The team behind the blockchain platform focused on real-world tokenized assets has stated that the drastic 90% drop in its native token’s value was triggered by exchanges abruptly closing positions without prior notice, potentially implicating one unnamed exchange.

On April 13, the token’s price plummeted from $6.30 to below $0.50, resulting in a swift loss of over 90% of its $6 billion market capitalization.

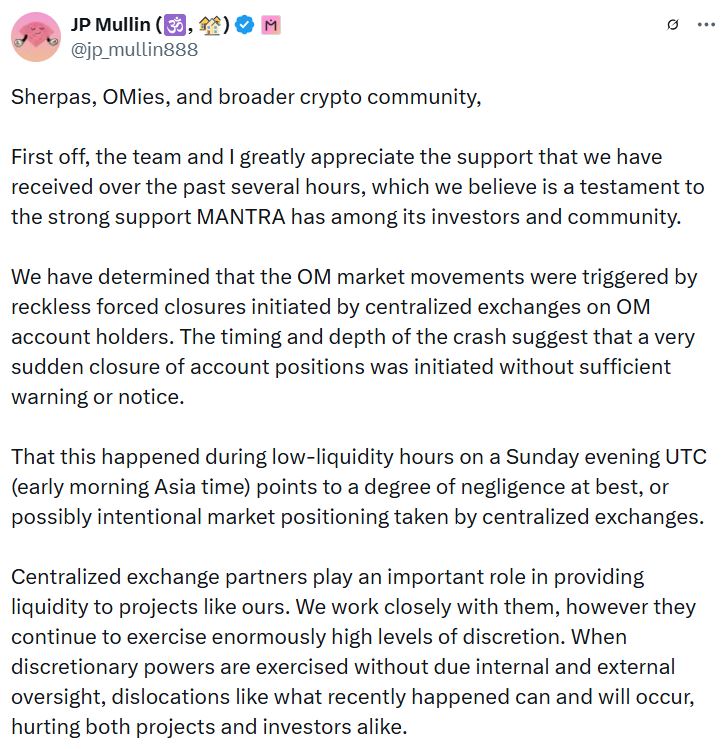

“We have concluded that the fluctuations in the OM market were instigated by irresponsible forced liquidations carried out by centralized exchanges on OM account holders,” one of the co-founders asserted in an April 13 statement.

“The abruptness and severity of the decline indicate that account positions were closed unexpectedly with little or no warning,” he further elaborated.

Source: Co-founder

“The fact that this incident occurred during low liquidity hours on a Sunday evening UTC, which coincides with early Asian morning time, suggests either a significant degree of negligence or possibly deliberate market manipulation by centralized exchanges.”

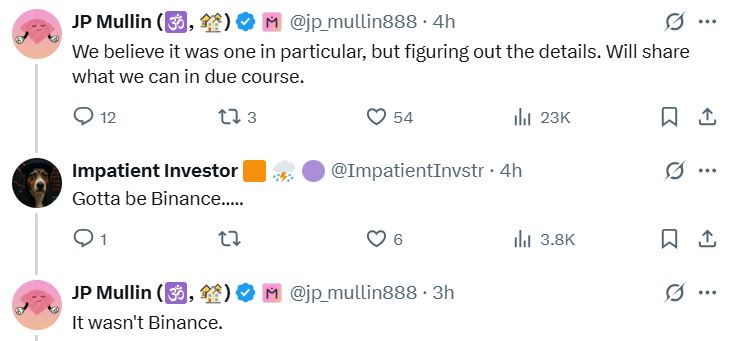

The co-founder mentioned that they believe a particular exchange might be primarily responsible but are still “working to uncover the specifics.” He reassured that the exchange in question is not Binance.

A community connect event is upcoming, where further information will be shared by the team.

Source: Co-founder

Some traders have accused the token’s decline of being a rug pull, while others are speculating that the team may have used their tokens as collateral to secure a substantial loan from a centralized exchange, which may have led to unforeseen margin calls due to parameters that changed.

The co-founder flatly rejected these claims in follow-up posts, stating, “The team did not have any outstanding loans” and insisted that no rug pull was planned.

“Tokens remain locked and are subject to the disclosed vesting schedules. The tokenomics for OM remain solid as we detailed in our recent report. Our token wallet addresses are active and publicly available,” he mentioned.

Source: Co-founder

Following the price crash, OM experienced a slight rebound, momentarily exceeding $1, but it is currently hovering around $0.7894, per data from CoinGecko.

The token reached an all-time high of just under $9 on February 23 and has now declined by over 91% from that peak.

Source: Star Xu

Millions of tokens moved the week before the drop

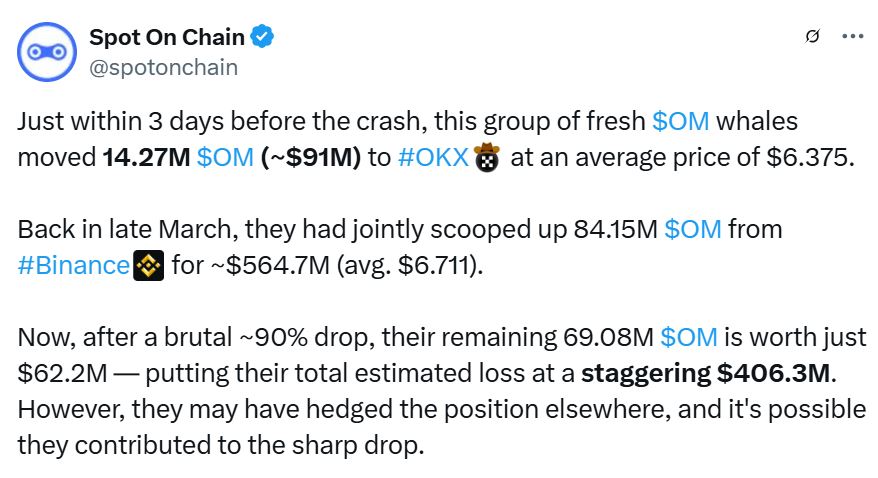

A blockchain analytics platform highlighted in an April 14 post that several large holders transferred 14.27 million tokens to the crypto exchange OKX just three days prior to the crash. In March, these same whales had acquired 84.15 million tokens valued at $564.7 million.

“Now, following a steep 90% decline, their remaining 69.08 million tokens are worth only about $62.2 million, marking an estimated total loss of around $406.3 million,” noted the analytics platform.

“However, they may have hedged their position elsewhere, potentially contributing to the swift depredation.”

Source: Analytics platform

Additionally, another analytics platform reported that since April 7, at least 17 wallets deposited 43.6 million tokens into various exchanges, equating to 4.5% of the circulating supply.

Note: The project has recently launched a $108M fund to support real-world asset tokenization and DeFi initiatives.

Just last January, the platform secured a $1 billion deal with an investment conglomerate to tokenize its diverse assets.

Furthermore, the project announced a virtual asset service provider license obtained from Dubai’s regulatory authority in February.

Magazine: Allegations of illicit arcade operations disguised as fake Bitcoin mining? Soldier fraud schemes in China: Asia Express