The CEO of Mantra, John Mullin, addressed crucial community concerns following the steep drop in the OM token during an Ask Me Anything (AMA) session held on April 14.

Mullin assured users that Mantra and its partners are actively working towards restoring the value of the Mantra (OM) token; however, specifics regarding token buybacks and potential burns are still in the planning stages.

“We’re still in the early phases of developing a strategy for a possible token buyback,” the CEO stated, emphasizing that the recovery of the OM token is Mantra’s “foremost priority at this moment.”

As of the latest update, OM was trading at $0.73, which is slightly above its post-crash low of $0.52 recorded on April 13 at around 7:30 pm UTC, according to data from CoinGecko.

“Unfounded claims”

Mullin also refuted allegations that significant investors in Mantra sold off the OM token prior to its decline, as well as claims that the Mantra team holds 90% of the token’s total supply.

“I believe these are unfounded. We released a community transparency report last week, detailing all the different wallets,” Mullin explained, pointing out the “two sides” of Mantra’s tokenomics.

Image Source: Cointelegraph

“There’s the Ethereum side and the mainnet side,” he noted, adding that the Ethereum-based token has a hard cap and has existed since August 2020.

“The largest holder of OM on exchanges is Binance,” Mullin mentioned, referencing public records.

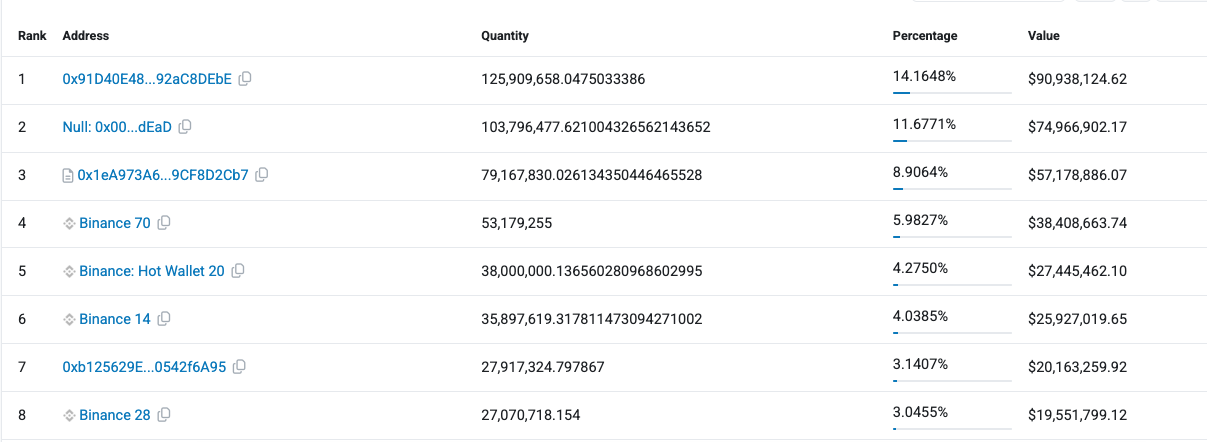

The top eight OM wallet addresses. Image Source: Etherscan

However, it’s worth noting that the highest OM wallet currently belongs to crypto exchange OKX, which manages 14% of the circulating supply, approximately 130 million tokens.

What’s next for Mantra’s $109-million Ecosystem Fund?

Mullin also discussed the Mantra Ecosystem Fund (MEF), a $109 million fund initiated on April 7 in partnership with major strategic investors, including Laser Digital and Shorooq.

Other participants in this fund include Brevan Howard Digital, Valor Capital, Three Point Capital, Amber Group, Manifold, UoB Venture, Damac, Fuse, LVNA Capital, Forte, among others.

Related: Mantra surges 200% after OM price drop but poses LUNA-like ‘significant concern’ risk

According to Mullin, the fund comprises not only the OM token but also includes “dollar commitments and contributions.”

Investors in Mantra’s $109 million fund. Image Source: Mantra

“We’ll continue to invest and support the ecosystem as part of this recovery strategy,” the CEO stated.

End of the staking program on Binance

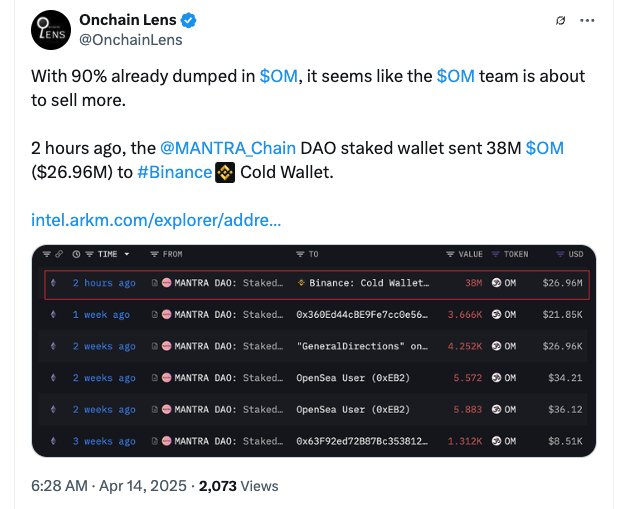

During the AMA, the Mantra CEO also clarified that a 38-million-OM transaction to the Binance cold wallet on April 14 was related to a staking program on Binance.

“It was actually Binance,” Mullin explained, noting that Binance had OM tokens on their exchange for staking purposes.

Image Source: Onchain Lens

“So, they simply returned them because the staking program concluded,” he said.

Mullin also pointed out that many of the transactions that raised concerns within the community after the decline involved collaterals from an unnamed exchange.

“Essentially, those tokens were used as collateral on an exchange. That exchange then decided it didn’t want to maintain that position anymore, for various reasons,” Mullin elaborated, adding:

“What essentially happened was that the positions were liquidated by the exchange administering the collateral, creating a sell-off that led to increased liquidations.”

Mullin emphasized that Mantra is dedicated to addressing the circumstances as transparently as possible.

“We’re not shying away from anything,” he remarked, describing the incident as a “very unfortunate situation.”

Magazine: Bitcoin eyes $100K by June, Shaq to settle NFT lawsuit, and more: Hodler’s Digest, April 6–12