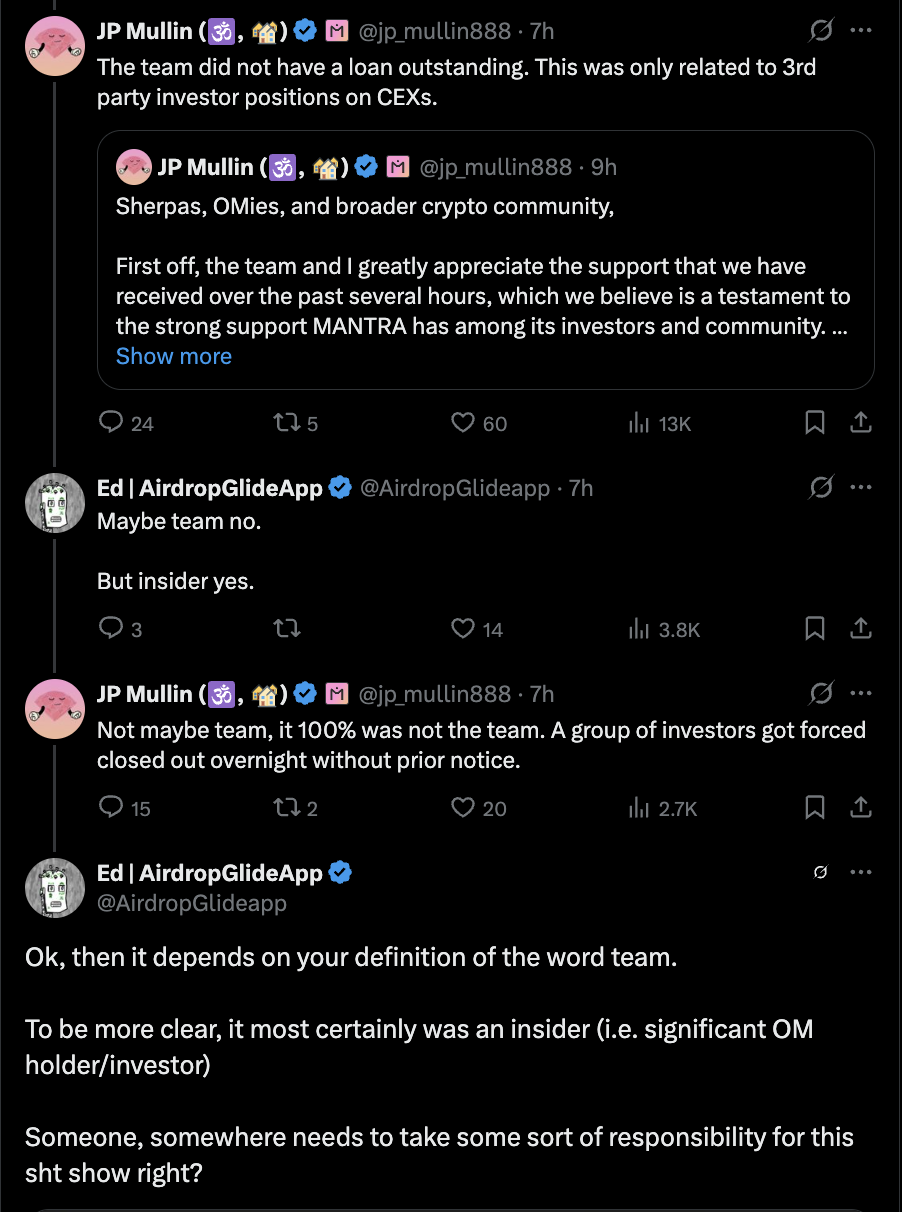

Many commentators suggested that the Mantra team, allegedly controlling 90% of the token’s supply, may have orchestrated the sell-off due to suspicious OM transfers to centralized exchanges just before the price drop.

Source: AltcoinGordon

Analyst Ed suggested that the Mantra team utilized their OM holdings as collateral to obtain risky loans from a centralized exchange.

He noted that a swift change in the platform’s loan risk parameters triggered a margin call, exacerbating the token’s sharp decline.

Source: Ed

Exchanges modify loan risk parameters to navigate market volatility and shield themselves from potential financial distress due to diminishing collateral values. Centralized exchanges, like OKX, have adjusted their parameters following updates in Mantra’s tokenomics back in October 2024.

Interestingly, that month saw Mantra double its total OM token supply from 888,888,888 to 1,777,777,777, transitioning to an uncapped, inflationary model with an initial annual inflation rate of 8%.

Source: Wu Blockchain

The CEO of OKX, Star Xu, described the situation surrounding Mantra as a “big scandal,” announcing that relevant reports regarding the crash would be forthcoming.

