Over the past week, Solana’s SOL has surged by more than 20% relative to Ether (ETH), with one trader anticipating a possible breakout towards $300, which would set a new record high.

SOL/ETH ratio reaches highest weekly close ever

The SOL/ETH ratio, which indicates Solana’s value in relation to Ethereum, climbed to 0.080 on April 13, achieving the highest weekly close in history, as per information from market analytics.

Since April 4, the SOL/ETH trading pair has been consistently forming higher highs on the daily chart, signaling a prevailing uptrend.

SOL/ETH daily chart. Source: Market Analytics/TradingView

The upward movement in the SOL/ETH pair follows a robust week for Solana, which has increased by 35% over the last seven days, compared to a 13% rise in ETH during the same period.

“The SOL/ETH chart has just shown signs of strength,” noted a trader in an April 14 update, adding:

“Solana has achieved its highest weekly close against Ethereum historically, indicating that the Solana ecosystem may continue to outshine others.”

Earlier, the SOL/ETH ratio had surged to 0.093 in January amidst a cryptocurrency price rally influenced by the inauguration of US President Donald Trump, which resulted in a brief rise to a new all-time high of $295.

Is Solana on track for $300 in April?

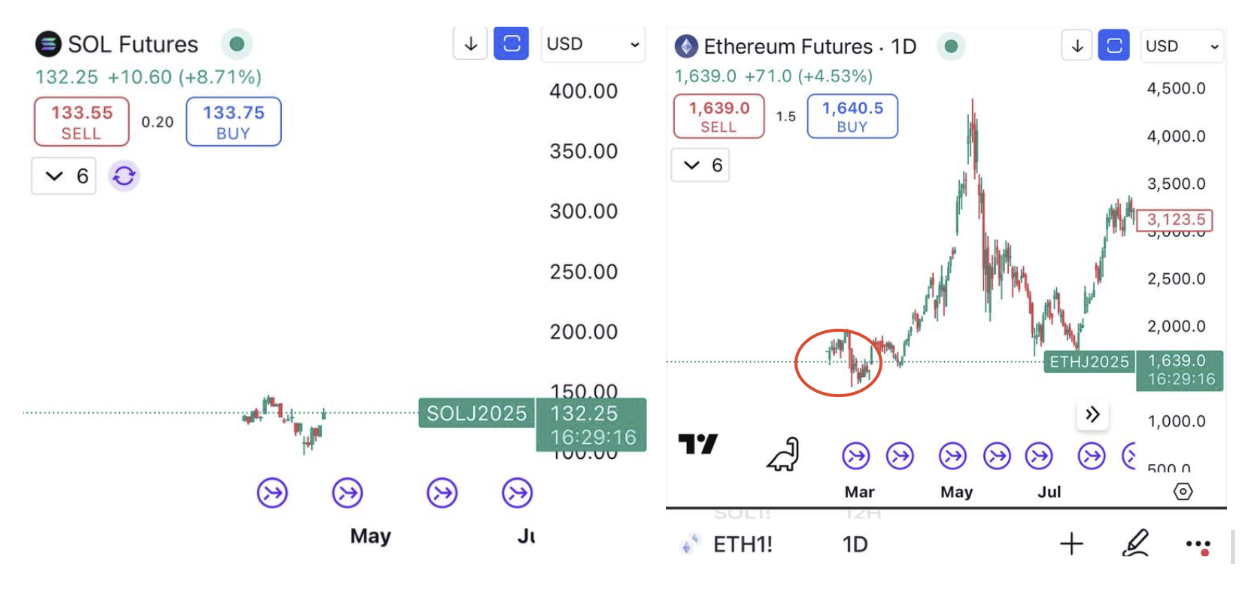

A well-known crypto trader recently shared a CME futures chart that implies SOL could trend towards the $300 milestone next.

The trader pointed out how Ethereum’s price consolidated around $2,000 on the CME chart before breaking through to new all-time highs in 2021.

“SOL is currently displaying a similar pattern on the CME futures chart,” the trader remarked, as SOL hovers around the $120 to $130 range, suggesting it could mirror Ethereum’s breakout to surpass the $300 mark.

