A Bitcoin-centric company has recently expanded its holdings by acquiring an additional 3,459 BTC.

An April 14 filing with the US Securities and Exchange Commission (SEC) reveals that this purchase occurred between April 7 and April 13 and cost the firm approximately $285.8 million.

As a result of this latest acquisition, the company now boasts a total of 531,644 BTC, with an overall expenditure of $35.9 billion, inclusive of fees, resulting in an average purchasing price of $67,556 per Bitcoin.

The current valuation of these holdings exceeds $45 billion at today’s market rates.

To facilitate this latest purchase, the firm sold its Class A common stock. In the past week, it issued 959,712 shares of MSTR, raising approximately $285.7 million in the process.

Market analyst Ragnar highlighted the magnitude of this raise, noting that the company generated around $8.79 million per hour during U.S. market hours last week, translating to approximately $146,513 per minute.

Bitcoin Yield

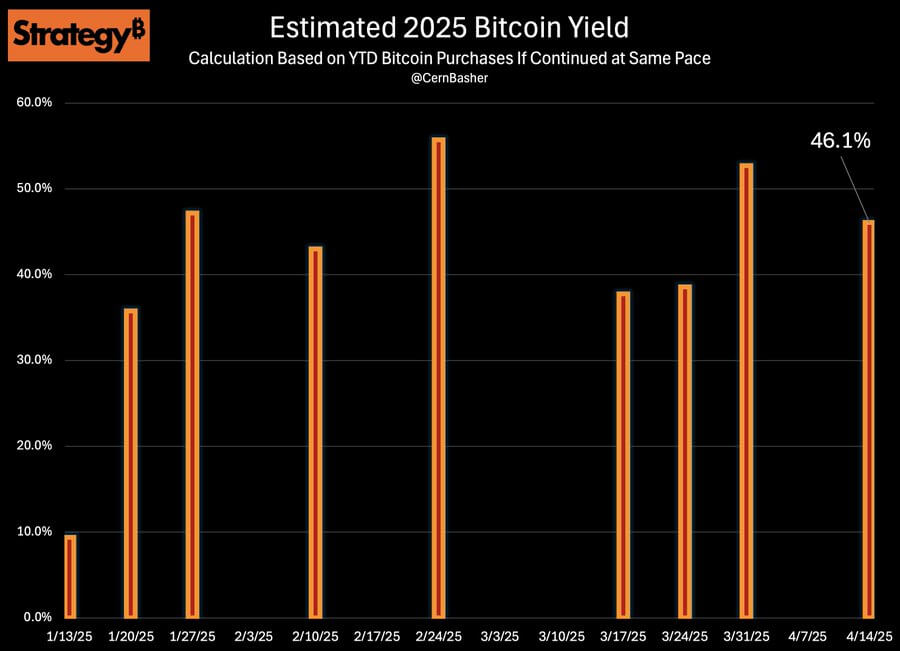

The chairman, a prominent advocate for Bitcoin, pointed out that the company’s yield from Bitcoin for 2025 has already reached 11.4% year-to-date.

This figure indicates the growth of Bitcoin per fully diluted share, essential for assessing shareholder value driven by the company’s Bitcoin strategy.

If this trajectory continues, it’s anticipated that the BTC yield could soar to 46% by the close of the year, according to an investment expert.