OM Recovery Similar to LUNA’s Bull Trap

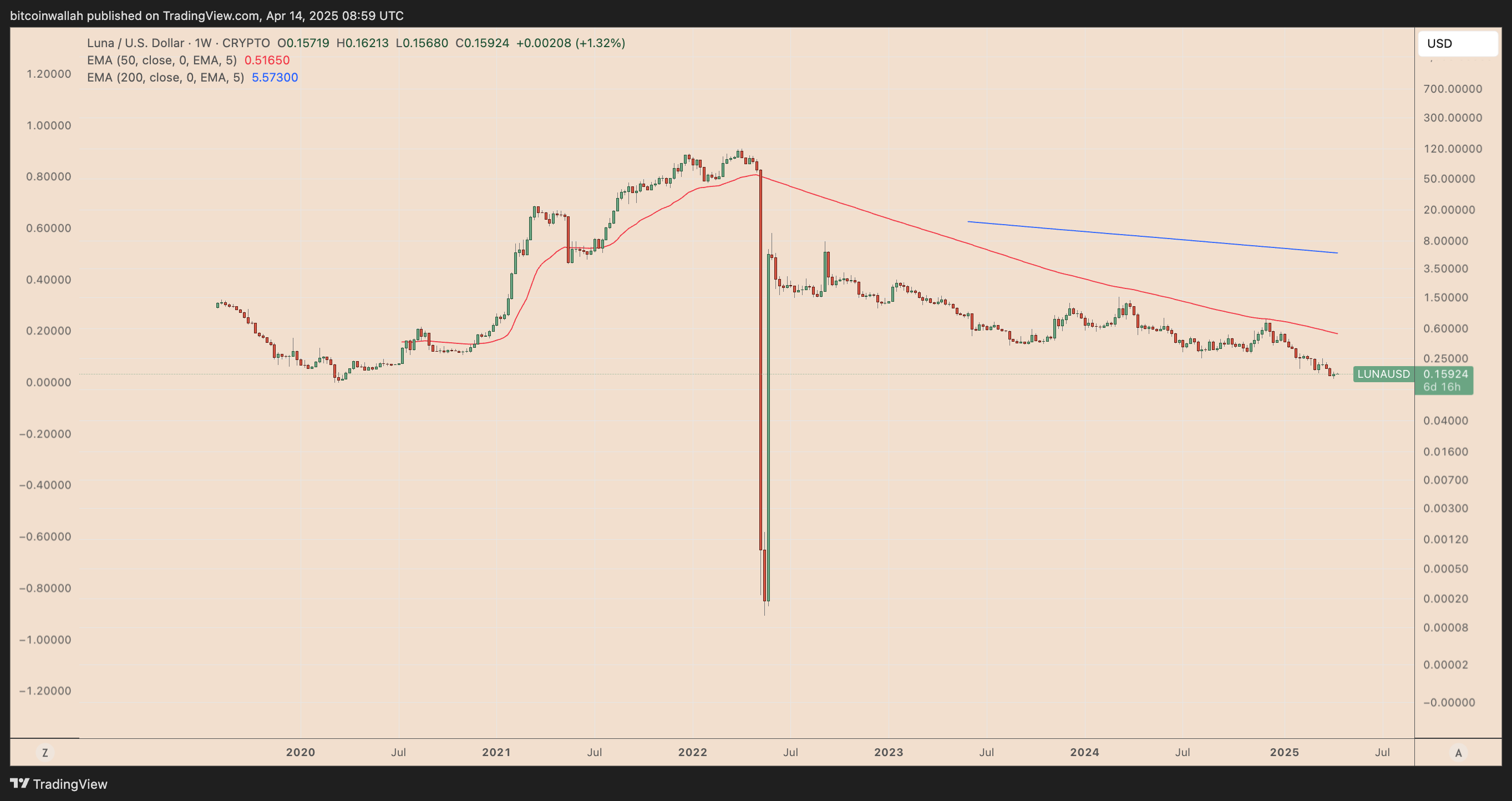

While OM’s 200% bounce from its $0.37 low may appear impressive, its pattern eerily resembles the classic bull trap observed during Terra’s LUNA crisis in May 2022.

OM’s price has plummeted below the 50-week exponential moving average (50-week EMA; marked in red) near $3.25 and is currently testing resistance at the 200-week EMA (highlighted in blue) around $1.08.

OM/USDT weekly price chart. Image source: TradingView

At the same time, the weekly relative strength index (RSI) for OM has dipped to 33.31, signaling diminishing momentum and raising the possibility of another significant decline.

Related: What is a rug pull in crypto and how to identify one?

This scenario closely resembles LUNA’s behavior following its crash. After a steep drop in May 2022, the price recovered briefly but failed to reclaim the critical 50-week and 200-week moving averages, leading to a deeper and more enduring downtrend.

LUNA/USD weekly price chart. Image source: TradingView

“If you ask me whether the bull market is over, my short answer is YES,” she asserted, adding:

“Any gains from this point are merely retracements.”

This article is not intended as investment advice or recommendations. Every investment and trading decision carries risks, and readers are encouraged to do their own research before proceeding.