“Much like Ethereum’s rise in 2021, Solana appears poised for a significant move in 2025.”

SOL CME Futures vs. ETH CME Futures chart. Source: BitBull

Related Topics: Fartcoin surges 104% in a week — Will Solana (SOL) follow suit?

Despite the optimistic chart patterns, various on-chain metrics indicate that SOL may encounter significant challenges on its path to new all-time highs.

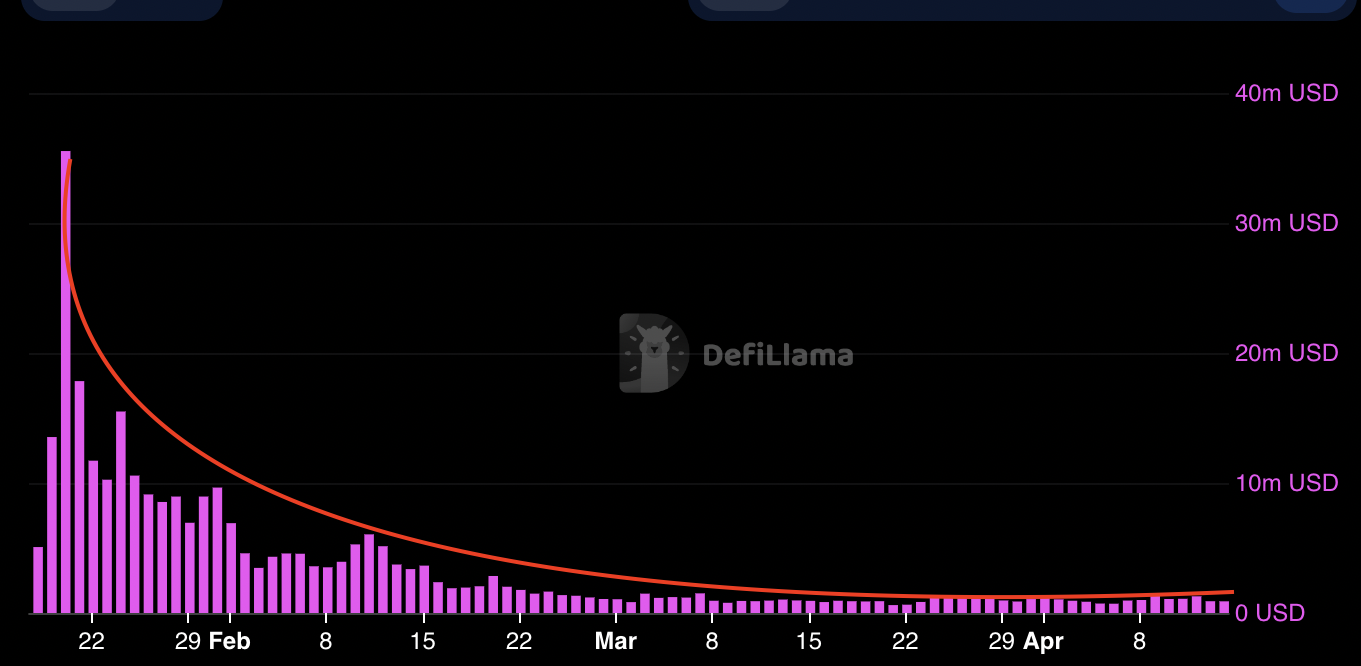

For instance, on April 14, Solana’s network fees plummeted over 97% to $898,235 million, compared to $35.5 million on January 20.

Solana network daily transaction fees, USD. Source: DefiLlama

This decline in fees corresponds with lower trading volumes on platforms like Raydium, Pump.fun, and Orca, while fees on other decentralised applications have remained steady since mid-February.

A parallel trend can be seen in daily DEX volumes on Solana, which fell to $2.17 billion on April 14, a staggering 93% decrease from the January 20 peak of $35.9 billion.

Solana weekly DEX volumes, USD. Source: DefiLlama

Consequently, for SOL to reach new all-time highs, an increase in network activity will be essential.

Currently, SOL has risen by 3% in the past 24 hours to $133, remaining 54.5% below its all-time high of January 19.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risks, and readers are encouraged to do their own research before making any decisions.